Looking for a trustworthy lender? Right Loans USA might be the solution you’ve been searching for. As a lender connection service, Right Loans USA helps individuals find reputable lenders quickly and easily. With a secure online platform and a wide network of lending partners, they simplify the loan process and prioritize your privacy.

Right Loans USA offers various types of loans, including personal loans, unsecured loans, installment loans, and emergency loans. Their website is available in English and Spanish, ensuring a user-friendly experience for all borrowers. Plus, they utilize industry-leading SSL encryption to safeguard your data.

Key Takeaways:

- Right Loans USA is a lender connection service that helps individuals find trustworthy lenders.

- They offer various types of loans, including personal, unsecured, installment, and emergency loans.

- Their website is available in English and Spanish, providing a user-friendly experience.

- Right Loans USA prioritizes your privacy and utilizes industry-leading SSL encryption.

- Their secure online platform connects borrowers with suitable loan options quickly and securely.

How Right Loans USA Works

Right Loans USA simplifies the loan process for borrowers. Users fill out a short and secure online form, which is protected by 256-bit SSL encryption. If approved, they will be redirected to a lender’s website where they can review the loan terms, including all applicable rates and fees. If the terms are accepted, the lender can transfer the funds directly into the borrower’s bank account as quickly as the next business day. Right Loans USA acts as a facilitator, saving borrowers the time and effort of filling out multiple loan applications on different websites.

Loan Terms and APR Information

Understanding the loan terms and Annual Percentage Rate (APR) is crucial when considering a loan from Right Loans USA. The APR is determined by factors such as the loan amount, repayment period, and timing of payments. Lenders are required by state law to disclose the APR before borrowers enter into a loan agreement.

Keep in mind that loan terms, including the rates and loan sizes offered, may vary based on your creditworthiness. It’s important to have a clear understanding of your creditworthiness and how it may impact the loan terms offered. State laws also play a role in determining loan amounts and APRs.

Before proceeding with a loan, it is essential to carefully read and review the terms and conditions provided by the lender. This will ensure that you have a comprehensive understanding of the loan agreement and can make an informed decision.

To illustrate the impact of loan terms and APR, consider the following example:

| Loan Amount | Repayment Period | APR | Monthly Payment | Total Repayment |

|---|---|---|---|---|

| $5,000 | 36 months | 10% | $161.34 | $5,808.24 |

| $10,000 | 36 months | 15% | $345.24 | $12,426.24 |

| $15,000 | 36 months | 20% | $537.05 | $19,337.80 |

Table: Example of Loan Terms and APR for Different Loan Amounts

Renewal Policy and Late Payments

When it comes to loan renewals, it’s important to note that each lender associated with Right Loans USA has its own policy in place, which may differ from lender to lender. Therefore, it is crucial for borrowers to review and understand their specific lender’s terms and conditions regarding the renewal of loans before signing the loan agreement.

In addition to renewal policies, borrowers should be aware of the potential consequences of late payments on their loans. Late payments may result in additional fees or even collection activities initiated by the lenders. These collection activities can include phone calls, emails, and letters requesting payment, as well as reporting the late payment incident to a consumer reporting agency.

It’s important for borrowers to consult their specific lender to fully understand the potential consequences of late or missed payments. Being aware of the renewal policy and the potential impact of late payments can help borrowers make informed decisions and avoid any unnecessary financial penalties.

Benefits of Right Loans USA

Right Loans USA offers several benefits to borrowers. With a convenient online process, you can complete the entire loan application in less than 5 minutes, eliminating the need to wait in line or visit a physical store. The website utilizes bank-level encryption to ensure the security of your personal information, giving you peace of mind that your data is safe during transmission.

One of the major advantages of Right Loans USA is the fast funding. While approval for a loan can be obtained within minutes, you can expect to receive the funds as soon as the next business day. This means that once approved, you can have access to the money you need quickly, without any unnecessary delays.

Another key benefit is the high loan amounts that Right Loans USA offers. If approved through their network, you have the opportunity to receive up to $50,000 directly deposited into your account. This allows you to access larger sums of money to meet your financial needs, whether it’s for emergencies, debt consolidation, or any other purpose.

