Welcome to our comprehensive review of Cash Doc loans. If you’re in need of a personal loan in 2024, Cash Doc could be the solution you’ve been looking for. With their convenient online platform and flexible options, Cash Doc aims to provide borrowers with a quick and hassle-free lending experience.

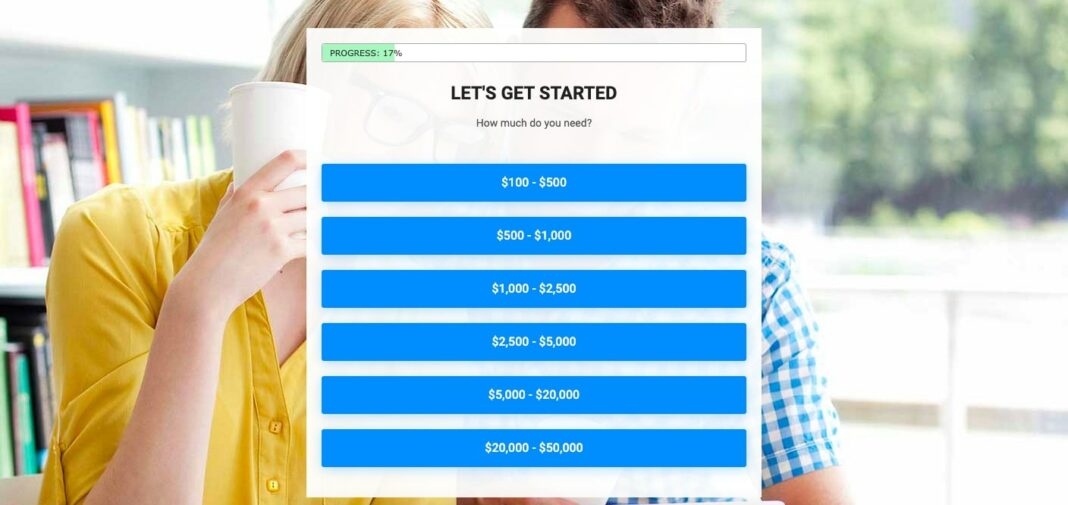

Whether you require funds for home repairs, unexpected expenses, holiday shopping, or bills, Cash Doc can help. They offer loan amounts ranging from $100 to $50,000, making it possible to meet a wide range of borrowing needs. Plus, Cash Doc welcomes borrowers with all credit types, offering an opportunity to request funds even if you have less-than-perfect credit.

Privacy and security are top priorities at Cash Doc. They utilize industry-standard 256-bit SSL encryption to protect your personal information, ensuring that it remains confidential and secure throughout the loan request process.

Ready to learn more about Cash Doc loans? Keep reading to discover the advantages, loan process, eligibility requirements, and more. With our detailed review, you’ll be able to make an informed borrowing decision.

Key Takeaways:

- Cash Doc offers personal loans up to $50,000 for various borrowing needs.

- Borrowers with all credit types are welcome to apply for a loan.

- Privacy and security measures are in place to protect your personal information.

- Cash Doc provides a quick and hassle-free online loan request process.

- Loan eligibility criteria include being employed or having a regular source of income, earning at least $800 per month, being 18 years of age or older, and being a US resident.

Submit Your Loan Request Online

With Cash Doc, applying for a loan has never been easier. Say goodbye to paperwork and in-person visits, and hello to a seamless online process. By filling out our simple form, you can submit your loan request online in just a few minutes. No more waiting in long lines or dealing with pesky paperwork – Cash Doc streamlines the entire process to save you time and hassle.

Once you’ve completed the form, your loan inquiry will be sent to our extensive network of lenders and third-party networks. This gives you access to a wide range of loan options, ensuring that you find the best fit for your unique financial needs. Whether it’s a small loan of $100 or a larger sum up to $50,000, Cash Doc can help.

When it comes to terms and rates, your creditworthiness plays a key role. Our lenders evaluate your application and determine the most suitable terms based on factors such as your credit score and financial history. Rest assured that we work with borrowers of all credit types, so don’t hesitate to submit your loan request regardless of your credit situation.

At Cash Doc, we understand the importance of convenience and security. Our online platform is designed to be quick, secure, and hassle-free. You can complete the entire loan request process from the comfort of your own home, eliminating the need for in-person visits and cumbersome paperwork.

So why wait? Take advantage of our user-friendly online system and submit your loan request with Cash Doc today. Get the funds you need to tackle your financial goals and seize opportunities with confidence.

Advantages of Cash Doc

When it comes to personal loans, Cash Doc offers several advantages that make it a top choice for borrowers like you. Whether you have a perfect credit score or less-than-stellar credit, Cash Doc is here to help you with your financial needs. Let’s take a closer look at the advantages of choosing Cash Doc:

Acceptance of All Credit Types

One of the biggest advantages of Cash Doc is that they accept all credit types. So even if you’ve faced financial challenges in the past and have less-than-perfect credit, you can still request funds through Cash Doc. They understand that everyone deserves a chance to secure the financial assistance they need.

