Looking for a quick and convenient way to secure a loan? Quick Loan Lending is a lender connection service that offers U.S. borrowers the opportunity to access various loan options from multiple lenders. Whether you need a personal loan, unsecured loan, installment loan, or emergency loan, Quick Loan Lending can connect you with the right lender to meet your financial needs.

As a borrower, you want to ensure that you have a clear understanding of the rates, terms, and customer service experience associated with your loan. Quick Loan Lending provides transparent information to help you make informed decisions before accepting any loan offers. By reviewing the terms and conditions provided by the lender, you can evaluate whether the loan aligns with your financial goals and capabilities.

It is important to note that Quick Loan Lending does not perform a credit check. However, individual lenders in their network may conduct a credit check to assess your creditworthiness. The loan amount you can obtain and the specific rates offered will depend on the lender’s policies and your creditworthiness. Take the time to carefully review the loan agreement, including the Annual Percentage Rate (APR), which represents the actual yearly cost of funds over the term of the loan.

When it comes to customer service, Quick Loan Lending strives to provide a seamless experience for borrowers. However, customer service experiences may vary depending on the specific lender. Be sure to read reviews and research the lender’s reputation to ensure you have a positive experience.

Key Takeaways

- Quick Loan Lending connects U.S. borrowers with multiple lending partners for a range of loan options.

- Review the terms and conditions of the loan before accepting it to understand the rates and repayment terms.

- Quick Loan Lending does not perform a credit check, but individual lenders may do so.

- Customer service experiences may vary depending on the lender.

- Take the time to research and choose the loan option that best suits your needs.

How it Works

To use Quick Loan Lending, you simply need to follow a few simple steps:

- Submit your personal and financial information through a secure short form on the Quick Loan Lending website.

- Your information will be encrypted to ensure its safety and securely transmitted to potential lenders.

- If you’re approved for a loan, you will be redirected to the lender’s website.

- On the lender’s website, you can review the specific terms and rates of the loan.

- If the terms are acceptable to you, you can proceed and accept the loan.

- Once you’ve accepted the loan, the lender may be able to deposit the funds directly into your bank account as soon as the next business day.

Using Quick Loan Lending is a quick and convenient way to access the funds you need, right when you need them.

Loan Options

When it comes to borrowing money, Quick Loan Lending provides a range of loan options to suit your specific needs. Whether you need funds for personal expenses, have an emergency situation, or require a loan without collateral, Quick Loan Lending has you covered. Here are the loan options available:

1. Personal Loans

Quick Loan Lending offers personal loans to help you finance various expenses, such as medical bills, home repairs, or education costs. With competitive interest rates and flexible repayment terms, personal loans can offer a practical solution to your financial needs.

2. Unsecured Loans

If you don’t have collateral to secure a loan, Quick Loan Lending provides unsecured loans that don’t require any form of guarantee. These loans are based on your creditworthiness and can be used for a range of purposes, from debt consolidation to covering unexpected expenses.

3. Installment Loans

For larger expenses that need to be paid off over time, Quick Loan Lending offers installment loans. These loans allow you to borrow a specific amount and repay it in monthly installments, making it more manageable for your budget. With fixed interest rates and predetermined repayment periods, installment loans provide stability and convenience.

4. Emergency Loans

In times of financial urgency, Quick Loan Lending understands the need for quick access to funds. That’s why they offer emergency loans to help you cover unexpected expenses, such as medical emergencies or car repairs. These loans can provide the financial assistance you need in a timely manner.

It’s important to note that the terms and conditions for each loan option will vary based on the lender’s policies and your creditworthiness. Before committing to a loan, it’s crucial to carefully review the terms and understand the repayment obligations. By choosing Quick Loan Lending, you can explore these loan options and find the one that best suits your unique requirements.

| Loan Option | Features |

|---|---|

| Personal Loans | – Competitive interest rates – Flexible repayment terms – Suitable for various expenses |

| Unsecured Loans | – No collateral required – Based on creditworthiness – Can be used for multiple purposes |

| Installment Loans | – Repayment in monthly installments – Fixed interest rates – Stability and convenience |

| Emergency Loans | – Quick access to funds – Designed for urgent needs – Helps cover unexpected expenses |

APR Information

The Annual Percentage Rate (APR) is a crucial factor to consider when obtaining a loan. It represents the annual rate at which the loan accrues interest, taking into account the loan amount, cost, repayment amounts, and timing of payments. Understanding the APR is essential to evaluate the overall cost of borrowing and make informed financial decisions.

