Welcome to our review of Direct Fund Center, a platform that provides financing options for individuals and businesses. If you are seeking streamlined funding solutions to meet your business needs, Direct Fund Center offers a range of options that may be suitable for you. In this review, we will explore how Direct Fund Center works and how it can help you efficiently fulfill your financing requirements.

Key Takeaways:

- Direct Fund Center is a platform that offers financing options for individuals and businesses

- It provides streamlined funding solutions to meet various financial needs

- The online application process is simple and takes less than 5 minutes to complete

- If approved, you can receive funds as quickly as the next business day

- Direct Fund Center prioritizes data security with 256-bit SSL encryption

How Direct Fund Center Works

To avail the financing options offered by Direct Fund Center, you need to follow a simple process. First, you need to submit your information by filling out a secure online form. The form is protected with 256-bit SSL encryption technology, ensuring the privacy and security of your data. Once you submit the form, you can expect a fast decision, usually within minutes. If your application is approved, the funds can be transferred to your bank account as soon as the next business day.

| Step | Description |

|---|---|

| Step 1 | Submit your information by filling out a secure online form. |

| Step 2 | Wait for a fast decision, usually within minutes. |

| Step 3 | If approved, receive your funds as soon as the next business day. |

Benefits of Direct Fund Center

Direct Fund Center offers several advantages to borrowers. One of the key benefits is the speed of funding. If approved, you may be able to receive your money in as little as 24 hours. Direct Fund Center also provides loans of up to $50,000, offering a substantial funding option. The platform ensures the security of your data with bank-level encryption, providing peace of mind. Additionally, Direct Fund Center offers the convenience of an entirely online process, eliminating the need to wait in line or visit a physical store.

| Benefits | Description |

|---|---|

| Fast Funding | Receive your money in as little as 24 hours after approval. |

| Up to $50,000 | Borrow a substantial loan amount to meet your financial needs. |

| Bank Level Encryption | Your personal data is protected with the highest level of security. |

| Online Convenience | Apply online from the comfort of your own home, eliminating the need for in-person visits. |

Types of Loans Offered

Direct Fund Center offers a variety of loan options to meet different financial needs. Whether you require funds for personal expenses, unexpected emergencies, or managing bills, their loan offerings can provide a convenient solution. The following types of loans are available:

| Loan Type | Description |

|---|---|

| Personal Loans | Loans intended for personal use, allowing you to cover a range of expenses. |

| Cash Advance Loans | Short-term loans designed to provide quick access to funds, ideal for unexpected expenses or financial emergencies. |

| Installment Loans | Loans that allow you to repay the borrowed amount over a set period in regular installments, offering flexibility and predictability. |

| Emergency Loans | Loans designed to assist during urgent situations, providing immediate financial relief. |

Direct Fund Center understands that financial needs can vary, and their diverse range of loan options ensures that borrowers have access to the most suitable financing solution for their specific requirements.

Loan Approval Criteria

When applying for a loan through Direct Fund Center, it’s important to understand the loan approval criteria. While Direct Fund Center itself does not perform a credit check, the lenders in their network may do so to determine your creditworthiness and the loan amount they can offer you. These lenders will consider various factors, including your credit history, income, and debt-to-income ratio, to assess your creditworthiness.

The loan APR, or Annual Percentage Rate, is another crucial factor to consider. The APR represents the actual yearly cost of funds over the loan term. It varies based on factors such as your creditworthiness, the loan amount, and the repayment term. A lower APR generally indicates a more favorable loan offer, as it means you’ll pay less in interest over time.

The loan amount you can borrow depends on the lender’s policies and your creditworthiness. While Direct Fund Center offers loans of up to $50,000, individual lenders may have their own limits based on their risk assessment. Your creditworthiness plays a significant role in determining the loan amount you’ll qualify for.

It is essential to carefully review and understand the terms and conditions of the lender you are matched with before accepting the loan. Each lender may have specific requirements and policies regarding repayment terms, fees, and other conditions. Taking the time to read and comprehend these terms ensures that you make an informed decision.

The loan purpose is another important consideration. Direct Fund Center provides financing solutions that can be used for various needs such as home repairs, unexpected expenses, holiday shopping, debt consolidation, or other personal or business purposes. Clarifying your loan purpose can help you better communicate your needs to the lender and ensure that you find the right loan solution.

