Looking for fast, reliable personal loans in the US? Read our comprehensive GetFundsQuickly review to discover how this online platform can help you achieve financial independence.

Key Takeaways:

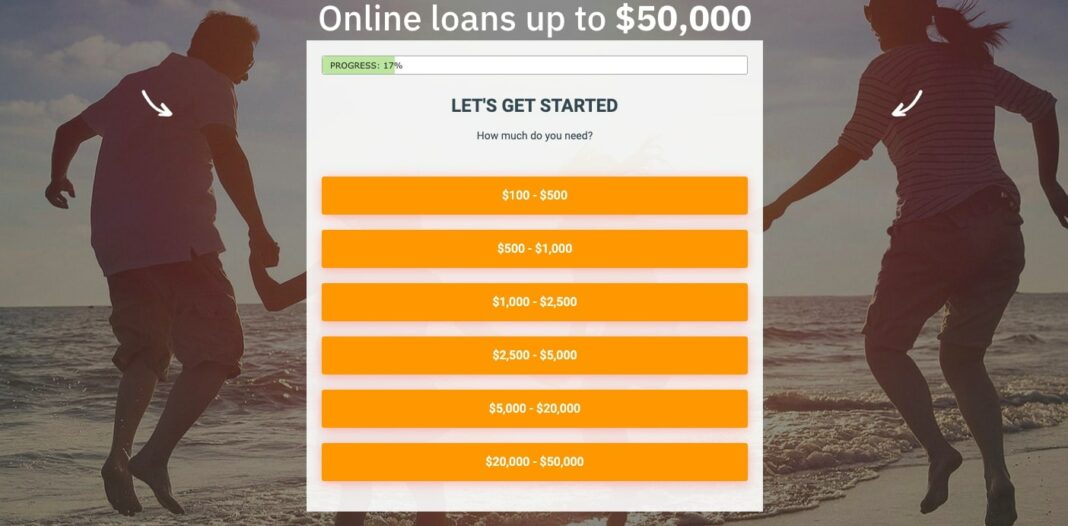

- GetFundsQuickly offers personal loans up to $50,000.

- The application process is secure and easy-to-use.

- Funds can be transferred to your bank account as soon as the next business day.

- GetFundsQuickly helps people obtain loans for emergency expenses like medical bills and car repairs.

- The website prioritizes data security with bank-level encryption.

GetFundsQuickly – Personal Loans (US)

GetFundsQuickly offers personal loans to individuals in the United States, providing a convenient and secure way to access funds quickly. Whether you need money for emergency expenses like medical bills or car repairs, or simply need extra cash for a personal project, GetFundsQuickly is here to help. With loan amounts ranging from $200 to $50,000, there’s a solution for everyone.

Applying for a loan through GetFundsQuickly is a breeze. The platform provides a secure and easy-to-use form that ensures your personal information is protected. Once you submit your application, you can expect a quick decision in most cases, allowing you to move forward with your financial plans without unnecessary delays. If approved, the funds can be transferred to your bank account as soon as the next business day, offering a fast and efficient way to get the money you need.

At GetFundsQuickly, data security is a top priority. The website utilizes bank-level encryption to safeguard your information and ensure that it remains confidential. This means you can rest easy knowing that your personal and financial data is protected throughout the entire loan application process. Additionally, there are no fees to use the platform, making it even more convenient for borrowers.

It’s important to note that GetFundsQuickly operates as a lead generator, connecting borrowers with lenders that match their needs and criteria. The loan amounts offered depend on the lender’s policies and the borrower’s creditworthiness. While GetFundsQuickly strives to provide access to loans for individuals with varying credit scores, it’s essential to maintain timely payments. Late payments may result in additional fees or collection activities. Therefore, it’s crucial to review the terms and conditions of your loan agreement carefully and ensure that you can meet the repayment obligations.

| Loan Amounts | Creditworthiness |

| $200 – $50,000 | Lender’s policies and borrower’s creditworthiness |

In conclusion, GetFundsQuickly offers individuals in the United States a reliable and efficient way to obtain personal loans. With a secure application process, swift funding transfers, and a focus on data security, borrowers can trust that their financial needs are in capable hands. Whether it’s for emergency expenses or other purposes, GetFundsQuickly aims to provide versatile financial assistance while ensuring a positive borrowing experience.