At Quick Loan Lending, we prioritize transparency and ensure that the lender or lending partner provides borrowers with the APR before entering into the loan agreement. This allows borrowers to fully comprehend the financial implications of the loan and make an educated decision based on their circumstances.

The APR can vary based on the borrower’s creditworthiness, with lower rates potentially available to customers who have excellent credit. State laws and the specific lender or lending partner may also affect the minimum and maximum loan amounts and APRs. It’s crucial for borrowers to carefully review the terms and conditions of the loan, including the APR, to ensure they align with their financial goals and obligations.

By providing borrowers with transparent and comprehensive information, Quick Loan Lending empowers individuals to make responsible borrowing decisions and navigate the loan process with confidence.

Renewal Policy

When it comes to loans, each lender has its own renewal policy, which can vary from one lender to another. As a borrower, it is crucial for you to thoroughly review the terms and renewal policy of your specific lender before signing the loan agreement. Understanding the renewal policy is essential to avoid any surprises or unexpected consequences down the line.

Renewal policies can differ significantly between lenders, so it is important to pay attention to the specific details provided by your lender. Some lenders may offer renewal options that allow you to extend the loan term if needed, while others may not provide this flexibility. It is essential to familiarize yourself with your lender’s renewal policy to make informed decisions regarding loan renewals.

Additionally, it is important to note that late payments on loans may result in additional fees or collection activities, depending on the lender’s policies. It is within your best interest to make timely payments to avoid any additional financial burden.

“Understanding the renewal policy is essential to avoid any surprises or unexpected consequences down the line.”

To summarize:

| Key Takeaways |

|---|

| Each lender has its own renewal policy. |

| Review the renewal policy before signing the loan agreement. |

| Late payments may result in additional fees or collection activities. |

Late, Partial, or Non-Payments and Collections

When you agree to a loan, you commit to fully repaying it according to the terms outlined in the loan agreement. It is important to make timely payments to avoid any complications or negative consequences.

If you are late on a payment, the lender may impose additional fees or penalties. These late fees can add up over time, making it even harder to catch up on your payments. It is crucial to review your loan agreement to understand the specific late payment policies set by your lender.

In the case of partial payments or non-payments, lenders may take further actions to collect the outstanding amounts. They may initiate collection activities, which can include phone calls, emails, or letters to remind you of your payment obligations.

In some cases, lenders may also report late, partial, or non-payments to a consumer reporting agency. This can have a negative impact on your credit score and make it more difficult for you to obtain future loans or credit.

It is essential to familiarize yourself with your lender’s policies regarding late payments and collections to avoid any potential issues. If you are facing financial difficulties, it is recommended to reach out to your lender as soon as possible to discuss alternative payment arrangements or options to avoid negative consequences.

Key Takeaways:

- Make timely payments to avoid additional fees or penalties.

- Review your loan agreement to understand the late payment policies of your lender.

- Partial payments or non-payments can lead to collection activities.

- Lenders may report late, partial, or non-payments to consumer reporting agencies, impacting your credit score.

- If you are facing financial difficulties, contact your lender to discuss alternative payment arrangements.

| Late, Partial, or Non-Payments and Collections | Actions and Consequences |

|---|---|

| Late Payments | Additional fees or penalties imposed by the lender |

| Partial Payments | Possible initiation of collection activities |

| Non-Payments | Initiation of collection activities and potential impact on credit score |

| Collections | Phone calls, emails, or letters from lenders to remind you of payment obligations |

| Credit Reporting | Potential reporting of late, partial, or non-payments to consumer reporting agencies |

Benefits of Quick Loan Lending

Quick Loan Lending offers several benefits to borrowers. With fast approval and quick funding, you can expect a seamless experience when accessing funds. The approval process typically takes only a few minutes, and you could receive the funds as soon as the next business day.

Your privacy and security are a top priority at Quick Loan Lending. The platform employs bank-level encryption to safeguard your personal information, ensuring that your data remains protected throughout the loan process.

Applying for a loan has never been easier. With Quick Loan Lending’s convenient online form, you can complete the entire loan request process without the hassle of waiting in line or visiting a physical store. Simply fill out the form from the comfort of your own home and submit it online.

“Quick Loan Lending ensures a fast and secure loan application process, allowing borrowers to access funds quickly and conveniently.”

