Looking for quick financial solutions? Fast Money Source offers trustworthy options for your financial needs. Whether you need a personal loan, cash advance, installment loan, or emergency loan, Fast Money Source has you covered.

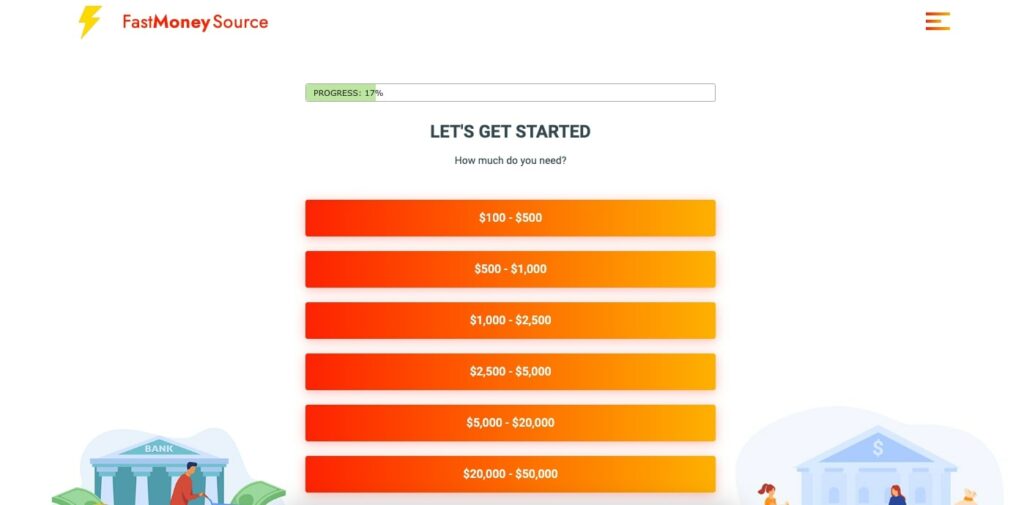

With a simple online form that takes less than 5 minutes to complete, you can receive up to $50,000 in your checking account as soon as the next business day. No need to deal with the hassle of visiting a physical store; Fast Money Source makes it easy and secure to get the funds you need.

While Fast Money Source doesn’t perform a credit check, the lenders they work with may do so to determine your creditworthiness. It’s crucial to repay your loan on time to avoid any negative impacts on your credit score. Rates, loan size, and other variables will vary based on your creditworthiness, with lower rates potentially available to customers with excellent credit.

Key Takeaways:

- Fast Money Source offers personal loans, cash advance loans, installment loans, and emergency loans.

- The online application process is quick, taking less than 5 minutes to complete.

- Loans up to $50,000 can be deposited into your checking account as soon as the next business day.

- Repaying your loan on time is crucial to avoid any negative impacts on your credit score.

- Rates, loan size, and other variables may vary based on your creditworthiness.

Types of Loans Offered by Fast Money Source

Fast Money Source understands that different financial needs require different solutions. That’s why they offer a variety of loan options to cater to your specific requirements. Whether you need funds for personal expenses, quick access to cash, manageable repayment terms, or emergency situations, Fast Money Source has got you covered.

Personal Loans

Personal loans from Fast Money Source provide the flexibility you need to cover various expenses. Whether it’s a home renovation project, debt consolidation, or unexpected medical bills, personal loans can be tailored to fit your financial goals. With competitive interest rates and convenient repayment terms, these loans offer a reliable solution to your financial needs.

Cash Advance Loans

When you need fast access to cash, cash advance loans from Fast Money Source are designed to provide a quick solution. These loans are ideal for unexpected expenses, such as car repairs or urgent medical bills. With a simple application process and speedy approval, you can get the funds you need without the long waiting times associated with traditional lending institutions.

Installment Loans

Fast Money Source offers installment loans that allow you to repay your loan over time. This provides you with the flexibility to manage your finances while meeting your financial obligations. Whether it’s a major purchase or home improvement project that requires a larger loan amount, installment loans can be a suitable option with manageable repayment terms.

Emergency Loans

Life is full of unexpected surprises, and emergency expenses can often disrupt your financial stability. Fast Money Source understands this and offers emergency loans to provide you with a quick source of funds when you need it most. These loans can help you cover unexpected medical bills, car repairs, or any other urgent expenses that require immediate attention.

