Payday SOS is a reliable lender connection service that offers a range of personal loan options, making it an ideal choice for individuals in the United States facing urgent financial emergencies. Whether you need a cash advance loan, installment loan, or emergency loan, Payday SOS can help you secure the funds you need quickly and conveniently.

One of the key advantages of Payday SOS is its commitment to providing a secure and hassle-free borrowing experience. The service utilizes bank-level encryption to safeguard your personal information, ensuring that your data remains protected throughout the entire loan application process.

When you apply for a loan through Payday SOS, the approval and funding process is exceptionally fast. In many cases, approved borrowers can receive their funds in as little as 24 hours, allowing you to quickly address your pressing financial needs.

Another benefit of choosing Payday SOS is the convenience of the online application process. Unlike traditional lenders that require you to visit a physical store or wait in long lines, Payday SOS enables you to complete the entire loan application from the comfort of your own home. This streamlined process saves you time and enables you to get the funds you require without unnecessary delays.

Payday SOS is dedicated to ensuring customer satisfaction. As a member of the Online Lenders Alliance, they prioritize transparency and fairness in their dealings with borrowers. They carefully vet their network of lenders to ensure reputable partners who adhere to fair debt collection practices.

It’s important to note that the APR on loans offered by Payday SOS’s partner lenders may vary depending on factors such as loan amount, duration, and any associated fees. Therefore, it’s crucial to carefully review the terms and conditions of any loan offer before accepting it to make an informed decision that aligns with your financial situation.

To avoid late payment fees and charges, Payday SOS emphasizes the importance of repaying the loan on time. While they don’t engage in debt collection practices themselves, they work with lenders who pursue collections fairly and responsibly.

In conclusion, Payday SOS offers a reliable and convenient solution for individuals in urgent need of personal loans in the United States. With their secure online platform, fast approval and funding process, and commitment to customer satisfaction, they provide a valuable resource for those facing financial emergencies. Remember to carefully review loan terms, repay your loan on time, and work with reputable lenders for a positive borrowing experience.

Key Takeaways:

- Payday SOS is a reliable lender connection service offering a variety of personal loan options.

- Personal loans through Payday SOS can be obtained quickly, with funds potentially available in as little as 24 hours.

- The online application process provided by Payday SOS is convenient and eliminates the need to visit physical stores or wait in long lines.

- Payday SOS prioritizes customer satisfaction and works with reputable lenders who adhere to fair debt collection practices.

- It’s important to carefully review loan terms and repay the loan on time to avoid late payment fees and charges.

Convenient and Secure Loan Options

Payday SOS understands the urgency of financial emergencies and provides a secure platform for individuals to access various types of personal loans in the United States. Whether you need a personal loan, cash advance loan, installment loan, or emergency loan, Payday SOS can connect you with lenders who can help.

One of the key benefits of using Payday SOS is the convenience it offers. The entire loan application process can be completed online, eliminating the need to wait in line or visit a physical store. This saves you time and allows you to apply for a loan from the comfort of your own home. Plus, Payday SOS uses bank-level encryption to ensure the safety of your personal information, giving you peace of mind while accessing the funds you need.

With Payday SOS, you can also expect a quick and efficient loan approval process. If approved, you may be able to receive the money in as little as 24 hours, providing a timely solution for your financial needs. Payday SOS works with a network of reputable lenders who are dedicated to helping borrowers in need, ensuring a secure and reliable loan experience.

Table: Loan Types Offered by Payday SOS

| Loan Type | Description |

|---|---|

| Personal Loan | A loan that can be used for various personal expenses with flexible repayment terms. |

| Cash Advance Loan | A short-term loan designed to provide immediate cash to cover unexpected expenses. |

| Installment Loan | A loan repaid in fixed monthly installments over a specified period, offering flexibility in managing your payments. |

| Emergency Loan | A loan designed to provide quick financial assistance during unexpected emergencies. |

No matter the type of loan you choose, Payday SOS is committed to ensuring that customers are informed and treated fairly. They are a member of the Online Lenders Alliance, an industry trade organization that promotes responsible lending practices. It is important to carefully review the terms and conditions of any loan offer before accepting it, as the APR and fees can vary based on factors such as loan amount and duration.

