Welcome to our review of Rainy Day Lending Loans, where we will explore the features and benefits of this online lending platform. Rainy Day Lending offers a seamless and efficient process for individuals seeking quick funding for unexpected expenses. With their diverse range of loan options and commitment to customer satisfaction, Rainy Day Lending aims to provide a reliable solution for those facing financial emergencies.

Key Takeaways:

- Rainy Day Lending offers online loans up to $50,000 for emergency expenses.

- The loan application process is quick and secure, allowing borrowers to apply from the comfort of their own home.

- Individuals with all credit types are welcome to request funding through Rainy Day Lending.

- Funds can be deposited directly into the borrower’s bank account as soon as the next business day.

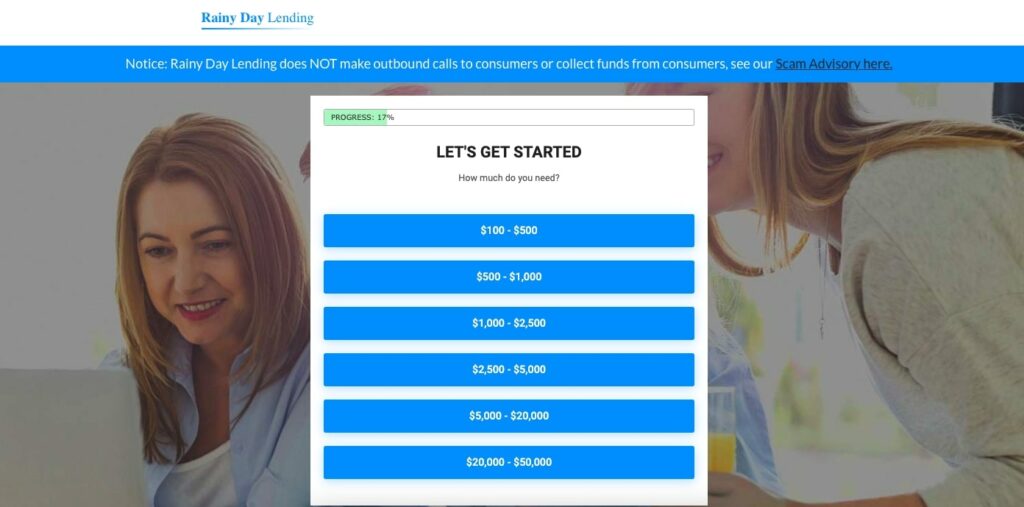

- Rainy Day Lending’s online loan request form is designed to be simple and user-friendly, taking less than 5 minutes to complete.

Personal Loans Online

When it comes to getting the funds you need, Rainy Day Lending is here to help. Our specialization in personal loans that can be obtained online sets us apart from traditional brick-and-mortar lenders. We understand the importance of convenience and privacy, which is why our loan application process is quick and secure, allowing you to submit your information from the comfort and privacy of your own home.

With Rainy Day Lending, you don’t have to worry about lengthy paperwork or time-consuming in-person visits. Our online loan application streamlines the process, making it easier than ever to access the funds you need. Whether you’re facing an unexpected expense or looking to consolidate debt, our personal loans provide the financial flexibility you need.

All Credit Types Welcome

One of the advantages of Rainy Day Lending is that they accept loan requests from individuals with all credit types. Whether you have excellent credit or a less-than-perfect credit history, you can still request funds through Rainy Day Lending. The company understands that financial emergencies can happen to anyone, and they aim to provide options for borrowers in various credit situations.

Money Deposited Directly

Rainy Day Lending prides itself on delivering quick results to borrowers. If a lender is found and the borrower agrees to the terms of the loan, the funds can be deposited directly into their bank account as soon as the next business day. This expedited process ensures that borrowers can access the funds they need in a timely manner.

Simple and Easy Process

When it comes to getting a loan, simplicity and ease are paramount. Rainy Day Lending understands this and has designed its online loan request form to be simple and user-friendly. No more navigating through complex and time-consuming applications. With Rainy Day Lending’s streamlined process, you can complete the form in just a few minutes – typically less than 5 minutes!

