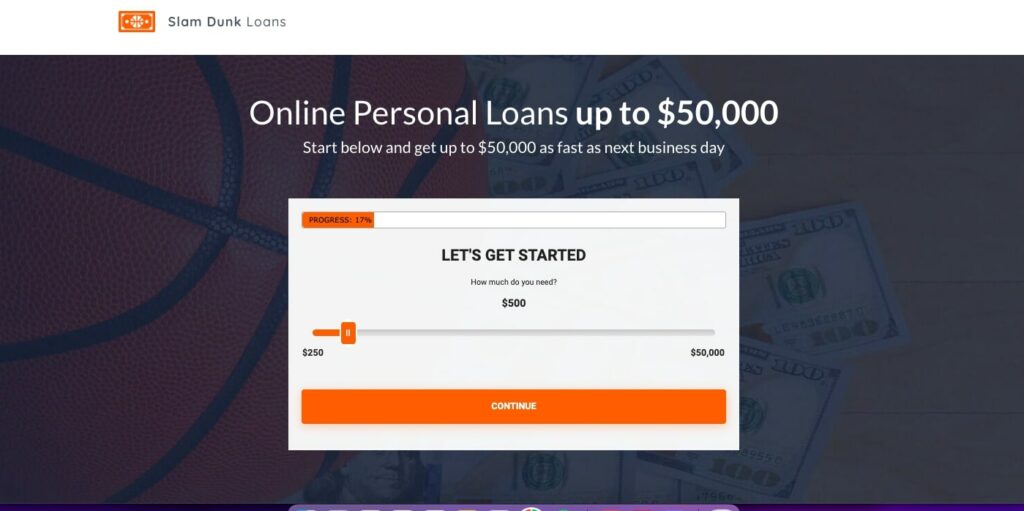

Looking for a hassle-free way to get a personal loan? Slam Dunk Loans has got you covered. As a service connecting borrowers with lending partners, Slam Dunk Loans offers up to $50,000 in loans for your various financial needs. Say goodbye to lengthy paperwork and hello to a quick and convenient application process.

Applying for a loan through Slam Dunk Loans is as easy as filling out a secure online form. With their commitment to customer convenience, you can get a decision from the lender fast, and if approved, receive the funds in your bank account as early as the next business day.

Whether you’re facing unexpected medical expenses, need to cover car repairs, or are looking to consolidate debt, Slam Dunk Loans provides an accessible solution to help you bridge the financial gap. They understand the urgency of your situation and strive to make the lending process as simple and efficient as possible.

Key Takeaways:

- Slam Dunk Loans offers up to $50,000 in personal loans

- The online application process is quick, secure, and hassle-free

- Funds can be transferred to your bank account as soon as the next business day

- Slam Dunk Loans prioritizes customer convenience and simplicity

- Various financial needs, including emergency expenses, can be covered with Slam Dunk Loans

How It Works

To apply for a loan with Slam Dunk Loans, simply follow these easy steps:

- Fill out a short and secure form: Provide the necessary personal and financial information in the online application form. This form is secured with 256-bit SSL encryption technology, ensuring the safety of your data.

- Receive a fast decision: Once you submit the form, you will receive a quick decision from the lender. This ensures a streamlined process and saves you time.

- Review terms and rates: If your loan application is approved, you will have the opportunity to review all the terms and rates provided by the lender. This allows you to make an informed decision and choose the best option for your needs.

- Funds transfer: Once you accept the loan offer, the funds can be quickly transferred to your bank account. This means you can access the money you need as soon as the next business day.

Applying for a loan with Slam Dunk Loans is a straightforward process. Their user-friendly platform and efficient system allow you to navigate the application process with ease. By filling out a simple form, you can secure the funds you need in a timely manner.

| Step | Description |

|---|---|

| 1 | Fill out the online application form |

| 2 | Receive a fast decision from the lender |

| 3 | Review all the terms and rates provided by the lender |

| 4 | Accept the loan offer and receive funds in your bank account |

What is Slam Dunk Loans?