To avoid any additional fees or charges, Payday SOS encourages borrowers to repay their loans on time. While they do not engage in debt collection practices themselves, they work with reputable lenders in their network who pursue collections fairly. By prioritizing timely repayment, you can maintain a positive borrowing experience and avoid unnecessary financial burdens.

Quick Loan Approval and Funding

With Payday SOS, individuals can experience rapid loan approval and funding, ensuring that they can address their financial emergencies without unnecessary delays. The convenience of the service lies in its ability to connect borrowers with suitable personal loan options quickly and securely. By partnering with a network of reputable lenders, Payday SOS streamlines the loan application process and expedites the funding process, allowing borrowers to access the funds they need in as little as 24 hours.

Payday SOS understands the urgency that comes with unexpected expenses, and their commitment to quick loan approval and funding sets them apart from traditional lenders. Gone are the days of waiting in long lines or enduring time-consuming paperwork. With the click of a button, borrowers can complete the online application process from the comfort of their own homes, saving valuable time and effort.

Moreover, their dedication to customer satisfaction ensures that borrowers are informed and treated fairly throughout the loan experience. Payday SOS is a member of the Online Lenders Alliance, which upholds high standards of transparency and ethical lending practices. Borrowers can rest assured that they are working with a reputable service that prioritizes their well-being.

Table 1: Loan Approval and Funding Process

| Step | Description |

|---|---|

| 1 | Complete the online application |

| 2 | Receive a loan offer from a lender in the Payday SOS network |

| 3 | Review the terms and conditions of the loan offer |

| 4 | Accept the loan offer |

| 5 | Get approved and receive funds in as little as 24 hours |

When considering a personal loan, it is essential to review the loan terms and conditions. Payday SOS provides borrowers with clear and concise information about the loan terms, including factors that can affect the APR and potential fees. Understanding these details empowers borrowers to make informed decisions and ensures that they are fully aware of their financial obligations.

In conclusion, Payday SOS offers a streamlined and efficient loan approval and funding process, providing individuals with the financial assistance they need when they need it most. By prioritizing convenience, security, and customer satisfaction, Payday SOS sets itself apart as a trusted lender connection service for anyone facing unexpected expenses or emergencies.

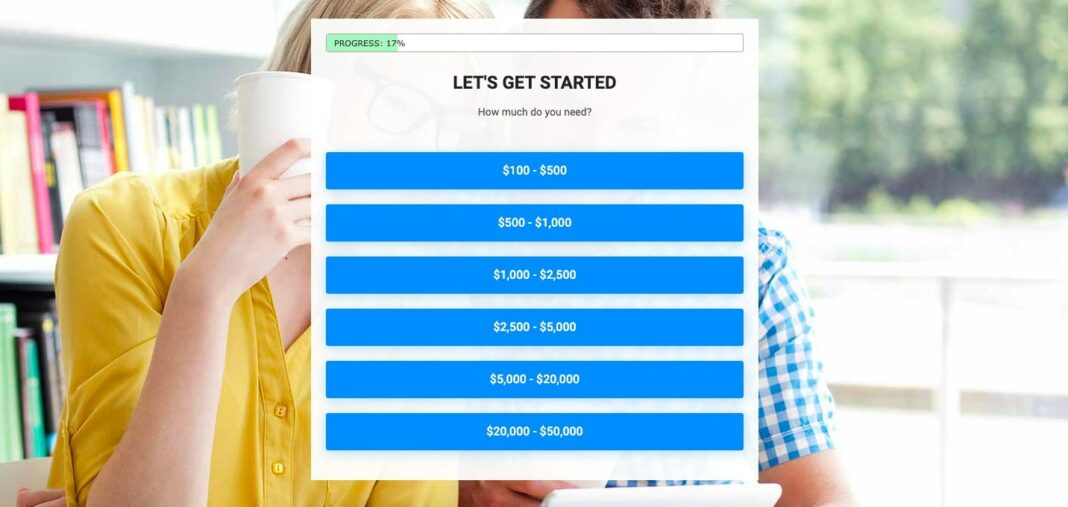

Online Application Process

Payday SOS simplifies the loan application process by offering an online platform that eliminates the need for borrowers to visit physical stores or wait in long lines. With just a few clicks, you can complete the entire loan application from the comfort of your own home.