Unlike traditional lenders, Rainy Day Lending believes in making the application process as hassle-free as possible. The form does not bombard you with long, complicated questions that make your head spin. Instead, it asks for the necessary information in a clear and concise manner, ensuring that you can easily navigate through the steps.

Once you start the application, you will be guided through the process, making it a breeze to complete your request. Rainy Day Lending understands that applying for a loan can be overwhelming, especially when dealing with urgent financial situations. That’s why they strive to provide a simple and intuitive experience, helping you get the funds you need without unnecessary stress.

“The loan application was so simple and straightforward. I was able to complete it in no time, and within hours, the funds were in my account. Rainy Day Lending truly lives up to its promise of a simple and easy process!” – Emily R.

Why Choose Rainy Day Lending’s Simple Loan Process?

There are many reasons why Rainy Day Lending’s simple and easy process stands out:

- No complicated forms or confusing questions

- Clear guidance throughout the application

- Minimal time investment – complete your request in minutes

- User-friendly interface for a smooth experience

- Convenience of applying from the comfort of your own home

With Rainy Day Lending, you can avoid the unnecessary headaches often associated with loan applications. Whether you’re facing a medical emergency, unexpected car repairs, or any other pressing financial need, their simple loan process ensures you can quickly and easily apply for the funds you require.

| Benefits of Rainy Day Lending’s Simple Loan Process |

|---|

| No complex forms |

| Quick and easy application |

| User-friendly interface |

| Guidance throughout the process |

| Apply from the convenience of your home |

Frequently Asked Questions

At Rainy Day Lending, we understand that borrowers often have questions about our loan process. Below, we have compiled answers to some of the most frequently asked questions to help you better understand our services.

What can a personal loan be used for?

A personal loan obtained through Rainy Day Lending can be used for a variety of purposes. Whether you need to cover unexpected medical expenses, consolidate high-interest debt, make home improvements, or fund a major purchase, our personal loans offer flexibility to meet your financial needs.

How fast can funds be received?

Once your loan request has been approved and you have agreed to the loan terms, funds can be deposited directly into your bank account as soon as the next business day. This expedited process ensures that you have access to the funds you need quickly.

What privacy and security measures are in place?

At Rainy Day Lending, we prioritize the privacy and security of your personal information. We use 256-bit SSL encryption to ensure that your data is transmitted securely. Our privacy policy provides additional details on how we handle and protect your information throughout the loan application process.

Do I need to visit a physical store to complete my loan application?

No, our loan application process is entirely online. You can complete the entire process from the comfort of your own home, without the need to visit a physical store location. This convenience sets us apart from traditional brick-and-mortar lenders.

Are there any fees associated with using the website?

There are no fees to use the Rainy Day Lending website or to submit a loan request. It is important to note, however, that loan fees and interest rates are determined by the lender and will be fully disclosed to you before you accept the loan.

What are the qualification requirements for a loan?

To qualify for a loan through Rainy Day Lending, you must meet certain eligibility criteria. You must be employed or have a regular source of income, earn a minimum of $800 per month, be at least 18 years old, and be a resident of the United States. Please note that filling out the online form does not guarantee loan approval, as the final decision is at the lender’s discretion.

If you have any further questions or need more information, please don’t hesitate to contact our customer support team. We are here to assist you throughout the loan process and provide the answers you need to make informed borrowing decisions.

Privacy and Security Measures

At Rainy Day Lending, we understand the importance of privacy, security, and data protection when it comes to handling our customers’ personal information. We have implemented robust measures to ensure that your data is secure throughout the loan application process.

One of the key security features we have in place is the use of 256-bit SSL encryption. This encryption technology safeguards your sensitive data by encrypting it during transmission. It ensures that any information you provide to us is securely and privately transmitted over the internet.

