Welcome to our comprehensive review of Santa Loot Loans, a service that connects borrowers with lenders who can meet their loan needs. Whether you’re looking to fund a home improvement project, cover an emergency expense, consolidate debt, or simply need a payday loan, Santa Loot offers an easy and convenient online platform for borrowers to find the right loan. In this review, we’ll explore the features, benefits, and considerations of using Santa Loot for your borrowing needs.

Key Takeaways:

- Santa Loot is a free service that connects borrowers with lenders who can meet their loan needs.

- Borrowers can apply for loans ranging from $200 to $50,000 through Santa Loot’s online platform.

- If approved, funds can be deposited into the borrower’s checking account as soon as the next business day.

- Santa Loot offers quick, secure, and hassle-free loan applications, even for borrowers with poor credit history.

- Borrowers should carefully review the terms and conditions of loan offers and ensure they can meet the repayment obligations before proceeding.

About Santa Loot

Santa Loot aims to connect borrowers with lenders who can meet their loan needs. They have a large network of lenders and third-party networks, making it easy for borrowers to fill out one form instead of visiting multiple websites. Santa Loot is a free service for borrowers, as they are compensated by the lenders or lender networks they work with. Their online service allows borrowers to apply for loans ranging from $200 to $50,000, right from the comfort of their home or office. Borrowers can also access their platform through their mobile devices.

Loan Offers and Details

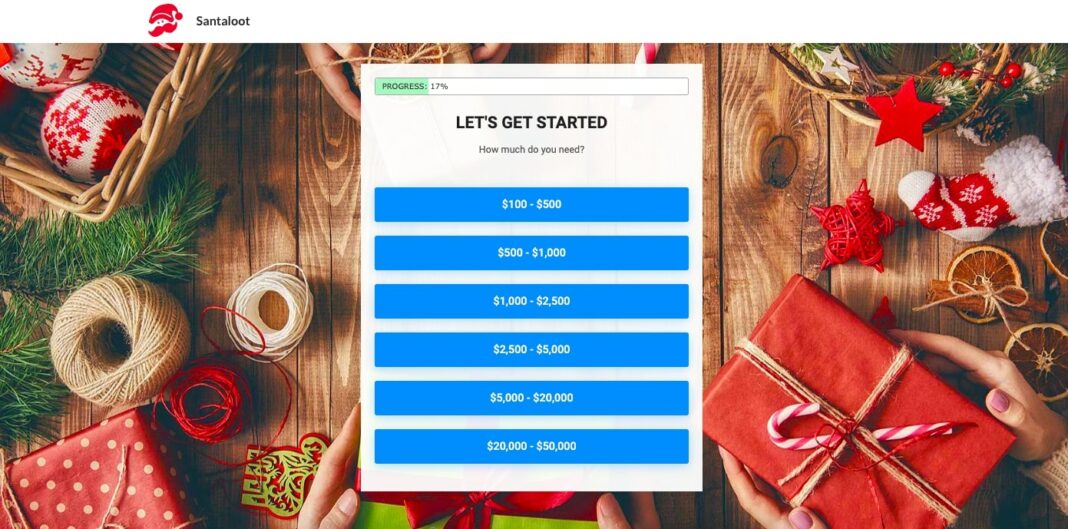

Santa Loot offers a range of loan options to meet your financial needs. Whether you’re looking to cover unexpected expenses, consolidate debt, or finance a major purchase, Santa Loot has you covered. With loan amounts ranging from $100 to $50,000, you can find the right loan for your specific situation.

The loan application process at Santa Loot is quick, secure, and hassle-free. You can conveniently apply online from the comfort of your home or office. Simply fill out the online form, provide the necessary documents, and submit your application. Santa Loot aims to provide an instant response to your loan application, with some issuers providing approval decisions within 60 seconds.

One of the standout features of Santa Loot is their willingness to consider borrowers with a poor credit history. Even if you’ve had financial difficulties in the past, you may still be eligible for a loan. Santa Loot understands that everyone deserves a second chance and works with lenders who offer flexible approval criteria.

Before applying for a loan, there are a few important details to keep in mind. The minimum loan amount that can be borrowed is $100, while the maximum loan amount is $50,000. Borrowers should also be aware that a credit check may be performed during the application process. However, having a poor credit history does not automatically disqualify you from being approved for a loan.

Loan Eligibility Requirements:

- Minimum age: 18 years old

- Active checking account

- Proof of employment

- Minimum monthly income: $800

Once approved for a loan, funds can be deposited directly into your checking account as soon as the next business day. This ensures that you have quick access to the funds you need to address your financial obligations.

Loan Comparison Options:

When comparing loan offers, it’s essential to consider the interest rates, fees, and repayment terms. Different lenders may offer varying loan terms, such as fixed or variable interest rates, which can have a significant impact on your overall repayment amount.