The online application process is designed to be user-friendly, allowing you to easily navigate through each step. You will be required to provide basic personal information, such as your name, address, and contact details. Additionally, you may need to provide details about your employment, income, and banking information.

Once you have submitted your application, Payday SOS will connect you with a network of reputable lenders who will review your information. If you meet the lender’s criteria, you may receive loan offers tailored to your specific financial needs.

| Benefits of Payday SOS Online Application Process |

|---|

| Convenience – Apply for a loan anytime, anywhere, without the hassle of visiting a physical store. |

| Efficiency – Complete the entire application process online, saving you time and effort. |

| Security – Payday SOS uses bank-level encryption to protect your personal information. |

| Speed – Receive loan offers in as little as a few minutes, and get funds deposited directly into your bank account within 24 hours if approved. |

By utilizing the online application process provided by Payday SOS, you can enjoy a convenient and secure way to apply for a personal loan. Remember to carefully review the terms and conditions of any loan offer before accepting it, as each lender may have different rates, fees, and repayment terms.

Commitment to Customer Satisfaction

Payday SOS places a strong emphasis on customer satisfaction, working closely with reputable lenders and maintaining a commitment to fair treatment and transparency. They strive to ensure that borrowers are informed, treated fairly, and satisfied with their loan experience. By connecting borrowers with suitable personal loan options quickly and securely, Payday SOS aims to provide a convenient and reliable solution for those in need of quick financial assistance.

As a member of the Online Lenders Alliance, Payday SOS follows industry best practices and subscribes to a code of conduct that prioritizes customer protection and responsible lending. They work with a network of reputable lenders who pursue collections fairly, ensuring that borrowers are treated with respect and offered reasonable repayment options in case of financial difficulties.

Furthermore, Payday SOS’s commitment to customer satisfaction extends to the safety and security of borrowers’ personal information. By implementing bank-level encryption measures, they ensure that sensitive data is protected from unauthorized access. This provides borrowers with peace of mind knowing that their personal and financial details are safeguarded throughout the loan application process.

Transparent Loan Terms and Conditions

When considering a loan offer from Payday SOS, it is important for borrowers to carefully review the terms and conditions provided by the lender. The APR on loans offered by the lenders in Payday SOS’s network varies depending on factors such as the loan amount, duration, and associated fees. Borrowers should take the time to understand these terms to make an informed decision.

In addition, Payday SOS encourages borrowers to repay their loans on time to avoid late payment fees and potential negative consequences. Timely repayment not only helps maintain a good credit standing but also demonstrates responsible financial behavior. By fulfilling their repayment responsibilities, borrowers can avoid additional fees and charges, ensuring a smooth and positive loan experience.

Overall, Payday SOS’s commitment to customer satisfaction, fair treatment, and transparency makes it a reliable option for individuals seeking personal loans in the United States. With a convenient online application process, quick approval and funding, and a range of loan options, Payday SOS strives to provide a seamless and satisfactory borrowing experience for those in need of financial assistance.

| Key Benefits of Payday SOS | Loan Options | Loan Approval and Funding | Application Process | Safety Measures |

|---|---|---|---|---|

| Convenience and reliability | Personal loans, cash advance loans, installment loans, emergency loans | Receive funds as quickly as 24 hours | Complete the entire application online | Bank-level encryption for data protection |

| Commitment to customer satisfaction | Transparent loan terms and conditions | Encouragement of timely repayment |

Loan Terms and Conditions

It is essential for borrowers to carefully review the loan terms and conditions provided by Payday SOS, as they vary depending on loan amount, duration, and associated fees. Understanding the terms and conditions of your loan is crucial to ensure that you are making an informed decision and are aware of your rights and responsibilities as a borrower.