To further protect your privacy, we have a comprehensive privacy policy in place that outlines how we handle and share your data. Our privacy policy provides transparency and clarity on how we collect, use, and safeguard your personal information. We encourage all borrowers to review our privacy policy to have a complete understanding of our data handling practices.

“Your privacy is our priority. We have implemented stringent measures to protect your personal information and ensure the security of your data.”

When you choose Rainy Day Lending for your loan needs, you can have peace of mind knowing that your information is in safe hands. We treat your data with the utmost care and take every precaution to protect it from unauthorized access or misuse.

| Privacy Measures | Security Features |

|---|---|

|

|

Rest assured that at Rainy Day Lending, we take your privacy and security seriously. Your trust is important to us, and we strive to go above and beyond to protect your personal information throughout your loan application journey.

No Fees to Use the Website

When it comes to using Rainy Day Lending’s website for your loan application, you can rest assured that there are no hidden fees or charges. The company believes in providing a transparent and hassle-free experience for borrowers, starting right from the application process.

Unlike some lenders who may surprise you with unexpected fees, Rainy Day Lending remains committed to keeping its website free to use. Whether you’re submitting your loan request or navigating through the various loan options, you won’t have to worry about any additional costs.

It’s important to note that while Rainy Day Lending doesn’t charge any fees, the actual loan fees and interest rates are determined by the lender. Before accepting the loan, borrowers will receive full disclosure of these terms, ensuring complete transparency. Rainy Day Lending understands the importance of providing borrowers with all the necessary information to make informed decisions about their loans.

So, when you choose Rainy Day Lending for your borrowing needs, you can confidently apply for a loan on their website, knowing that there are no fees involved. Experience the convenience of a free loan application process and take the first step towards securing the funds you need.

Loan Qualification Requirements

To submit a loan request through Rainy Day Lending, you must meet the following eligibility criteria:

- Be employed or have a regular source of income

- Earn at least $800 per month

- Be 18 years of age or older

- Be a resident of the United States

Please note that filling out the online form does not guarantee loan approval. The final decision is at the discretion of the lender.

“To submit a loan request through Rainy Day Lending, you must meet certain eligibility criteria.”

| Loan Qualification Requirements | Description |

|---|---|

| Employment or Regular Source of Income | Applicants must demonstrate that they are employed or have a reliable source of income to ensure their ability to repay the loan. |

| Minimum Monthly Income | Borrowers should earn at least $800 per month to meet the income requirement set by the lender. |

| Age Requirement | Applicants must be 18 years of age or older to be eligible for a loan through Rainy Day Lending. |

| Residency | Only residents of the United States are eligible to apply for loans through Rainy Day Lending. |

Important Disclosures

Rainy Day Lending provides important disclosures to ensure transparency and protect borrowers from scams. It is crucial for borrowers to review these disclosures before making any decisions regarding their loan requests. The following information is intended to provide clarity and guidance:

Disclosures on Outbound Calls and Fund Collection

It is essential to note that Rainy Day Lending does not make outbound calls to consumers. If you receive any calls from individuals claiming to represent Rainy Day Lending, please be cautious as they may be fraudulent. Additionally, Rainy Day Lending does not collect funds directly from consumers. The loan application and fund disbursement process is facilitated exclusively through their lending partners.

Scam Advisory and How to Identify Potential Scams

Protecting borrowers from scams is a top priority for Rainy Day Lending. They offer valuable resources and guidance on how to identify potential loan scams. By equipping borrowers with this knowledge, Rainy Day Lending aims to empower individuals to make informed decisions about their financial well-being. It is crucial to stay vigilant and be aware of the following red flags:

- Unsolicited loan offers via phone, email, or text message

- Requests for upfront payment or fees before receiving the loan

- Promises of guaranteed loans, regardless of credit history

- Requests for personal or financial information that seems suspicious

If you encounter any of these warning signs, it is important to report them to Rainy Day Lending and relevant authorities. By remaining cautious and alert, borrowers can protect themselves from potential scams.