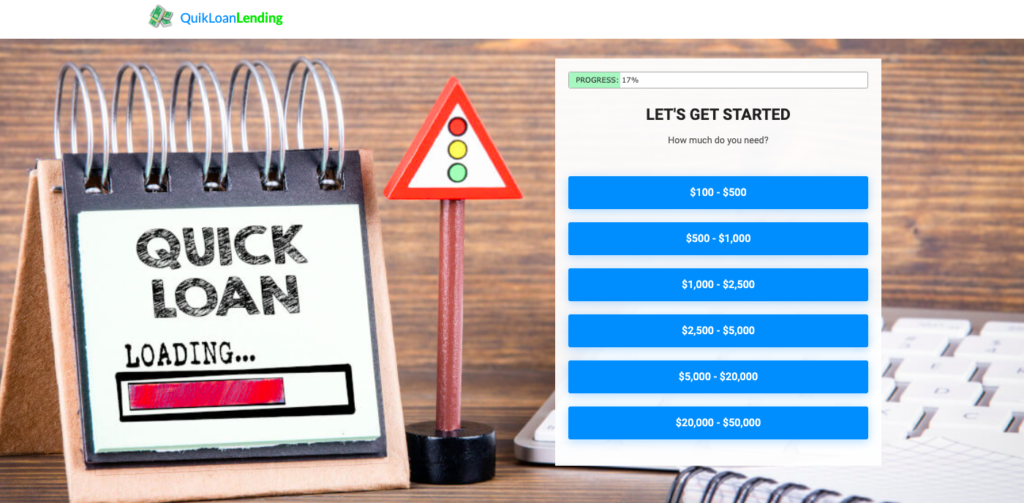

Easy Online Form

Quick Loan Lending aims to provide a hassle-free experience for borrowers with its easy online form. Designed to be both simple and secure, the online form allows borrowers to complete their loan request in less than 5 minutes. With user-friendly features and intuitive navigation, the form streamlines the application process, making it quick and convenient for borrowers.

The online form is integrated with multiple lenders, giving borrowers access to a wide range of loan options. By partnering with various lenders, Quick Loan Lending maximizes the chances of finding a suitable loan for every borrower’s unique financial needs and circumstances. This saves borrowers time and effort from having to individually research and approach different lenders.

| Benefits of Quick Loan Lending’s Easy Online Form: |

|---|

| Quick completion in less than 5 minutes |

| Integration with multiple lenders |

| Online decision within minutes |

Once the online form is submitted, borrowers can expect to receive an online decision within minutes. This allows them to quickly review the loan offers available to them and make an informed decision based on their financial situation and needs.

Credit Check and Loan APR

When considering a loan through Quick Loan Lending, it is important to understand the role of a credit check and the loan APR. While Quick Loan Lending itself does not perform a credit check, the individual lenders in their network may do so to assess your creditworthiness and determine the loan amount. This check helps the lenders evaluate your financial history and determine the risk associated with lending to you.

The loan APR, or Annual Percentage Rate, is a crucial factor to consider when accepting a loan. It represents the actual yearly cost of funds over the term of the loan and is expressed as a percentage. The loan APR includes the interest rate as well as any additional fees associated with the loan. It is essential to review the loan agreement, including the loan APR, before accepting the loan to understand the total cost of borrowing.

Quick Loan Lending advises borrowers to carefully review the lender’s terms and conditions, including the loan APR and repayment terms, before accepting the loan. This ensures that you have a clear understanding of the total cost of the loan and any specific requirements or conditions associated with it. It is important to make an informed decision based on your individual financial situation and needs.

Loan Amount and Store Visits

When it comes to obtaining a loan through Quick Loan Lending, the loan amount available to you will depend on the policies set by the lender as well as your own creditworthiness. This means that the amount you can borrow may vary from lender to lender.

While Quick Loan Lending provides a convenient online loan application process, it’s important to note that some lenders may require borrowers to visit their physical store in order to receive the funds on the same day. However, whether a store visit is necessary or not will ultimately depend on the specific lender you are working with.

Here are a few key points to keep in mind:

- The loan amount you are eligible for will be determined by the lender’s policies and your creditworthiness.

- Some lenders may require borrowers to visit their physical store for same-day funding purposes.

- The necessity for a store visit will vary depending on the lender you choose to work with.