Slam Dunk Loans is a service that connects customers with lending partners who offer loans for emergency expenses. It is frequently used by individuals across the country to cover medical expenses, mechanic fees, and bills. They aim to provide loans up to $50,000 without extensive paperwork, making the process convenient for borrowers in need of quick funds.

| Borrowers | Loan Amount | Loan Purpose |

|---|---|---|

| Individuals | Up to $50,000 | Emergency expenses |

Slam Dunk Loans understands that unexpected financial burdens can arise, and they strive to offer a solution that provides quick access to funds without the hassle of traditional loan applications. Whether it’s an unforeseen medical bill or urgent car repairs, Slam Dunk Loans aims to assist borrowers in need of immediate financial assistance.

“Slam Dunk Loans provided the financial lifeline I needed when I had to cover unexpected medical expenses. Their easy and convenient process made it simple to apply for a loan without the stress of extensive paperwork.”

-Samantha Wilson, satisfied customer

With Slam Dunk Loans, borrowers can avoid the lengthy process typically associated with traditional loans. By partnering with reputable lending institutions, Slam Dunk Loans streamlines the application process, providing customers with a quick and efficient way to secure the funds they need.

Whether it’s a medical emergency, an unforeseen repair, or any other emergency expense, Slam Dunk Loans is committed to helping individuals access the financial support they require. Their user-friendly online platform provides a convenient pathway for borrowers to connect with lending partners and receive the necessary funds in a timely manner.

Key Benefits of Slam Dunk Loans:

- Convenient and efficient loan application process.

- No extensive paperwork required.

- Access to loans up to $50,000.

- Quick transfer of funds for approved borrowers.

- Flexible repayment options.

- Responsive customer service team.

Why Slam Dunk Loans

When it comes to finding the right loan, Slam Dunk Loans stands out from the competition. With their commitment to customer satisfaction and convenient online platform, there are several reasons why you should consider Slam Dunk Loans for your borrowing needs.

Quick and Secure Application Process

One of the standout features of Slam Dunk Loans is their quick and secure online application process. Their user-friendly form is designed to make applying for a loan hassle-free. You can fill out the form from the comfort of your own home, saving you time and avoiding the need to wait in long lines at a physical branch.

What’s more, Slam Dunk Loans prioritizes the security of your personal and financial information. Utilizing 256-bit technology, they ensure your data is protected throughout the entire process. You can have peace of mind knowing that your information remains secure and confidential.

Accessibility for All Credit Histories

Even if you have a poor credit history, you still have a chance to be approved for a loan with Slam Dunk Loans. They understand that individuals may face financial challenges and believe in giving everyone an opportunity to receive the funds they need. So, whether you have excellent credit or less-than-perfect credit, Slam Dunk Loans welcomes your application.

Flexible Loan Options

Slam Dunk Loans offers a range of loan options to suit your specific needs. Whether you require a small loan to cover unexpected expenses or a larger loan for a major purchase, they can help. With loan amounts of up to $50,000 available, you have the flexibility to find the right loan amount that fits your financial situation.

Customer Satisfaction

“Slam Dunk Loans provided me with a hassle-free experience and excellent customer service. From the moment I started the online application to receiving the funds in my bank account, everything went smoothly. I highly recommend Slam Dunk Loans to anyone in need of a personal loan!”

– Amanda Johnson, satisfied customer

Comparing Slam Dunk Loans with Competitors

| Features | Slam Dunk Loans | Competitor A | Competitor B |

|---|---|---|---|

| Loan Amounts | Up to $50,000 | Up to $25,000 | Up to $30,000 |

| Application Process | Quick and secure online form | In-person at a branch | Online form with lengthy requirements |

| Credit History Consideration | Accepts all credit histories | Limited to good credit | Strict credit requirements |

| Customer Satisfaction | Positive reviews, excellent support | Mixed reviews, average support | Negative reviews, poor support |

Based on the table above, it is clear that Slam Dunk Loans offers competitive advantages over its competitors. With higher loan amounts, a more convenient application process, and a more inclusive credit history policy, Slam Dunk Loans stands out as a top choice for borrowers.