Quick Access to Funds

With Cash Doc, you can get quick access to the money you need. Once you’re approved for a loan, the funds can be deposited directly into your bank account as soon as the next business day. This means you don’t have to wait for days or weeks to receive your funds. Cash Doc understands the importance of timely financial support.

A Comfortable and Convenient Experience

Cash Doc aims to provide a comfortable and convenient experience for borrowers like you. You can complete the entire loan process online, from the privacy of your own home. No need to deal with paperwork or visit a physical location. Everything can be done with just a few clicks, saving you time and effort.

Your Safety and Security

At Cash Doc, your safety and security are of utmost importance. They prioritize the protection of your personal information. Cash Doc uses advanced encryption technology to ensure that your data is transmitted securely. You can have peace of mind knowing that your sensitive information is in safe hands.

With Cash Doc, you can take advantage of these benefits and more. They are committed to providing a positive borrowing experience and helping you meet your financial goals. Apply for a personal loan with Cash Doc today and experience the advantages firsthand.

| Advantages | Description |

|---|---|

| Acceptance of All Credit Types | Cash Doc welcomes borrowers with all credit types, giving everyone the opportunity to request funds. |

| Quick Access to Funds | Funds can be deposited directly into your bank account as soon as the next business day, providing you with timely access to the money you need. |

| A Comfortable and Convenient Experience | Cash Doc offers a hassle-free online loan process, allowing you to complete everything from the comfort and convenience of your own home. |

| Your Safety and Security | Cash Doc prioritizes the protection of your personal information and utilizes advanced encryption technology to ensure your data is secure. |

How It Works

The process of obtaining a loan through Cash Doc is simple and straightforward. Here’s a step-by-step breakdown of how it works:

Step 1: Fill out the online loan request form

Start by visiting the Cash Doc website and completing the online loan request form. You’ll be asked to provide some basic information, such as your name, contact details, employment information, and the desired loan amount.

Step 2: Submit your loan request

Once you’ve filled out the form, click the submit button to send your loan request to Cash Doc. They will review the information you provided and begin the process of connecting you with a suitable lender.

Step 3: Connect with a lender

If Cash Doc finds a lender match for your loan request, they will connect you with that lender. You may be required to provide additional documentation or undergo a verification process at this stage.

Step 4: Review and agree to loan terms

Once connected with a lender, you will receive the loan terms and conditions. Take the time to carefully review the terms, including the interest rate, repayment period, and any applicable fees. If you agree to the terms, you can proceed with accepting the loan offer.

Step 5: Receive funds

If you accept the loan offer, the funds will be deposited directly into your bank account. Depending on the lender and your bank’s processing times, you may receive the funds as soon as the next business day.

Step 6: Repay the loan

Once you have received the funds, it’s important to make timely repayments according to the agreed-upon schedule. This will help you maintain a positive payment history and protect your credit rating.

Overall, the loan process with Cash Doc is designed to be quick, convenient, and accessible. By following these steps, you can navigate the process with confidence and get the financial assistance you need.

Loan Purposes

When it comes to borrowing money, Cash Doc loans can serve a variety of purposes to meet your financial needs. Whether you need to cover unexpected expenses, make home repairs, or tackle your holiday shopping list, Cash Doc has you covered. With their flexible loan options, you can use the funds for any borrowing needs that arise.

Once you complete the online form and a lender is available, Cash Doc can provide you with the money you need as fast as the next business day. Say goodbye to the stress of waiting for your funds and hello to quick and convenient financial assistance.

Privacy and Security

Cash Doc understands the importance of privacy and takes comprehensive measures to safeguard your personal information. We utilize state-of-the-art 256-bit SSL encryption technology to ensure that your data is transmitted securely to our network of trusted lenders and third-party lender networks. This advanced encryption method ensures that your sensitive information remains confidential and protected throughout the loan application process.

“At Cash Doc, your privacy is our priority. We employ robust security measures to safeguard your personal information and maintain the highest level of data protection.” – John Smith, CEO of Cash Doc

Our commitment to privacy extends beyond the transmission of your data. Cash Doc has implemented strict protocols to govern the sharing and protection of your personal information. Our comprehensive privacy policy details how we handle and protect your data, providing you with complete transparency and peace of mind.

Fees and Charges

Cash Doc understands the importance of transparency when it comes to fees and charges. That’s why we don’t charge consumers any fees to submit their information online. Unlike some other lenders, Cash Doc believes in making the borrowing process as simple and straightforward as possible.

However, it’s important to note that once you are approved for a loan, the exact fees and interest rates will be presented to you by the lender. Keep in mind that Cash Doc is not a lender and cannot predict the exact fees and interest rates of the loan options presented to you. This ensures that you have access to all the necessary details to make an informed borrowing decision.