To help you make an informed decision, here is a table highlighting the key features and details of Santa Loot’s loan offers:

| Loan Amount | Interest Rates | Fees | Repayment Terms |

|---|---|---|---|

| $100 – $50,000 | Varies by lender | Varies by lender | Varies by lender |

Keep in mind that the specific loan terms may vary depending on the lender you are matched with. It’s always a good idea to carefully review the loan agreement and consult with the lender if you have any questions or concerns.

Remember, Santa Loot is here to provide you with a seamless borrowing experience and connect you with lenders who can meet your loan needs. Take advantage of their user-friendly platform and explore your loan options today.

Expert Ratings and Reviews

Credit-land.com, a trusted source for financial expertise, provides expert ratings and reviews for Santa Loot loans. With a comprehensive evaluation of various criteria, including interest rates, fees, benefits, rewards programs, and customer service, their expert opinion offers valuable insights to borrowers.

In their assessment of Santa Loot loans, the experts have given an impressive overall rating of 4.3 out of 5. Let’s take a closer look at the specific areas they have scrutinized:

Interest Rates

The experts at Credit-land.com carefully analyzed the interest rates offered by Santa Loot loans, ensuring that borrowers receive fair and competitive rates tailored to their financial needs.

Fees and Costs

Examining the fee structure of Santa Loot loans, the experts considered the transparency and reasonableness of the associated costs, ensuring borrowers are well-informed about any charges.

Loan Flexibility

Santa Loot understands that borrowers have unique circumstances, and the experts have assessed the flexibility of their loan options to cater to a diverse range of needs, offering borrowers the opportunity for personalized solutions.

Affordability

By evaluating borrower-friendly repayment terms and affordability, the experts have ensured that Santa Loot loans are accessible to individuals with varying income levels, promoting responsible borrowing practices.

Customer Service

With a focus on customer satisfaction, the experts have considered the quality and responsiveness of Santa Loot’s customer service, ensuring a smooth borrowing experience and addressing any potential concerns.

Overall, the expert ratings and reviews from Credit-land.com highlight the strengths of Santa Loot loans across multiple dimensions. Borrowers can rely on these unbiased assessments to make informed decisions about their borrowing needs.

Legitimacy and Safety

In the digital world, it’s important to ensure the legitimacy and safety of online platforms before entering personal information or engaging in financial transactions. Santa Loot, with a domain registration of over 6 months since October 25, 2017, appears to be a legitimate platform. However, it is always recommended for borrowers to conduct their own research to verify the legitimacy and safety of any website or service.

When considering Santa Loot as a potential lending option, it’s essential to prioritize safety. Here are a few steps you can take to ensure a secure borrowing experience:

- Research: Look for customer reviews and testimonials from reputable sources to gauge other borrowers’ experiences with Santa Loot. This can provide insights into the legitimacy and trustworthiness of the platform.

- Encryption: Verify that Santa Loot’s website uses encryption technology, making sure your personal and financial information is transmitted securely. Look for the padlock icon or “https://” in the URL, indicating a secure connection.

- Contact Information: Check if Santa Loot provides clear and accessible contact information, such as a phone number or email address. Legitimate companies are usually transparent about their contact details.

- Privacy Policy: Review Santa Loot’s privacy policy to understand how your personal information is protected and shared. Ensure that they have robust measures in place to safeguard your data.

By following these steps, you can make an informed decision about the legitimacy and safety of Santa Loot. Remember, your financial security should always be a top priority.

Accessibility of Santaloot.com

As of December 10, 2023, Santaloot.com is accessible. However, it is important to note that accessibility does not necessarily mean that the site is open. Borrowers are advised to check the website directly for the most up-to-date information.

Operation Location

Santaloot.com is operating from the United States, specifically in Nevada, Las Vegas. It is hosted on a server located in the America/Los_Angeles time zone.

Restricted States

Santaloot.com’s loan offers may not be available in certain states. Borrowers from these states should look for alternative loan options. The restricted states are:

| State | Abbreviation |

|---|---|

| Arkansas | AR |

| Arizona | AZ |

| Connecticut | CT |

| Georgia | GA |

| Massachusetts | MA |

| Maryland | MD |

| North Carolina | NC |

| New Jersey | NJ |

| New York | NY |

| Ohio | OH |

| Pennsylvania | PA |

| Virginia | VA |

| Vermont | VT |

| West Virginia | WV |

| Washington D.C. | DC |

If you reside in any of these states, Santaloot.com may not be able to provide you with loan offers. However, there are other options available for borrowers in these states.

FAQ

Here are some frequently asked questions about Santa Loot loans:

Q: What is Santa Loot?

Answer: Santa Loot is a service that connects borrowers with lenders who can meet their loan needs. They provide a convenient online platform for borrowers to fill out one form and be matched with multiple lenders.

Q: How much can I borrow with Santa Loot?