Resources for Credit Repair and Debt Relief

Rainy Day Lending understands that managing credit and debt can be challenging. To assist borrowers in their financial journeys, they offer resources for credit repair and debt relief. These resources can provide valuable insights and strategies for improving credit scores and managing debt effectively. Borrowers are encouraged to explore these resources to support their financial well-being.

Company Evaluation

Rainy Day Lending’s website has undergone an evaluation for trustworthiness conducted by ScamAdviser. The assessment revealed both positive and negative indicators that borrowers should consider when evaluating the company’s credibility.

Positive Indicators

ScamAdviser identified several positive aspects that contribute to the website’s trustworthiness:

- SSL certificate validity: The website has a valid SSL certificate, indicating a secure connection between the user’s browser and the site.

- Years of existence: Rainy Day Lending’s website has been operational for multiple years, demonstrating a level of stability and longevity.

- Trust from reputable security companies: The website has garnered trust from reputable security companies, which adds to its credibility.

Negative Indicators

However, there are also negative indicators that raise some concerns about the company’s trustworthiness:

- Owner identity hidden on WHOIS: The owner of the website has chosen to hide their identity in the WHOIS database, which may raise questions about transparency.

- Limited website visitors: The website does not attract a significant amount of visitors, which may impact the perception of its popularity and reliability.

| Positive Indicators | Negative Indicators |

|---|---|

|

|

While Rainy Day Lending has received positive ratings for its SSL certificate validity, existence, and trust from reputable security companies, the negative indicators of the owner hiding their identity and the limited website visitors should be taken into account when evaluating the company’s trustworthiness. It is important for borrowers to consider these factors and make an informed decision when engaging with the company.

Conclusion

In conclusion, Rainy Day Lending provides a reliable and efficient solution for individuals facing financial emergencies. With their straightforward online loan request process, borrowers can easily apply for funds, regardless of their credit type. The company’s commitment to privacy and data security ensures that customers’ personal information is safeguarded throughout the application process.

While there have been concerns raised by ScamAdviser, it’s important for borrowers to consider the provided information and make informed decisions. Rainy Day Lending strives to maintain transparency and encourages borrowers to review important disclosures to understand the terms and conditions associated with their loans.

For those in need of quick and hassle-free funding, Rainy Day Lending offers a convenient solution. Their commitment to customer service and accessibility sets them apart from traditional lenders. Whether you have excellent credit or a less-than-perfect credit history, Rainy Day Lending is there to assist you in times of financial need.

FAQ

What can a personal loan from Rainy Day Lending be used for?

A personal loan from Rainy Day Lending can be used for a variety of purposes, such as emergency expenses, debt consolidation, home improvements, or personal expenses.

How fast can I receive funds from Rainy Day Lending?

If a lender is found and you agree to the loan terms, the funds can be deposited directly into your bank account as soon as the next business day.

What privacy and security measures does Rainy Day Lending have in place?

Rainy Day Lending prioritizes the privacy and security of your personal information. They utilize 256-bit SSL encryption to ensure that your sensitive data is transmitted securely.

Are there any fees associated with using the Rainy Day Lending website?

No, Rainy Day Lending does not charge any fees to borrowers for using their website or submitting a loan request. However, the loan fees and interest rates are determined by the lender, and you will receive full disclosure of these terms before accepting the loan.

What are the qualification requirements for a loan from Rainy Day Lending?

To qualify for a loan from Rainy Day Lending, you must be employed or have a regular source of income, earn at least $800 per month, be 18 years of age or older, and be a resident of the United States.

Does Rainy Day Lending make outbound calls or collect funds from consumers?

No, Rainy Day Lending does not make outbound calls to consumers or collect funds from consumers. If you receive any suspicious calls or requests, please report them immediately.

How can I evaluate the trustworthiness of the Rainy Day Lending website?

The Rainy Day Lending website has been evaluated by ScamAdviser. While it has received positive ratings for its SSL certificate validity and trust from reputable security companies, there are some negative indicators to consider as well. These include the owner hiding their identity on WHOIS and the website not having many visitors. It is important to consider these factors when assessing the credibility of the company.