So why wait? Experience the convenience, security, and flexibility that Slam Dunk Loans provides. Apply now and get the funds you need!

Benefits of Slam Dunk Loans

When it comes to obtaining a personal loan, Slam Dunk Loans offers several benefits that can make your borrowing experience easier and more convenient.

1. Online Application Form

With Slam Dunk Loans, you can complete your loan application form online, right from the comfort of your own home. This eliminates the need to visit a physical branch or wait in long lines, saving you time and hassle.

2. Secure Process

Your security is a top priority at Slam Dunk Loans. They utilize 256-bit SSL encryption technology, ensuring that your personal and financial information is protected throughout the entire loan application process. You can have peace of mind knowing that your data is safe and confidential.

3. Approval Regardless of Credit History

Unlike traditional lending institutions, Slam Dunk Loans provides opportunities for loan approval regardless of your credit history. Whether you have excellent credit or have faced financial challenges in the past, there is a chance to be approved for the loan you need.

4. Fast Funding

With Slam Dunk Loans, you can receive your funds as soon as the next business day after loan approval. This can be a lifeline in times of financial need, allowing you to quickly address emergency expenses and regain your financial stability.

5. Flexible Repayment Options

Slam Dunk Loans offers flexible repayment options to fit your financial situation. You can work with your lender to determine a repayment plan that suits your budget and allows you to comfortably pay off your loan over time.

Overall, Slam Dunk Loans offers a streamlined and secure loan application process, approval regardless of credit history, and convenient funding options. Whether you need help with unexpected expenses or want to consolidate debt, Slam Dunk Loans can be a valuable resource to meet your financial needs.

Loan Options

Slam Dunk Loans offers a variety of loan options to meet your specific financial needs. Whether you’re facing unexpected medical expenses or need to cover the costs of car repairs, they have you covered. With loan amounts ranging up to $50,000, you can find the right loan to suit your circumstances.

Here’s a breakdown of the loan options available through Slam Dunk Loans:

| Loan Type | Loan Amount |

|---|---|

| Personal Loans | Up to $50,000 |

| Emergency Expenses | Varies depending on lenders |

| Medical Bills | Varies depending on lenders |

| Car Repairs | Varies depending on lenders |

These loan options provide flexibility and convenience, allowing you to address your financial needs effectively. Whether you need a small amount for a minor repair or a larger sum to cover a major expense, Slam Dunk Loans has options to suit your situation. By offering loans tailored to specific needs, Slam Dunk Loans ensures that you can find the loan that fits your circumstances best.

Remember, it’s important to carefully consider your needs before choosing a loan option. Take into account your current financial situation and the specific expenses you need to cover. By understanding your requirements, you can select the loan that will help you address your financial needs with ease.

Eligibility Criteria

To be eligible for a loan through Slam Dunk Loans, you need to meet certain criteria. While every lender may have specific requirements, the general eligibility criteria include:

- Being at least 18 years old

- Holding a valid bank account

- Providing proof of income or employment

The specific eligibility criteria may vary depending on the lender. It is important to review the requirements outlined by Slam Dunk Loans and their lending partners before applying.

If you meet the eligibility criteria, you can proceed with the application process and potentially receive the funds you need.

Loan Repayment

When borrowing through Slam Dunk Loans, it’s crucial to understand the repayment terms set by the lender. Before accepting the loan, carefully review the terms and conditions to ensure you can meet the repayment obligations. Loan repayment periods can vary, ranging from a few months to several years, depending on the lender and the loan amount.

Most lenders require borrowers to make monthly payments towards their loan. These payments are typically fixed amounts, allowing for easier budgeting and financial planning.