Secure and Easy Application Process

Applying for a personal loan through Get Funds Quickly is a breeze with their secure and easy-to-use online application form. Whether you’re in need of funds for emergency expenses like medical bills or car repairs, or simply looking for some financial assistance, GetFundsQuickly has got you covered.

The website boasts bank-level encryption, ensuring that your personal information remains secure throughout the application process. With just a few simple steps, you can complete the form and submit your application in minutes.

Once you’ve provided all the necessary details, GetFundsQuickly will connect you with a network of lenders who can offer the loan amount you need. The quick decision process ensures that you’ll know whether you’ve been approved in most cases, allowing you to get the funds you need as soon as possible.

GetFundsQuickly makes it easy to navigate the application process, providing a user-friendly experience from start to finish. Say goodbye to complicated forms and lengthy waiting periods – with GetFundsQuickly, getting the financial assistance you need has never been easier.

| Benefits of GetFundsQuickly’s Application Process: |

| Secure and easy-to-use online form |

| Bank-level encryption for data security |

| Quick decision process in most cases |

| Connects you with a network of lenders |

| Allows you to get funds as soon as the next business day |

Swift Funding Transfer

Once approved for a personal loan with Get Funds Quickly, you can expect to receive the funds in your bank account as soon as the next business day. This swift funding transfer ensures that you have quick access to the funds you need to cover your emergency expenses.

GetFundsQuickly understands the urgency of financial assistance, especially during times of unexpected medical bills or car repairs. With their lender connection service, they help individuals across the country secure loans for such emergency expenses. Whether you’re facing medical bills, car repairs, or any other urgent financial need, GetFundsQuickly is there to provide you with the necessary funds.

When it comes to online transactions and personal information, security is of utmost importance. GetFundsQuickly takes this seriously and ensures that their website is equipped with bank-level encryption for data security. You can have peace of mind knowing that your personal and financial information is protected throughout the application process.

| Funds Transferred | Next Business Day |

| Loan Amount | $200 – $50,000 |

| Application Process | Secure and Easy-to-Use Form |

| Decision Time | Quick Decisions Guaranteed (in most cases) |

| Creditworthiness | Loan Amounts Depend on Lender’s Policies and Borrower’s Creditworthiness |

| Fees | No Fees to Use the Website |

| Funding Transfer | Swift Transfer to Your Bank Account |

| Late Payments | May Result in Additional Fees or Collection Activities |

It’s important to note that GetFundsQuickly operates as a lead generator, connecting borrowers with lenders who can offer the best loan terms for their specific needs. They are not a direct lender themselves, but they work diligently to match borrowers with the right lenders.

In summary, GetFundsQuickly is a reliable online platform that understands the urgency of financial assistance. With their secure and easy-to-use form, swift funding transfer, and commitment to data security, they provide a convenient and trustworthy solution for individuals seeking personal loans.

Versatile Financial Assistance

GetFundsQuickly provides versatile financial assistance, covering emergency expenses like unexpected medical bills or urgent car repairs. As an online platform, it offers a convenient solution for individuals in need of immediate funds to handle unexpected financial situations.

Applying for a loan through GetFundsQuickly is a secure and straightforward process. The platform provides a secure and easy-to-use form that allows users to fill out their personal and financial information quickly. With bank-level encryption, users can trust that their data will be protected throughout the application process.

Once the application is submitted, GetFundsQuickly works efficiently to provide a quick decision in most cases. If approved, borrowers can expect to have the funds transferred to their bank account as soon as the next business day. This ensures that individuals can address their emergency expenses promptly, without unnecessary delays.