When exploring loan options through Payday SOS, you will find that the specific terms and conditions can vary from lender to lender. These terms may include factors such as the interest rate, repayment period, and any additional fees or charges that may be applicable. By carefully reviewing these terms, you can determine the total cost of your loan and make an informed decision about whether it meets your needs.

For example, a lender may offer a lower interest rate for a shorter repayment period, while another lender may offer a longer repayment period with a higher interest rate. By comparing the terms and conditions of different loan offers, you can choose the option that best fits your financial situation and repayment capabilities.

| Loan Amount | Interest Rate | Repayment Period | Associated Fees |

|---|---|---|---|

| $1,000 | 10% | 6 months | $50 origination fee |

| $2,000 | 12% | 12 months | No associated fees |

| $3,000 | 15% | 24 months | $75 late payment fee |

In addition to the specific terms and conditions, it is important to understand the potential consequences of not repaying your loan on time. Late payment fees and additional charges may be applied, impacting the total cost of your loan. By understanding and adhering to the repayment responsibilities, you can avoid these extra costs and maintain a positive borrowing experience.

By carefully reviewing the loan terms and conditions provided by Payday SOS, you can make an informed decision about your borrowing needs. Comparing the options available to you and understanding the associated costs will help you choose the loan that best suits your financial situation and ensures a smooth borrowing experience.

Repayment Responsibilities

Payday SOS encourages borrowers to fulfill their repayment responsibilities promptly to avoid incurring late payment fees or facing unnecessary financial burdens. When you receive a loan through Payday SOS, it is essential to understand the terms and conditions of the loan agreement. This includes knowing the due date and the total amount owed, which consists of the loan amount, interest, and any applicable fees.

To assist borrowers in managing their repayment responsibilities, Payday SOS recommends creating a budget and setting aside funds specifically for loan repayment. By prioritizing loan repayment, you can avoid the stress of falling behind on payments and potential consequences such as additional charges or damage to your credit score.

Payday SOS believes in transparent communication with borrowers. If, for any reason, you anticipate difficulties in meeting your repayment obligations, it is crucial to reach out to the lender promptly. They may be able to work with you to find a solution, such as adjusting your repayment schedule or exploring alternative options.

Remember, responsible borrowing not only helps you fulfill your obligations but also contributes to maintaining a positive credit history. By repaying your loan on time, you can establish a reliable track record with lenders, which may increase your chances of obtaining favorable loan terms in the future.

| Repayment Tips: |

|---|

| 1. Set up automatic payments to ensure timely repayment. |

| 2. Create a repayment plan that fits your budget. |

| 3. Avoid unnecessary expenses to prioritize loan repayment. |

| 4. Seek assistance or guidance from the lender if facing difficulties. |

Fair Debt Collection Practices

Payday SOS works exclusively with lenders who engage in fair debt collection practices, providing borrowers with peace of mind regarding their loan agreements. They understand that unexpected financial situations can arise, and they strive to work with borrowers to find feasible repayment solutions.

When a borrower is unable to repay their loan on time, Payday SOS encourages open communication with the lender to explore options such as loan extensions or restructuring. This flexibility allows borrowers to avoid costly late payment fees and penalties that may otherwise be imposed by lenders who do not follow fair debt collection practices.

Payday SOS is committed to transparency and preventing abusive debt collection practices. They carefully vet and partner with lenders who adhere to regulations set forth by relevant authorities, ensuring that borrowers are treated with respect and fairness throughout the loan process.

| Key Highlights of Payday SOS’s Fair Debt Collection Practices: |

|---|

| 1. Communication: Lenders associated with Payday SOS maintain open lines of communication with borrowers, providing them with clear information about their loan terms, repayment options, and any potential consequences of late payments. |

| 2. Flexibility: Borrowers facing financial difficulties are encouraged to reach out to their lender to discuss possible solutions. Lenders may offer loan extensions, alternate repayment plans, or other options to help borrowers navigate their financial challenges. |

| 3. Compliance: Payday SOS partners with lenders who comply with applicable regulations, ensuring that borrowers are not subjected to unlawful debt collection practices. |

Borrowers can rest assured that when they choose Payday SOS for their lending needs, they will be connected with reputable lenders who prioritize fair debt collection practices and work in the best interest of borrowers.