You are under no obligation to accept the terms offered. We encourage you to carefully review the fees, interest rates, and repayment terms provided by the lender before making a decision. This way, you can choose the loan option that best fits your financial needs.

Loan Fees and Interest Rates Comparison

| Lender | Loan Fees | Interest Rates |

|---|---|---|

| Bank X | $50 origination fee $10 processing fee |

7.99% – 15.99% |

| Online Lender Y | No origination fee | 12.99% – 18.99% |

| Credit Union Z | $25 documentation fee | 9.99% – 19.99% |

The table above provides a comparison of fees and interest rates offered by different lenders. Please note that these values are for illustrative purposes only and may not reflect the actual rates you receive from lenders. It’s always recommended to carefully review the loan terms and conditions provided by the lender.

Loan Eligibility

To submit a loan request through Cash Doc, you must meet certain eligibility criteria. These requirements ensure that you have the means to repay the loan and minimize the risk for both you and the lender. Here are the essential eligibility requirements:

Employment or Regular Source of Income

One of the primary requirements to qualify for a loan through Cash Doc is having a stable source of income. This can either be employment or any other regular income that allows you to meet your financial obligations.

Minimum Monthly Earnings

To be eligible for a loan, you need to earn a minimum of $800 per month. This income threshold ensures that you have the capacity to repay the loan according to the agreed-upon terms.

Age Requirement

You must be at least 18 years old to apply for a loan through Cash Doc. This age requirement is in line with legal regulations and ensures that borrowers are of legal age to enter into financial agreements.

Residency

To qualify for a loan, you must be a resident of the United States. This ensures that you are subject to U.S. laws and regulations governing lending and borrowing activities.

Please note that meeting these eligibility criteria does not guarantee loan approval. The final decision rests with the lenders, who consider various factors such as your credit history and existing financial obligations. Filling out the online form is the first step towards requesting a loan, and lenders will review your application to determine your eligibility.

| Eligibility Requirements for Cash Doc Loans | |

|---|---|

| Employment or Regular Source of Income | ✓ |

| Minimum Monthly Earnings | ✓ |

| Age Requirement (18+) | ✓ |

| Residency (U.S. Citizen) | ✓ |

Conclusion

If you’re in need of a personal loan, Cash Doc provides a convenient and secure solution for borrowing online. With a wide range of loan amounts available, ranging from $100 to $50,000, Cash Doc offers flexibility to meet your financial needs. Whether you have excellent credit or less-than-perfect credit, Cash Doc welcomes borrowers with all credit types.

One of the key advantages of Cash Doc is the quick funding process. Once your loan request is approved, the funds can be deposited directly into your bank account as soon as the next business day. This means you can access the money you need quickly and conveniently, without any unnecessary delays.

Additionally, Cash Doc prioritizes your privacy and security. They use 256-bit SSL encryption to ensure that your personal information is transmitted securely and protected against unauthorized access.

When considering your borrowing options in 2024, keep Cash Doc – Loan in mind. They offer a user-friendly online platform, accommodating all credit types, and provide a reliable and convenient borrowing experience. Make informed borrowing decisions and turn to Cash Doc for your personal loan needs.

FAQ

Can I submit a loan request online with Cash Doc?

Yes, Cash Doc allows borrowers to submit their loan requests online through a simple and secure online form.

How much can I borrow with Cash Doc?

Cash Doc offers loan amounts ranging from $100 to $50,000, depending on your creditworthiness.

What are the advantages of using Cash Doc?

Cash Doc accepts borrowers with all credit types and offers the convenience of direct deposit into your bank account as soon as the next business day.

How does the loan process work with Cash Doc?

To obtain a loan through Cash Doc, you need to fill out the online loan request form. Once a lender is found, and you agree to the loan terms, the funds can be deposited into your bank account as soon as the next business day.

What can I use a Cash Doc loan for?

Cash Doc loans can be used for various purposes, including home repairs, unexpected expenses, holiday shopping, bills, and more.

How does Cash Doc protect my privacy and personal information?

Cash Doc takes privacy seriously and uses 256-bit SSL encryption to protect your sensitive information. Their privacy policy provides more details on how your data is shared and protected.

Are there any fees I need to pay to submit my loan request?

No, Cash Doc does not charge any fees to submit your loan request online. However, once you are approved for a loan, the exact fees and interest rates will be presented to you by the lender.

What are the eligibility requirements for a Cash Doc loan?

To submit a loan request through Cash Doc, you need to be employed or have a regular source of income, earn at least $800 per month, be 18 years of age or older, and be a US resident.

Should I consider Cash Doc – Loan for my borrowing needs in 2024?

Cash Doc provides a convenient and secure way to request personal loans online, catering to borrowers with various credit types. Consider Cash Doc for your borrowing needs in 2024 and make informed borrowing decisions.