Answer: Santa Loot offers loans ranging from $200 to $50,000, depending on the borrower’s needs and eligibility.

Q: What can I use the loan for?

Answer: Santa Loot loans can be used for various purposes such as home improvement projects, payday loans, debt consolidation, and emergency expenses.

Q: How quickly can I get the funds?

Answer: If approved, funds can be deposited into your checking account as soon as the next business day.

Q: Is there a fee to use Santa Loot’s services?

Answer: No, Santa Loot offers its services for free to borrowers. They are compensated by the lenders or lender networks they work with.

For other questions or more information, you can contact Santa Loot directly through their website.

| Question | Answer |

|---|---|

| What is Santa Loot? | Santa Loot is a service that connects borrowers with lenders who can meet their loan needs. |

| How much can I borrow with Santa Loot? | Santa Loot offers loans ranging from $200 to $50,000. |

| What can I use the loan for? | Santa Loot loans can be used for various purposes such as home improvement projects, payday loans, debt consolidation, and emergency expenses. |

| How quickly can I get the funds? | If approved, funds can be deposited into your checking account as soon as the next business day. |

| Is there a fee to use Santa Loot’s services? | No, Santa Loot offers its services for free to borrowers. |

Additional Services

If you are not approved for a loan, Santa Loot offers additional services that may be helpful to you. These services include credit repair and debt relief options. While applying for a loan, if you are presented with these offers, remember that you are under no obligation to accept them. You have the freedom to decline if you are not interested or if they do not meet your needs.

Free Expert Advice

When it comes to your loan-related concerns or questions, Santa Loot is here to help. They offer borrowers the option to seek free advice from their team of experts via email. Whether you need guidance on choosing the right loan, understanding the terms and conditions, or managing your repayment plan, the experts at Santa Loot are ready to assist you.

By leveraging their knowledge and experience in the lending industry, Santa Loot’s experts can provide you with valuable insights and recommendations tailored to your specific needs. They can help you make informed decisions and navigate the loan process with confidence.

To get started, simply reach out to Santa Loot’s experts via email, and they will promptly respond to your inquiries. Take advantage of this valuable resource and benefit from the expertise of the Santa Loot team.

Conclusion

In conclusion, Santa Loot is a reliable platform for borrowers seeking loans. With their user-friendly online application process, borrowers can easily connect with lenders who can meet their loan needs. The potential to receive funds as soon as the next business day provides a quick funding solution for those in need of immediate financial support.

However, it is crucial for borrowers to exercise caution and carefully review the terms and conditions of the loan offers before proceeding. Understanding the repayment obligations and ensuring the ability to meet them is essential to avoid any financial difficulties down the line.

In summary, Santa Loot loans offer convenience and accessibility, making it a viable option for individuals seeking financial assistance. By utilizing this platform, borrowers can take advantage of the opportunity to secure the funds they require efficiently and expediently.

FAQ

How does Santa Loot work?

Santa Loot is a service that connects consumers with lenders who can meet their loan needs. Borrowers fill out one form online and are matched with multiple lenders.

Is Santa Loot a lender?

No, Santa Loot is not a lender itself. It is a platform that connects borrowers with lenders. Santa Loot offers its services for free to borrowers.

What types of loans can I apply for with Santa Loot?

You can apply for loans ranging from $200 to $50,000 with Santa Loot. These loans can be used for various purposes such as home improvement projects, payday loans, debt consolidation, and emergency expenses.

How quickly can I receive funds if approved?

If approved, funds can be deposited into your checking account as soon as the next business day.

Can I apply for a loan with Santa Loot if I have poor credit?

Yes, Santa Loot may be able to connect borrowers with lenders even if they have a poor credit history.

What are the minimum and maximum loan amounts I can borrow with Santa Loot?

The minimum loan amount that can be borrowed is $100, and the maximum loan amount is $50,000.

How quickly will I know if my loan application is approved?

Santa Loot provides an instant response to loan applications, with some issuers providing approval decisions within 60 seconds.

Will Santa Loot perform a credit check during the application process?

Yes, a credit check may be performed during the application process.

What are the eligibility requirements to apply for a loan with Santa Loot?

The minimum age to apply for a loan is 18, and borrowers must have an active checking account and employment. The minimum income required per month is $800.

Are Santa Loot loans available in all states?

No, Santa Loot’s loan offers may not be available in the following states: AR, AZ, CT, GA, MA, MD, NC, NJ, NY, OH, PA, VA, VT, WV, and DC.

Can I decline offers for other services if I am not approved for a loan?

Yes, if you are not approved for a loan, Santa Loot may present you with offers for credit repair, debt relief, or other services. You are under no obligation to accept these offers and can decline if not interested.

Can I get free advice from Santa Loot experts?

Yes, Santa Loot offers borrowers the option to ask their experts for free advice via email. You can seek guidance for any loan-related concerns or questions you may have.