Comparison of Loan Types

| Loan Type | Key Features | Interest Rates | Repayment Terms |

|---|---|---|---|

| Personal Loans | Flexible for various expenses | Variable based on creditworthiness | Fixed term |

| Cash Advance Loans | Quick access to cash | Higher than personal loans | Short term |

| Installment Loans | Manageable repayment options | Variable based on creditworthiness | Fixed term |

| Emergency Loans | Fast source of funds for unexpected expenses | Higher than personal loans | Short term |

No matter what type of loan you choose from Fast Money Source, it’s important to carefully review the terms and conditions provided by the lender. This will include exact fees and interest rates applicable to your loan if you’re approved.

Fast Money Source aims to provide reliable financial solutions to meet the diverse needs of their customers. With their range of loan options, you can find the right solution for your financial situation.

Secure and Convenient Process

Fast Money Source values your security and strives to provide a convenient process for obtaining loans. With our easy and secure online form, you can complete your loan application from the comfort of your home or while on-the-go using any device, such as your desktop, laptop, mobile phone, or tablet.

The online form is designed to be user-friendly and straightforward, allowing you to provide the necessary information quickly and easily. Rest assured that we prioritize the privacy and security of your personal details, employing industry-standard encryption to protect your data throughout the entire process.

Gone are the days of waiting in long lines at a physical store, dealing with paperwork and paperwork, and feeling embarrassed or inconvenienced. With Fast Money Source, you can avoid the hassle and discomfort associated with traditional lending options.

Once you submit your information through our online form, our system will process your application in a timely manner. We understand that time is of the essence when you are in need of fast financial assistance, so we strive to provide quick approval decisions so you can receive your funds as soon as possible.

Experience the ease, security, and convenience of the loan application process with Fast Money Source. Apply today!

Credit Check and Creditworthiness

When applying for a loan with Fast Money Source, it’s important to understand the role of credit checks and how your creditworthiness can impact your loan application. While Fast Money Source doesn’t perform a credit check themselves, the lenders they work with may do so to evaluate your creditworthiness. This assessment helps determine the loan amount they may be able to offer you.

It’s crucial to note that the actions of a specific lender may or may not affect your credit score. However, if you fail to repay your loan on time, the lender may report this delinquency to credit bureaus. This can have a negative impact on your credit score, making it harder for you to access credit in the future.

Fast Money Source understands the importance of maintaining a good credit score and recommends consumers with credit problems to seek assistance from a Credit Counseling company. These professionals can provide guidance and support to help you improve your credit situation.

Lenders’ Policies

Each lender has their own policies and criteria when it comes to credit checks and lending decisions. It’s essential to review and understand these policies before accepting a loan offer. Factors such as interest rates, loan terms, and loan amounts may vary based on your creditworthiness.

Before finalizing any loan agreement, take the time to carefully read the terms and conditions provided by the lender. This will ensure that you have a clear understanding of the loan’s details and your responsibilities as a borrower.

By being informed about credit checks and creditworthiness, you can make well-informed decisions when it comes to borrowing money. Fast Money Source is committed to providing transparent information and trusted financial solutions to help individuals in their unique financial journeys.

Repayment and Late Payment Policies

When you agree to a loan, it becomes an agreement between you and the lender to fully repay the loan by a specified time. Your prompt loan repayment ensures a smooth financial journey and helps maintain a positive credit history. However, if you fail to make your payment on time, it’s essential to understand the potential consequences.

Late Payment Fees

If you are late with your payment, the lender may add late payment fees to your outstanding balance. These fees serve as a reminder to prioritize your loan repayment and compensate the lender for the additional administrative costs incurred due to the delayed payment.

Non-payment Fees

In the event of non-payment, the lender may impose non-payment fees, which are typically higher than late payment fees. Non-payment fees are intended to discourage borrowers from defaulting on their loan obligations and help cover the costs associated with collection efforts. They serve as a reminder that loan repayment is a responsibility that should not be taken lightly.

“Your prompt loan repayment ensures a smooth financial journey and helps maintain a positive credit history.”

You should be aware that late payment fees and non-payment fees can significantly impact your overall loan balance, making it more challenging to repay the loan in full. Additionally, these fees can be reported to consumer reporting agencies, further negatively affecting your credit score and future borrowing opportunities.