Online Application Process

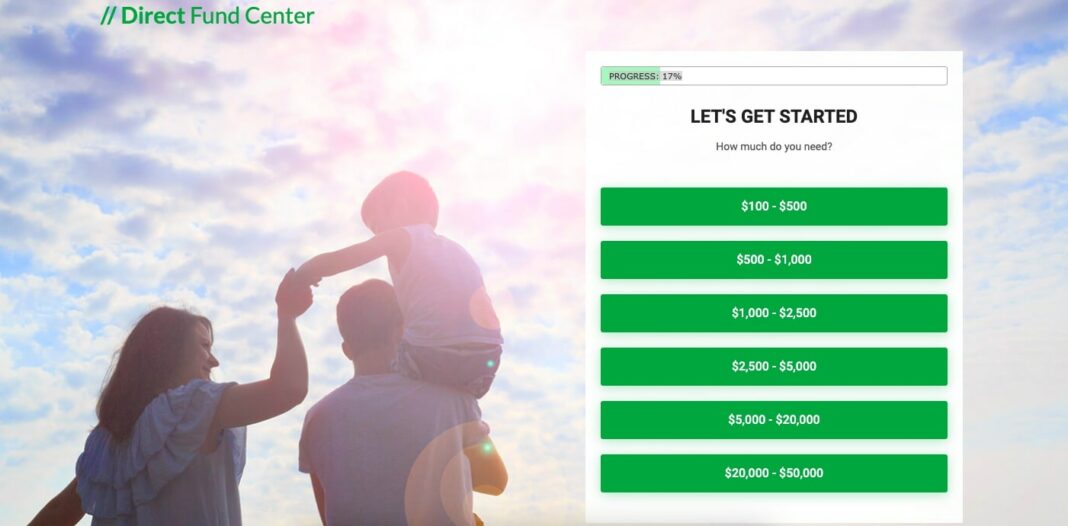

Applying for a loan through Direct Fund Center is a quick and hassle-free process. They have designed an easy-to-use online form that takes less than 5 minutes to complete. This user-friendly form ensures a seamless experience, allowing you to provide the necessary information conveniently.

By integrating with multiple lenders, Direct Fund Center saves you time and effort. Instead of individually applying to different lenders, you can submit your information once through their online form, and it will be shared with the lenders in their network. This process increases your chances of finding a suitable loan option that meets your needs.

Once you have completed the online form, you can expect to receive an online decision within minutes. This swift response time enables you to quickly assess your loan options and make an informed decision based on your financial requirements.

Direct Fund Center understands the importance of ease and efficiency when it comes to the loan application process. That is why they have simplified and streamlined the online application process, making it accessible and user-friendly for borrowers.

Loan Amount and Funding Time

Direct Fund Center offers flexible loan options to cater to your financial needs. Depending on the lender and your creditworthiness, you can borrow loan amounts ranging from $200 up to an impressive $50,000. This allows you to access the funds you require, whether it’s for a small expense or a larger investment.

When it comes to funding time, Direct Fund Center understands the importance of prompt financial support. If your loan application is approved, you could receive the funds as quickly as the next business day. This swift funding ensures that you can address your financial needs without unnecessary delays.

Security Measures

Direct Fund Center prioritizes the security of your personal information. To ensure a secure transmission, they utilize 256-bit SSL encryption technology. This advanced encryption scrambles your data during transmission, making it unreadable to anyone who might try to intercept it.

Rest assured that when you submit your information on DirectFundCenter.com, it is protected by the highest level of encryption available. Your data is safeguarded from unauthorized access and potential cyber threats.

Direct Fund Center’s commitment to data privacy goes beyond secure transmission. They have implemented robust security protocols to protect your personal information from unauthorized access, ensuring the confidentiality and integrity of your data.

By using 256-bit SSL encryption, Direct Fund Center safeguards your information and provides you with peace of mind, knowing that your data is protected during its transmission.

Limitations and Disclaimers

While Direct Fund Center provides financing options, it is important to understand the limitations and restrictions that may apply. Not all lenders in their network can offer loan amounts up to $50,000. The availability of loans is subject to individual lender policies and your creditworthiness. It is crucial to review the terms and conditions provided by the lender before accepting a loan.

In addition, state laws may impose certain restrictions on loan amounts and APRs. These regulations may vary depending on your state of residence. It is essential to familiarize yourself with the laws and regulations specific to your state to ensure compliance with legal requirements.

“Understanding the loan availability, state restrictions, and lender terms is vital to make informed borrowing decisions.”

| Limitations and Disclaimers | |

|---|---|

| Loan Availability | Varies based on lender policies and creditworthiness |

| State Restrictions | Subject to state laws on loan amounts and APRs |

| Lender Terms | Review terms and conditions before accepting a loan |

Loan Repayment and Renewal

Once you have secured a loan through Direct Fund Center, it is crucial to understand the lender’s terms regarding loan repayment and renewal. Each lender in Direct Fund Center’s vast network may have their unique policies in place, which you should review carefully before signing the loan agreement.

Familiarizing yourself with the lender’s renewal policy is particularly important. Some lenders may offer the option to extend or renew your loan if needed. However, it is essential to ascertain the specific conditions and requirements for loan renewal.