To summarize, the benefits of choosing Right Loans USA include:

- Fast funding with approval within minutes and funds received as soon as the next business day

- High loan amounts, with the possibility of receiving up to $50,000

- Bank-level encryption for the security of your personal information

- A convenient online process that can be completed in less than 5 minutes

These advantages make Right Loans USA a reliable and efficient choice for borrowers seeking fast and secure funding.

Loan Application Process

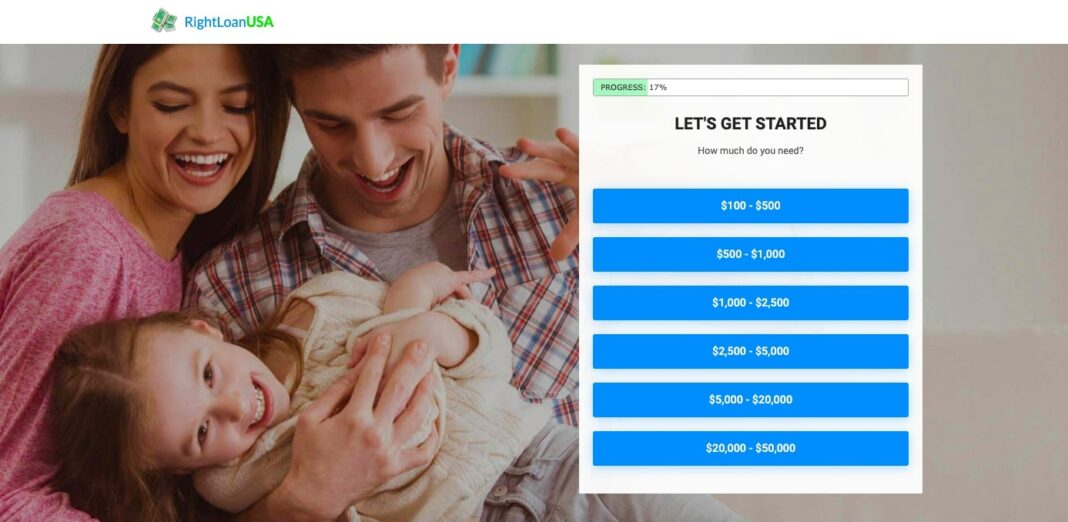

Right Loans USA offers a quick and convenient loan application process, eliminating the hassle of visiting multiple loan websites. With our integrated online form, you only need to fill out one application to connect with multiple lenders. This streamlined process saves you time and effort, allowing you to receive a decision from a lender within minutes.

By using our online form, you provide the necessary information for lenders to assess your loan request. This includes personal details, employment information, and income verification. Once you submit the form, our system matches you with potential lenders who can meet your borrowing needs. You’ll receive an online decision promptly, putting you one step closer to securing the funds you need.

Our platform’s integration with multiple lenders ensures that you have access to a diverse range of loan options. Each lender has their own rates, terms, and eligibility criteria, so you can compare and choose the best offer for your financial situation. This flexibility gives you the power to make an informed decision based on your specific needs.

With Right Loans USA, you can complete the entire loan application process from the comfort of your own home. Our user-friendly interface and secure online platform make it easy for you to provide the necessary information and navigate through the application process. Say goodbye to the stressful and time-consuming task of filling out separate applications on different loan websites.

Frequently Asked Questions (FAQ)

Right Loans USA addresses common questions regarding their service. Here are some frequently asked questions:

Does Right Loans USA perform a credit check?

Right Loans USA itself does not perform a credit check. However, the lending partners they work with may conduct a credit check to determine creditworthiness and loan eligibility.

What does APR stand for, and how does it affect my loan?

APR stands for Annual Percentage Rate. It represents the annual interest rate charged for borrowing and includes any additional fees or charges associated with the loan. The APR can vary based on factors such as your creditworthiness and state law.

What is the range of loan amounts offered by Right Loans USA?

Right Loans USA works with lenders who offer loan amounts ranging from $200 to $50,000. The actual loan amount you can qualify for will depend on the individual lender’s policies and your creditworthiness.

Do I have to visit an in-store location to receive my loan funds?

In some cases, lenders may require borrowers to visit their store to pick up the loan funds. This allows for same-day access to the funds. However, the specific requirement will depend on the policies of the lender you are matched with.

Obtaining the Funds

Right Loans USA aims to provide you with quick access to the funds you need. If your loan application is approved, you can receive up to $50,000 directly deposited into your checking account as soon as the next business day. It’s a convenient and secure way to get the financial assistance you require in a timely manner.