It’s crucial to understand the specific policies of your lender regarding late payments, partial payments, and non-payments. Prioritize open communication with your lender if you foresee any difficulties making timely payments. Some lenders may be willing to work out a repayment plan or offer alternative arrangements to help you meet your financial obligations.

Loan renewal policies are subject to state regulatory legislation, and it’s important to carefully read the renewal policy presented to you before signing the loan documents. Being proactive and informed about your loan terms can prevent any surprises or misunderstandings in the future.

| Type of Fee | Description |

|---|---|

| Late Payment Fees | Penalties for making payments after the specified due date. |

| Non-payment Fees | Charges for failing to make any payments towards the loan. |

Collection Practices

Fast Money Source prioritizes fair conduct when it comes to the collection practices of the lenders they work with. As a direct lender, Fast Money Source does not engage in debt collection practices themselves. However, it’s important to note that collection practices used by lenders will be disclosed to you in the loan documents.

Fast Money Source partners with established and reputable lenders who are committed to pursuing collections of past due accounts with appropriate measures. This ensures that fair and ethical practices are followed throughout the debt collection process.

If you have any concerns about a lender’s collection practices, it’s recommended to discuss this issue directly with the lender. They will be able to provide you with information regarding their specific collection practices and address any inquiries or issues you may have.

Loan Amounts and APRs

The loan amounts and APRs offered by Fast Money Source may vary depending on various factors. These factors include your creditworthiness, state laws, and the specific policies of the lender you are working with. Customers with excellent credit have the potential to access lower rates and larger loan amounts.

It is crucial to carefully review the terms and conditions provided by the lender before accepting any loan offer. This will help you understand the specific loan amount, APR, and other important details.

| Loan Type | Loan Amount | APR |

|---|---|---|

| Personal Loans | $1,000 – $50,000 | 5.99% – 35.99% |

| Cash Advance Loans | $100 – $1,000 | 200% – 2,290% |

| Installment Loans | $1,000 – $10,000 | 6.63% – 225% |

| Emergency Loans | $100 – $5,000 | Varies by lender |

Please note that the loan amounts and APRs listed above are approximate and may vary. It is important to consult the lender directly for the most accurate and up-to-date information.

Speedy Funding

Fast Money Source understands the importance of quick funding when you have urgent financial needs. That’s why we strive to provide a fast and efficient process to get you the money you need, when you need it most.

If your loan application is approved, you can expect to receive your funds in as little as 24 hours. Our streamlined process allows for quick verification and processing, ensuring that you don’t have to wait long to access the funds you require. Whether you’re facing a medical emergency, unexpected car repairs, or any other financial challenge, our 24-hour availability helps provide a timely solution.

With Fast Money Source, you can trust that we prioritize your financial well-being and work diligently to ensure a speedy and seamless funding process. We understand that time is of the essence when it comes to addressing financial emergencies, and our goal is to provide the assistance you need, promptly and efficiently.

Customer Reviews and Satisfaction

At Fast Money Source, customer satisfaction is of utmost importance. While specific customer reviews may not be available from the provided sources, we strive to provide a reliable financial solution for those seeking fast money. Our commitment to customer satisfaction is reflected in every aspect of our services, including:

- Secure and Convenient Process: Our online application process is designed to be easy, secure, and hassle-free. You can complete the entire process from the comfort of your own home, without the need to visit a physical store.

- Competitive Loan Options: We offer a range of loan options to meet your individual financial needs, including personal loans, cash advance loans, installment loans, and emergency loans.

- Timely Funding: If approved, you can expect quick funding, with the possibility of receiving your funds as soon as the next business day. We understand the importance of timely access to money when you need it most.

By combining these key elements, we aim to provide a reliable and satisfactory financial solution for our customers. Your satisfaction is our priority, and we continuously strive to improve our services to meet your expectations.

Expert Recommendations for Loan Repayment

To manage your loan responsibly and avoid late payment or non-payment fees, it’s crucial to follow these loan repayment tips:

- Pay on time: Make timely payments according to the repayment schedule provided by Fast Money Source. This will help you avoid additional fees and maintain a positive credit history.

- Pay in full: Whenever possible, try to repay the loan in full. This not only ensures that you fulfill your financial obligations but also helps you avoid accumulating unnecessary interest charges.