It is crucial to adhere to the lender’s terms regarding loan repayment. Failure to make timely payments can have consequences. Late payment consequences may include additional fees, increased interest rates, or even collection activities. To avoid such consequences, it is of utmost importance to understand and fulfill your obligations diligently.

| Lender | Repayment Terms | Renewal Policy | Late Payment Consequences |

|---|---|---|---|

| Lender A | <Repayment Terms for Lender A> | <Renewal Policy for Lender A> | <Late Payment Consequences for Lender A> |

| Lender B | <Repayment Terms for Lender B> | <Renewal Policy for Lender B> | <Late Payment Consequences for Lender B> |

| Lender C | <Repayment Terms for Lender C> | <Renewal Policy for Lender C> | <Late Payment Consequences for Lender C> |

Eligibility Requirements

To be eligible for a loan through Direct Fund Center, you must meet the following criteria:

- You must be at least 18 years old.

- You must be a resident of the United States.

Meeting these requirements is essential for accessing the financing options provided by Direct Fund Center.

Conclusion

In conclusion, Direct Fund Center provides a comprehensive range of financing solutions to cater to diverse financial needs. With their streamlined online process, borrowers can easily apply for funds and receive fast funding, making it a convenient choice for individuals and businesses alike.

The secure data transmission ensures the privacy and protection of your personal information throughout the application process. By reviewing the details provided in this review, you can gain a comprehensive overview of Direct Fund Center and determine if their financing solutions align with your specific requirements.

Whether you need funds for business expansion, unexpected expenses, or personal use, Direct Fund Center offers a reliable platform to explore various financing options. Their commitment to convenience, speed, and security makes them an attractive choice for borrowers seeking efficient financing solutions.

FAQ

How does Direct Fund Center work?

To avail the financing options offered by Direct Fund Center, you need to submit your information by filling out a secure online form. The form is protected with 256-bit SSL encryption technology, ensuring the privacy and security of your data. Once you submit the form, you can expect a fast decision, usually within minutes. If your application is approved, the funds can be transferred to your bank account as soon as the next business day.

What are the benefits of using Direct Fund Center?

Direct Fund Center offers several advantages to borrowers. One of the key benefits is the speed of funding. If approved, you may be able to receive your money in as little as 24 hours. Direct Fund Center also provides loans of up to $50,000, offering a substantial funding option. The platform ensures the security of your data with bank-level encryption, providing peace of mind. Additionally, Direct Fund Center offers the convenience of an entirely online process, eliminating the need to wait in line or visit a physical store.

What types of loans does Direct Fund Center offer?

Direct Fund Center provides various types of loans to cater to different financial needs. These include Personal Loans, Cash Advance Loans, Installment Loans, and Emergency Loans. These loan options offer a convenient way to access funds quickly and can be utilized for emergency expenses, bills, and more.

Does Direct Fund Center perform a credit check?

While Direct Fund Center itself does not perform a credit check, the lenders in their network may do so to determine your creditworthiness and the loan amount they can offer you. The loan APR, or Annual Percentage Rate, represents the actual yearly cost of funds over the loan term and varies based on factors like creditworthiness. The loan amount you can borrow depends on the lender’s policies and your creditworthiness. Direct Fund Center recommends reading the lender’s terms and conditions before accepting the loan. The loan purpose can be for various needs such as home repairs, unexpected expenses, holiday shopping, and more.

How long does the online application process take?

The online application process offered by Direct Fund Center is quick and hassle-free. Their easy-to-use online form takes less than 5 minutes to complete. It is integrated with multiple lenders, saving you time and effort. By submitting your information online, you can receive an online decision within minutes.

What is the loan amount and funding time with Direct Fund Center?

Direct Fund Center allows individuals to borrow loan amounts ranging from $200 to $50,000, depending on the lender and your creditworthiness. If approved, you could receive the funds as quickly as the next business day, providing you with timely financial support.

How does Direct Fund Center ensure data security?

Direct Fund Center prioritizes the security of user data. They utilize 256-bit SSL encryption technology to ensure secure transmission of your personal information. This encryption scrambles your data during transmission and decrypts it upon arrival at DirectFundCenter.com. Rest assured, Direct Fund Center takes steps to safeguard your data privacy.

Are there any limitations or disclaimers with Direct Fund Center loans?

While Direct Fund Center provides financing options, it is important to note that not all lenders can offer loan amounts up to $50,000. The loan availability is subject to the lender’s policies and your creditworthiness. Additionally, state laws may impose restrictions on loan amounts and APRs. It is essential to review the lender’s terms and conditions before accepting a loan.

What are the repayment and renewal policies for Direct Fund Center loans?

Each lender in Direct Fund Center’s network has its own terms and conditions regarding loan repayment and renewal. It is advisable to review these terms and their renewal policy before signing the loan agreement. Late payments may result in additional fees or collection activities. Understanding the lender’s policies can help ensure responsible borrowing.

What are the eligibility requirements for a loan through Direct Fund Center?

To be eligible for a loan through Direct Fund Center, you must be at least 18 years old and a resident of the United States. Meeting these requirements is essential for accessing their financing options.