Get the Money You Need

When you’re in need of quick cash, Quick Loan Lending has got you covered. We understand that unexpected expenses can arise, and you may require financial assistance to meet your needs. That’s why we offer borrowers the opportunity to receive up to $50,000 in loan proceeds directly deposited into their checking account as soon as the next business day.

With our simple and straightforward loan request process, starting is easy. Just visit the Quick Loan Lending website and fill out our online form. The form only takes a few minutes to complete, and it’s designed to be user-friendly and convenient.

Once you’ve submitted your loan request, our platform connects you with multiple lending partners who will review your application. If approved, you’ll be redirected to the lender’s website, where you can review the specific terms and rates of your loan.

If the terms are agreeable, the lender can deposit the funds into your checking account quickly, ensuring that you have access to the money you need without delay. Our goal is to make the process as efficient and convenient as possible, so you can focus on taking care of your financial obligations.

Don’t let financial stress hold you back. Start here with Quick Loan Lending and get the money you need today.

Benefits of Choosing Quick Loan Lending

When you choose Quick Loan Lending, you’ll enjoy several benefits:

- Fast approval: Our platform strives to provide borrowers with quick approvals, often within minutes.

- Quick funding: If approved, you can receive the funds as soon as the next business day.

- Bank-level encryption: Your personal information is encrypted to ensure its security.

- Online form: Our easy-to-use online form saves you time and eliminates the need to wait in line.

At Quick Loan Lending, we understand that when you’re in need of funds, time is of the essence. That’s why we’ve built a platform that prioritizes efficiency and convenience, so you can get the money you need when you need it most.

Conclusion

Quick Loan Lending provides a comprehensive solution for U.S. borrowers looking for quick access to a variety of loan options. With their platform, borrowers can conveniently compare rates, terms, and customer service experiences from multiple lenders. Whether you need a personal loan, unsecured loan, installment loan, or emergency loan, Quick Loan Lending has you covered.

While each lender may have different rates, terms, and customer service standards, Quick Loan Lending ensures that borrowers have the tools they need to make an informed decision. It’s crucial for borrowers to carefully review the terms and conditions of the loan before accepting to ensure it aligns with their financial goals and capabilities.

With Quick Loan Lending, you can enjoy a seamless loan application process and potentially receive the funds you need as quickly as the next business day. Start exploring your loan options today and find the solution that best meets your financial needs.

FAQ

What is Quick Loan Lending and how does it work?

Quick Loan Lending is a lender connection service that allows borrowers in the United States to submit their loan requests online. The platform works with multiple lending partners to provide a range of loan options. Once the borrower’s information is submitted, they may be redirected to a lender’s website to review specific loan terms and rates. If they accept the terms, the funds may be deposited into their bank account as soon as the next business day.

What types of loans does Quick Loan Lending offer?

Quick Loan Lending offers various loan options, including personal loans, unsecured loans, installment loans, and emergency loans.

What is the Annual Percentage Rate (APR) and how does it affect the loan?

The APR represents the annual rate at which the loan accrues interest. It can vary based on factors such as the loan amount, repayment terms, and the borrower’s creditworthiness. Borrowers are advised to review the APR and other terms and conditions before accepting the loan.

What is the renewal policy for loans obtained through Quick Loan Lending?

Each lender has its own renewal policy, so borrowers should review their specific lender’s terms before signing the loan agreement.

What happens if I am late on my loan payment?

Late payments may result in additional fees or collection activities, depending on the lender’s policies. Borrowers should review their lender’s specific policies regarding late payments to understand the potential consequences.

What are the benefits of using Quick Loan Lending?

Quick Loan Lending offers fast approval, quick funding, and a secure online form that can be completed in minutes. Borrowers also have the option to compare loan options from multiple lenders.

How long does it take to complete the online form?

The online form can be completed in less than 5 minutes, and borrowers can expect to receive an online decision within minutes.

Will my credit be checked when using Quick Loan Lending?

Quick Loan Lending does not perform a credit check, but the individual lenders in their network may do so to assess creditworthiness and determine the loan amount. Borrowers should review the lender’s terms and conditions, including the loan APR, before accepting the loan.

How much can I borrow through Quick Loan Lending?

The maximum loan amount depends on the lender’s policies and the borrower’s creditworthiness. Some lenders may also require borrowers to visit their physical store to receive same-day funding.

How quickly can I receive the loan proceeds?

If approved, the lender may be able to deposit the funds directly into your bank account as soon as the next business day.