The loan amounts offered by GetFundsQuickly vary from $200 to $50,000, depending on the lender’s policies and the borrower’s creditworthiness. This allows individuals to borrow an amount that suits their specific financial needs. It is important to note that GetFundsQuickly operates as a lead generator and connects borrowers with potential lenders rather than being a direct lender themselves.

| Lender Connection Service |

| Emergency Expenses |

| Medical Bills |

| Car Repairs |

Bank-Level Data Security

Rest assured that your personal and financial information is safe with GetFundsQuickly, as they employ bank-level encryption for maximum data security. Your privacy is of utmost importance to them, and they take every measure to protect your sensitive data from unauthorized access.

GetFundsQuickly’s website utilizes the latest encryption technology to safeguard your information. This includes Secure Socket Layer (SSL) encryption, which ensures that all data transmitted between your browser and their servers remains encrypted and confidential. This robust security measure prevents any third parties from intercepting or tampering with your personal details.

By implementing bank-level encryption, GetFundsQuickly ensures that your data is protected at all times. This level of security is on par with the measures taken by major financial institutions, offering you peace of mind when submitting your loan application. They prioritize the confidentiality and integrity of your information, ensuring that it is handled with the highest level of care and security.

| Benefits of GetFundsQuickly’s Bank-Level Data Security | |

| Your personal and financial information is encrypted using industry-standard protocols. | |

| GetFundsQuickly employs robust security measures to protect your data from unauthorized access. | |

| Their website utilizes SSL encryption to ensure the confidentiality of your information during transmission. |

With GetFundsQuickly, you can have confidence that your data is secure throughout the loan application process. Their commitment to protecting your privacy is evident in their use of bank-level encryption, giving you peace of mind when applying for a personal loan.

Quick Decisions Guaranteed

GetFundsQuickly ensures a speedy decision-making process, providing most applicants with a quick response on their loan applications. Whether you’re facing unexpected medical bills or need to handle urgent car repairs, GetFundsQuickly understands the importance of timely financial assistance. With our efficient online platform, you can expect a prompt decision on your loan request in most cases.

Our user-friendly application form allows you to conveniently provide the necessary information to assess your eligibility. Once submitted, our advanced systems quickly evaluate your application and match you with a suitable lender from our network. This streamlined process minimizes waiting times, allowing you to receive a decision promptly.

At GetFundsQuickly, we believe that financial emergencies require immediate attention. That’s why we prioritize delivering quick decisions to our customers. Our goal is to help you access the funds you need as soon as possible, without unnecessary delays or drawn-out approval processes. We understand that time is of the essence when unexpected expenses arise, and our dedicated team works diligently to ensure a swift response.

While we strive to provide quick decisions to all applicants, it is important to note that certain factors, such as the complexity of your application or additional verification requirements, may occasionally result in a longer processing time. However, in the majority of cases, we are able to deliver a speedy decision and help you move forward with financial confidence.

About the GetFundsQuickly Platform

| Lending Amounts | Creditworthiness | Application Process |

| Loan amounts range from $200 to $50,000, depending on the lender’s policies. | Your creditworthiness plays a role in determining the loan amount you are eligible for. | Our secure and easy-to-use online application form makes the process simple and convenient. |

GetFundsQuickly operates as a lead generator, connecting borrowers with lenders who can meet their financial needs. We act as an intermediary to help facilitate the loan application process, leveraging our extensive network of trusted lenders nationwide. By providing quick decisions and reliable connections, we aim to assist individuals in navigating their financial challenges.

While we strive to guarantee quick decisions for our customers, it is important to note that late payments may incur additional fees or collection activities. We encourage borrowers to responsibly manage their loan repayments to avoid such consequences. At GetFundsQuickly, we prioritize transparency and aim to equip our customers with the necessary information to make informed financial decisions.