Next Business Day Funding

With Right Loans USA, you don’t have to wait for weeks to get your loan funds. Once your application is approved, the money can be transferred to your checking account as soon as the next business day. This means that you can have the funds you need without any unnecessary delays or complications.

Flexible Options

Whether you need the funds for an emergency expense, home improvement, or debt consolidation, Right Loans USA provides a range of loan options tailored to your specific needs. The loan amounts can go up to $50,000, giving you the flexibility to address your financial goals effectively.

| Benefit | Details |

|---|---|

| Quick Access to Funds | Receive up to $50,000 directly deposited into your checking account |

| Convenient Timeline | Get your funds as soon as the next business day |

| Flexible Loan Options | Choose from a range of loan amounts to meet your financial needs |

Important Disclosures

Right Loans USA acts as a lead generator, connecting borrowers with lenders who can provide the funds they need. While the service aims to connect borrowers with loans up to $50,000, it’s important to note that not all lenders can offer this maximum loan amount. The loan availability and specific loan terms, including the maximum loan amount, vary based on individual lender policies and the borrower’s creditworthiness.

The time it takes to receive the loan proceeds may also vary among lenders. Some lenders may offer quick funding, providing the funds as soon as the next business day, while others may take longer. Additionally, depending on the lender and the specific loan application, borrowers may be required to provide additional documentation.

To use the Right Loans USA service, borrowers must meet certain eligibility criteria. Borrowers must be at least 18 years old and residents of the United States. It’s important to note that Right Loans USA does not facilitate loans in states where the applied loan is illegal, so borrowers should ensure their state allows for the type of loan they are applying for.

Conclusion

In summary, Right Loans USA is a trusted and reliable lender connection service that provides borrowers with a secure and convenient way to find suitable loan options. With its user-friendly interface and streamlined application process, individuals can easily submit their loan requests and receive funds quickly when they need it the most.

However, borrowers should exercise caution and thoroughly review the loan terms, APRs, and renewal policies before accepting any loan offer. It is important to fully understand the terms and conditions provided by the lender to ensure that it aligns with their financial needs and capabilities.

Overall, Right Loans USA offers an efficient and trustworthy solution for borrowers seeking financial assistance. By connecting individuals with multiple lenders, they increase the chances of finding the right loan that meets their specific requirements. Whether it’s for a personal expense, emergency situation, or any other financial need, Right Loans USA is here to help.

FAQ

Does Right Loans USA perform a credit check?

Right Loans USA does not perform a credit check themselves. However, some lending partners may conduct a credit check as part of the loan application process to assess creditworthiness and loan eligibility.

What is the loan APR?

The loan APR, or Annual Percentage Rate, represents the annual rate charged for borrowing. The APR can vary based on factors such as creditworthiness and state law.

What is the range of loan amounts offered?

Loan amounts offered through Right Loans USA range from $200 to $50,000. However, the actual loan amount depends on individual lender policies and the borrower’s creditworthiness.

Can I access the loan funds on the same day?

In some cases, lenders may require borrowers to visit their store to pick up the loan funds for same-day access. However, the time it takes to receive the funds may vary among lenders and is also subject to bank processing times.

How does Right Loans USA connect borrowers with lenders?

Right Loans USA acts as a lead generator, connecting borrowers with its network of lenders. By filling out a single online form, users can submit their loan requests and receive offers from multiple lenders.

What information do I need to provide in the loan application process?

The loan application process requires users to fill out a short online form. The form may ask for information such as personal details, employment information, and banking details for loan disbursement.

Does Right Loans USA provide quick access to funds?

If approved for a loan, users can receive up to $50,000 directly deposited into their checking account as soon as the next business day. However, the time to receive the funds may vary among lenders and is subject to bank processing times.

Is there an age requirement to use Right Loans USA?

Yes, using the service requires borrowers to be at least 18 years old.

Are there any residency restrictions to use Right Loans USA?

To use Right Loans USA, borrowers must be residents of the United States. However, they should not reside in any state where the applied loan is illegal.

Will late payments incur additional fees?

Late payments may result in additional fees or collection activities, depending on the lender’s policies. Borrowers should consult their specific lender’s terms and conditions to understand the consequences of late or missed payments.