Timely loan repayment is essential to maintain a good credit score and avoid any additional fees or penalties. Missing payments can negatively impact your creditworthiness and make it more difficult to secure future loans or credit.

Table: Loan Repayment Example

| Loan Amount | Interest Rate | Repayment Period | Monthly Payment |

|---|---|---|---|

| $10,000 | 8% | 3 years | $309.39 |

| $20,000 | 12% | 5 years | $444.46 |

| $30,000 | 15% | 7 years | $473.25 |

This table provides an example of loan repayment amounts for different loan amounts, interest rates, and repayment periods. Keep in mind that the actual terms may vary depending on the lender and your specific loan agreement.

It is important to budget effectively and ensure that you can comfortably afford the monthly payments before accepting a loan. This will help you manage your finances responsibly and avoid any unnecessary financial stress.

Privacy and Security

At Slam Dunk Loans, we understand the importance of privacy and security when it comes to handling our customers’ personal and financial information. That’s why we have implemented robust measures to ensure that your data is protected throughout the loan application process.

To safeguard your sensitive information, we utilize 256-bit SSL encryption technology. This industry-standard encryption protocol creates a secure connection between your browser and our website, making it virtually impossible for anyone to intercept or access your data.

With this advanced encryption in place, you can have peace of mind knowing that your personal and financial information remains confidential and secure throughout the entire process.

“Your privacy and security are our top priorities. We go above and beyond to ensure that your data is protected using the latest encryption technology.”

We understand that privacy and security are paramount when it comes to financial transactions, and we are committed to providing a secure environment for our customers’ peace of mind.

Rest assured that your information is safe with Slam Dunk Loans, and we will never compromise on your privacy and security.

| Privacy Measures | Security Features |

|---|---|

|

|

Customer Service

At Slam Dunk Loans, we prioritize providing excellent customer service to our borrowers. We understand that navigating the loan application process may raise questions or concerns, and we are here to assist you every step of the way.

Our dedicated customer service team is available to provide support and address any inquiries you may have. Whether you need clarification on the application requirements, want to understand the loan terms and conditions better, or have any other concerns, we are here to help.

You can reach out to our customer service team via email or phone, and we will ensure a prompt response to your queries. Our knowledgeable representatives are ready to provide personalized assistance and guide you towards a seamless loan application experience.

“Slam Dunk Loans provides exceptional customer service! Their team assisted me throughout the loan application process, making it a hassle-free experience.”

– Jennifer Ames, satisfied Slam Dunk Loans customer

Why Choose Our Customer Service:

- Responsive and Prompt: Our customer service team is committed to providing timely responses to your inquiries, ensuring a smooth loan application process.

- Knowledgeable Assistance: Our representatives are well-versed in the loan application process, enabling them to address your concerns with expertise and offer guidance tailored to your needs.

- Personalized Support: We understand that each borrower’s situation is unique. Our customer service team strives to provide personalized assistance, ensuring that all your questions are answered and concerns addressed.

- Affable and Professional: Our team combines friendliness with professionalism, creating a supportive and welcoming environment for our borrowers.

At Slam Dunk Loans, we value our customers and are committed to delivering outstanding customer service. We believe that helping you navigate the loan application process with ease is a crucial part of our commitment to your financial well-being.

| Customer Service Benefits | Slam Dunk Loans |

|---|---|

| Responsive Support | ✓ |

| Knowledgeable Assistance | ✓ |

| Personalized Guidance | ✓ |

| Affable and Professional | ✓ |

Applying for a Loan

When you decide to apply for a loan through Slam Dunk Loans, the process is straightforward and convenient. The first step is to complete the online application form, which requires providing personal and financial information. This includes details about your employment and income.

Tip: Be sure to provide accurate and up-to-date information when filling out the form. This will increase your chances of loan approval.