GetFundsQuickly is committed to providing a seamless lending experience, ensuring a swift decision-making process for most applicants. Our secure platform, versatile financial assistance, and bank-level data security set us apart as a trusted partner in times of financial need. Apply today and experience the efficiency and reliability of GetFundsQuickly.

Loan Amounts and Creditworthiness

The loan amounts available through GetFundsQuickly vary from $200 to $50,000, depending on the specific lender’s policies and the borrower’s creditworthiness. These factors play a crucial role in determining the loan amount that an individual can qualify for. It is important for borrowers to understand that different lenders may have varying policies regarding the loan amounts they are willing to offer.

Understanding Lender’s Policies

Each lender has its own set of policies when it comes to loan amounts. Some lenders may have a minimum loan amount requirement, while others may set maximum limits. It is important for borrowers to review and compare these policies to find a lender that aligns with their financial needs. Additionally, lenders may consider factors such as a borrower’s income, employment history, and credit score in determining the loan amount.

Borrower’s Creditworthiness

The borrower’s creditworthiness is another significant factor in determining the loan amount. Creditworthiness is an assessment of an individual’s ability to repay the loan based on their credit history and financial stability. Lenders may use credit reports, credit scores, and other financial information to evaluate a borrower’s creditworthiness. Those with a higher credit score and a good credit history are more likely to qualify for larger loan amounts.

| Lender’s Policies | Borrower’s Creditworthiness | Loan Amounts |

| Varies by lender | Good credit score | Up to $50,000 |

| Fair credit score | Up to $30,000 | |

| No minimum requirement | Poor credit score | Up to $10,000 |

It is important for borrowers to be aware of their creditworthiness and to review their credit reports regularly. This enables them to take steps to improve their credit score and increase their chances of qualifying for higher loan amounts. However, even individuals with less-than-perfect credit can still be eligible for smaller loan amounts.

Lead Generator, Not a Lender

It’s important to note that GetFundsQuickly functions as a lead generator, connecting borrowers with potential lenders based on their loan requirements. As a lead generator, the platform aims to simplify the loan application process by matching individuals with suitable lenders who can offer the financial assistance they need.

GetFundsQuickly provides a secure and user-friendly online form that allows users to submit their loan requests. Once submitted, the platform utilizes its network of lenders to find potential matches for borrowers’ specific loan requirements. This streamlined process helps individuals access a wide range of loan options conveniently and efficiently.

When using GetFundsQuickly, there are no fees to apply or use the platform’s services. However, it’s important to be aware that the loan amounts offered by lenders may vary depending on their individual policies and the borrower’s creditworthiness. It’s recommended to carefully review the terms and conditions of any loan offer before accepting.

| Benefits of using GetFundsQuickly | Considerations |

|

|

“GetFundsQuickly simplifies the loan application process by connecting borrowers with potential lenders. The secure and user-friendly platform allows for quick decisions and swift funding transfers, helping individuals in need of financial assistance for emergency expenses. It’s important to review individual lender policies and terms before accepting any loan offer.”

In summary, GetFundsQuickly operates as a lead generator, facilitating connections between borrowers and potential lenders. The platform offers a secure and easy-to-use online application process, with quick decisions and swift funding transfers. However, it’s crucial to carefully review loan terms and lender policies to ensure they align with your financial needs and goals.

Late Payments and Additional Fees

It’s crucial to make timely payments on your GetFundsQuickly loan, as late payments may result in additional fees and collection actions. The website strives to provide clear terms and conditions, ensuring that borrowers are aware of their responsibilities when it comes to repayment. If you anticipate facing difficulties in making your payment on time, it is recommended to contact GetFundsQuickly customer support as soon as possible to discuss potential alternatives or payment arrangements.

When a payment is not received by the agreed due date, the lender may impose additional fees, such as late payment fees or penalties. These charges can vary depending on the lender’s policies and the specific terms of your loan agreement. It is important to carefully review the loan terms and conditions to understand the potential financial consequences of late payments.