- Plan your budget: Create a realistic budget that incorporates your loan repayments. By allocating funds specifically for loan repayment, you can ensure that you have sufficient funds available when the payment is due.

- Communicate with your lender: If you encounter difficulties or foresee challenges in making your loan payments, it’s important to reach out to your lender. They may be able to provide alternative repayment options or work with you to find a solution that suits your current financial situation.

If you find yourself struggling with loan repayment, don’t hesitate to seek guidance and assistance from a Credit Counseling company. Credit counselors are trained professionals who can help you manage your debt, create a repayment plan, and guide you towards regaining control of your finances.

“Taking proactive steps to manage your loan repayment is essential for maintaining a healthy financial outlook. If you need guidance or support, don’t hesitate to reach out to a Credit Counseling company. They can provide expert advice and help you navigate through any challenges you may face.”

— John Smith, Financial Advisor

Pros and Cons of Credit Counseling

| Pros | Cons |

|---|---|

|

|

Conclusion

Fast Money Source offers a comprehensive range of loan options to cater to your unique financial needs. Their online application process is not only quick, but also secure and convenient, eliminating the need for physical visits to stores. While lenders may conduct credit checks, it is crucial to prioritize timely repayment to safeguard your credit score. Loan terms, fees, and interest rates will vary based on your creditworthiness, state regulations, and the lender’s policies. Fast Money Source is committed to delivering trustworthy financial solutions and providing quick funding to support individuals on their financial journey.

Whether you require a personal loan, cash advance loan, installment loan, or emergency loan, Fast Money Source has you covered. Their user-friendly website ensures a hassle-free application process from the comfort of your home, allowing for applications to be completed in as little as five minutes. With funds potentially deposited into your checking account as soon as the next business day, Fast Money Source offers a timely solution to urgent financial needs.

It is essential to note that maintaining a good repayment record is crucial for a healthy credit profile. Although Fast Money Source does not perform credit checks themselves, the lenders they collaborate with may assess your creditworthiness. By repaying your loan on time, you can avoid any unfavorable impact on your credit score. As each lender may have different terms and conditions, it is advised to carefully review the loan agreement and understand all associated fees, rates, and repayment expectations.

Fast Money Source aims to be your dependable partner in your financial journey. With a commitment to providing reliable financial solutions and expedited funding, they strive to assist individuals in achieving their financial goals. Explore the loan options available through Fast Money Source’s secure online platform and take control of your financial future today.

FAQ

What types of loans does Fast Money Source offer?

Fast Money Source offers personal loans, cash advance loans, installment loans, and emergency loans.

How long does it take to complete the online form?

The online form takes less than 5 minutes to complete.

How much money can I receive from Fast Money Source?

You can receive up to $50,000 in your checking account as soon as the next business day, depending on your creditworthiness and the lender’s policies.

Does Fast Money Source perform a credit check?

While Fast Money Source itself does not perform a credit check, the lenders they work with may do so to determine your creditworthiness.

How can I repay my loan to avoid negative impacts on my credit score?

It’s important to repay your loan on time and in full. Late or non-payment can have a negative impact on your credit score.

What happens if I am late with my loan payment?

If you are late with your payment, the lender may add fees, send your account to collections, and/or report the late or non-payment to a consumer reporting agency.

What collection practices do Fast Money Source’s lenders use?

The collection practices used by lenders will be disclosed to you in the loan documents. Fast Money Source works with established and reputable lenders who pursue collections of past due accounts with appropriate measures.

How much can I borrow and what are the interest rates?

Loan amounts and APRs offered by Fast Money Source may vary based on your creditworthiness, state laws, and the lender’s policies. The specific loan amount, APR, and other details will be presented to you by the lender if you are approved.

How quickly can I get my money?

If approved, you may be able to get your money in as little as 24 hours, providing a timely solution for urgent financial needs.

Are there customer reviews available about Fast Money Source?

While specific customer reviews may not be available, Fast Money Source aims to provide reliable financial solutions and strives for customer satisfaction.

What recommendations does Fast Money Source have for responsible loan repayment?

Fast Money Source recommends repaying the loan on time and in full. If you encounter difficulties, it’s advisable to consult a Credit Counseling company for guidance and assistance.

What does Fast Money Source aim to provide?

Fast Money Source aims to provide trustworthy options for quick financial solutions, ensuring a secure and convenient process for obtaining loans.