Once you submit the application form, the lender will review your information and make a decision promptly. You can expect to receive a fast decision, which eliminates lengthy waiting times. This ensures that you can quickly move forward with your financial plans.

“Applying for a loan through Slam Dunk Loans is a hassle-free and efficient process. With their seamless online application form, you can complete the process from the comfort of your own home.”

In conclusion, Slam Dunk Loans provides a convenient and accessible platform for applying for a loan. By following the simple steps outlined above, you can get one step closer to securing the funds you need to meet your financial goals.

Conclusion

Slam Dunk Loans is your go-to solution when you need a personal loan quickly and conveniently. Their user-friendly online application process streamlines the entire loan application, approval, and funding process, ensuring a hassle-free experience. With their secure platform and a wide range of loan options, Slam Dunk Loans offers a reliable resource for meeting your emergency financial needs.

When you choose Slam Dunk Loans, you can access loan amounts of up to $50,000, providing the financial support you require. The funds can be transferred to your bank account as soon as the next business day, ensuring you can address your financial obligations without delay.

Whether you need the loan for medical expenses, home repairs, or any other unexpected costs, Slam Dunk Loans has got you covered. Their commitment to customer satisfaction, efficient service, and secure platform make them an ideal choice for individuals seeking personal loans. Apply now and experience the convenience and reliability of Slam Dunk Loans.

FAQ

How Does Slam Dunk Loans Work?

Slam Dunk Loans works by connecting customers with lending partners who offer personal loans. Customers can fill out an online form to apply for a loan, and if approved, they can review and accept the terms provided by the lender. The funds can then be transferred to the borrower’s bank account.

What Is Slam Dunk Loans?

Slam Dunk Loans is a service that aims to connect customers with lending partners who offer personal loans. They provide a quick and secure online form that allows borrowers to apply for loans up to $50,000. The funds can be transferred to the borrower’s bank account as soon as the next business day.

Why Choose Slam Dunk Loans?

Slam Dunk Loans offers a convenient and hassle-free loan application process. They prioritize customer security and protect their information with 256-bit SSL encryption technology. Additionally, even individuals with poor credit history may be approved for a loan.

What Are the Benefits of Slam Dunk Loans?

Slam Dunk Loans offers an online application form that can be completed from the comfort of your home. They prioritize customer security and protect sensitive information with encryption technology. Regardless of credit history, individuals have the opportunity to be approved for a loan.

What Loan Options does Slam Dunk Loans Provide?

Slam Dunk Loans offers personal loans ranging up to $50,000. These loans can be used for emergency expenses such as medical bills or car repairs. Customers can choose the loan amount that suits their specific needs and financial situation.

What Are the Eligibility Criteria for a Loan with Slam Dunk Loans?

While every lender may have specific requirements, generally borrowers should be at least 18 years old, have a valid bank account, and provide proof of income or employment. The specific eligibility criteria may vary depending on the lender.

What are the Repayment Terms for Loans Obtained through Slam Dunk Loans?

The repayment terms for loans obtained through Slam Dunk Loans will vary depending on the lender. Borrowers should carefully review the terms and conditions of the loan before accepting it. The repayment period may range from a few months to several years, and borrowers will typically need to make monthly payments.

How Does Slam Dunk Loans Ensure Privacy and Security?

Slam Dunk Loans prioritizes the privacy and security of their customers’ information. They utilize 256-bit SSL encryption technology to protect sensitive data during the loan application process. This ensures that personal and financial information remains secure and confidential.

What Customer Service Support Does Slam Dunk Loans provide?

Slam Dunk Loans aims to provide excellent customer service to their borrowers. They offer assistance throughout the loan application process and are available to answer any questions or address concerns. Customers can reach out to their customer service team for support via email or phone.

How Can I Apply for a Loan with Slam Dunk Loans?

To apply for a loan with Slam Dunk Loans, simply complete the online application form. The form will ask for personal and financial information, including employment details and income. It is important to provide accurate and up-to-date information to increase the chances of loan approval.