Safety and Encryption Measures

Payday SOS prioritizes the security of personal information by employing bank-level encryption technologies, ensuring that borrowers’ data remains safe and confidential. Their robust encryption measures protect sensitive information from unauthorized access, providing customers with peace of mind when applying for a loan online.

When you submit your personal details through Payday SOS’s secure platform, your information is encrypted and transmitted using industry-standard SSL (Secure Socket Layer) technology. This encryption process scrambles your data, making it virtually impossible for anyone to intercept or decipher it.

Furthermore, Payday SOS adheres to stringent security protocols to safeguard customer data. Their systems are regularly audited and updated to maintain the highest level of security. They also employ strict access controls to ensure that only authorized personnel have access to sensitive information.

| Safety and Encryption Measures at Payday SOS | |

|---|---|

| Encryption Technology | Bank-level SSL encryption |

| Data Protection | Robust security protocols and access controls |

| Regular Audits | Systems audited and updated to maintain security |

As a member of the Online Lenders Alliance, Payday SOS is committed to upholding the highest standards of customer protection. They work with reputable lenders who share the same commitment to fair debt collection practices and customer satisfaction.

Remember, it’s important to be cautious when sharing personal information online. Always ensure you are using a secure platform like Payday SOS, which puts your safety first and employs the latest encryption technologies to protect your data.

Conclusion

Payday SOS is a trusted lender connection service that provides individuals in the United States with quick access to reliable personal loans, offering convenience, security, and peace of mind during financial emergencies.

With various loan options available, including personal loans, cash advance loans, installment loans, and emergency loans, Payday SOS ensures that borrowers can find the right solution for their immediate financial needs. The service stands out for its convenient and secure platform, allowing users to apply for loans online without the need for lengthy paperwork or physical store visits.

When you choose Payday SOS, you can rest assured that your personal information is protected by bank-level encryption, safeguarding your privacy throughout the loan application process. If approved for a loan, you can expect to receive the funds in as little as 24 hours, allowing you to address your financial obligations without delay.

Payday SOS is committed to providing a positive customer experience, ensuring that borrowers are well-informed and treated fairly. It is important to carefully review the terms and conditions of any loan offer, as the APR may vary depending on factors such as the loan amount, duration, and associated fees. Prompt repayment is encouraged to avoid any additional charges or fees.

As a member of the Online Lenders Alliance, Payday SOS prioritizes customer satisfaction and works with reputable lenders who adhere to fair debt collection practices. Their commitment to safety and security, along with their dedication to providing fast and reliable loan services, make Payday SOS the preferred choice for individuals in need of financial assistance during challenging times.

FAQ

What is Payday SOS?

Payday SOS is a lender connection service that helps people across the country get loans for emergency expenses.

What types of loans does Payday SOS offer?

Payday SOS offers various types of loans including personal loans, cash advance loans, installment loans, and emergency loans.

Why is Payday SOS popular?

Payday SOS is popular because it provides a convenient and secure way to access the money you need quickly.

How does Payday SOS ensure the safety of personal information?

Payday SOS uses bank-level encryption to ensure the safety of your personal information.

How quickly can I receive the money if approved for a loan?

If approved for a loan, you may be able to receive the money in as little as 24 hours.

Can I complete the loan process online?

Yes, the entire loan process can be completed online, eliminating the need to wait in line or go to a physical store.

Is Payday SOS a member of any industry organizations?

Yes, Payday SOS is a member of the Online Lenders Alliance.

What factors affect the APR on loans offered by Payday SOS?

The APR on loans offered by the lenders in Payday SOS’s network varies depending on factors such as loan amount, duration, and fees.

What happens if I am unable to repay the loan on time?

If you are unable to repay your loan on time, additional fees or charges may apply.

Does Payday SOS engage in debt collection practices?

No, Payday SOS does not engage in debt collection practices themselves but works with reputable lenders who pursue collections in a fair manner.

What safety measures does Payday SOS implement?

Payday SOS implements bank-level encryption to protect the personal information of borrowers.