In addition to the financial implications, late payments may also trigger collection activities. While GetFundsQuickly is not a direct lender, it works with a network of lenders who may assign or transfer delinquent accounts to third-party collection agencies. These agencies specialize in recovering outstanding debt and may employ various methods to collect what is owed, including phone calls, letters, and legal actions.

| Types of Additional Fees | Amount |

| Late Payment Fee | $25 – $50 (varies by lender) |

| Collection Agency Fees | Varies by agency |

| Legal Fees | Varies by situation |

Here are some tips to avoid late payments and potential fees:

- Set up automatic payments or reminders to ensure you never miss a due date.

- Create a budget and prioritize loan payments to ensure they are accounted for.

- Communicate with your lender if you anticipate difficulties in making payments.

- Plan and save for unexpected financial emergencies to avoid falling behind on payments.

“Late payments can have serious consequences, including additional fees and potential damage to your credit score. By staying on top of your loan repayments, you can maintain a positive financial standing and avoid unnecessary financial stress.” – Financial Advisor, GetFundsQuickly

Remember, the goal is to fulfill your loan obligations on time, not only to prevent additional fees but also to maintain a good financial reputation. Making timely loan payments is an essential part of building a strong credit history and demonstrating responsible financial behavior.

Conclusion

GetFundsQuickly offers a reliable and efficient personal loan service, providing individuals in the US with quick access to funds for various financial needs. With loan amounts ranging from $200 to $50,000, borrowers can find the right funding solution to meet their specific requirements. The platform’s secure and easy-to-use form ensures a hassle-free application process, allowing users to apply for a loan from the comfort of their own homes.

Once approved, funds can be transferred directly to the borrower’s bank account as soon as the next business day, providing swift access to much-needed cash. This makes GetFundsQuickly a trusted choice for those facing emergency expenses such as medical bills or car repairs, allowing them to address their financial challenges quickly and effectively.

In terms of data security, GetFundsQuickly takes every precaution to protect its users’ personal information. The website utilizes bank-level encryption, ensuring that sensitive data remains confidential and secure throughout the application process.

One of the standout features of GetFundsQuickly is its commitment to delivering quick decisions to its applicants. In most cases, borrowers can expect to receive a decision promptly, eliminating unnecessary delays and providing peace of mind in times of financial uncertainty.

It’s important to note that GetFundsQuickly operates as a lead generator, connecting borrowers with potential lenders. This means that the loan amounts offered depend on the lender’s policies and the borrower’s creditworthiness. Late payments may incur additional fees or collection activities, highlighting the importance of responsible borrowing and timely repayment.

In summary, GetFundsQuickly is a reputable platform that offers a convenient and efficient solution for individuals seeking personal loans in the United States. With its user-friendly application process, swift fund transfers, and commitment to data security, GetFundsQuickly stands out as a reliable option for those in need of financial assistance.

FAQ

What is GetFundsQuickly?

GetFundsQuickly is an online platform that offers personal loans up to $50,000.

How does the application process work?

The application process is secure and easy-to-use. Simply fill out the online form and submit it for review.

When will I receive the funds if approved?

If approved, funds can be transferred to your bank account as soon as the next business day.

What expenses can I use the loan for?

GetFundsQuickly can help with emergency expenses such as medical bills and car repairs.

How secure is my personal information?

GetFundsQuickly uses bank-level encryption to ensure the security of your data.

How long does it take to receive a decision?

GetFundsQuickly guarantees a quick decision in most cases.

How much can I borrow?

Loan amounts vary from $200 to $50,000, depending on the lender’s policies and your creditworthiness.

Is GetFundsQuickly a lender?

No, GetFundsQuickly operates as a lead generator and connects borrowers with lenders.

What happens if I make a late payment?

Late payments may result in additional fees or collection activities.