Welcome to our comprehensive Merit Platinum Card review! In this article, we will delve into the features, benefits, and drawbacks of this store card to help you decide if it’s the right choice for you.

Key Takeaways:

- The Merit Platinum Card is a store card exclusive to the Horizon Outlet online store.

- It offers a $750 unsecured credit line and has a monthly membership fee of $14.77.

- No credit or employment check is required for approval.

- Benefits include roadside assistance, free legal consultation, prescription drug discounts, and free credit report access.

- The card has a 0% APR on purchases, with a minimum payment of $25 or 10% of the balance.

- It does not report to credit bureaus, so it does not help with building credit.

- Customer reviews have been mixed, with some reporting unauthorized charges.

Now, let’s take a closer look at the Merit Platinum Card and help you determine if it’s the right credit card for your needs.

What is the Merit Platinum Card?

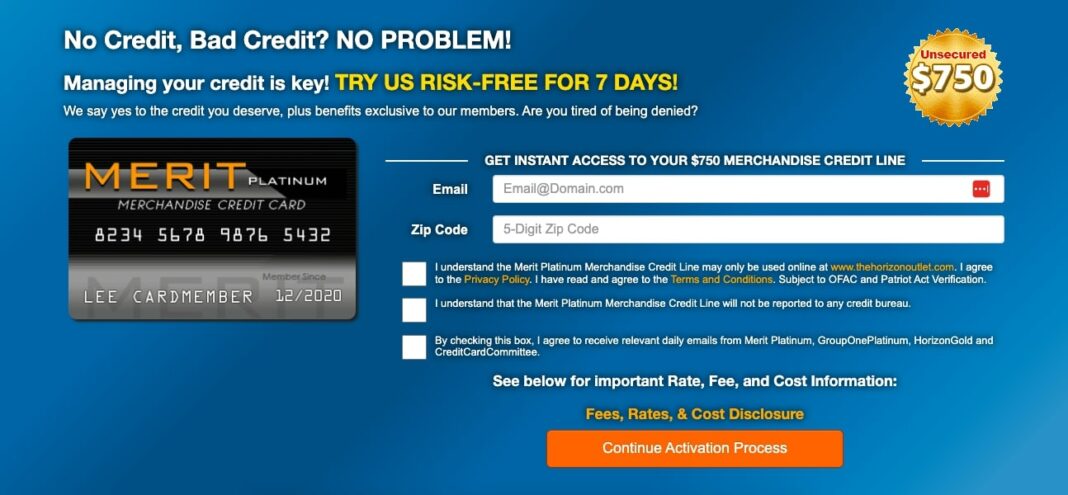

The Merit Platinum Card is a store card that is exclusively available for use at the Horizon Outlet online store, offering cardholders a credit line of $750 and a monthly membership fee of $14.77. This card is designed for individuals with low or no credit who are looking to access credit and shop conveniently at the Horizon Outlet. While it may not be as widely accepted as traditional credit cards, the Merit Platinum Card provides an opportunity to establish a positive payment history and enjoy various benefits.

By becoming a cardholder, you gain access to a credit line of $750, allowing you to make purchases at the Horizon Outlet online store. The store offers a wide range of products, including electronics, appliances, home goods, and more. The Merit Platinum Card provides a convenient payment solution for those looking to shop at the Horizon Outlet without the need for a traditional credit card.

In addition to its credit line, the Merit Platinum Card offers various benefits to cardholders. These benefits include roadside assistance, which can be particularly useful in case of emergencies or unexpected breakdowns. Furthermore, cardholders are entitled to free legal consultation, prescription drug discounts, and free access to their credit report. These perks provide added value and convenience for individuals who choose to utilize the Merit Platinum Card.

Merit Platinum Card Features and Benefits

| Features | Benefits |

| Roadside assistance | Provides help in case of emergencies or breakdowns |

| Free legal consultation | Access to professional legal advice |

| Prescription drug discounts | Savings on prescription medication |

| Free credit report access | Allows monitoring of credit history and identity theft protection |

It is important to note that the Merit Platinum Card does not report to credit bureaus, meaning it does not contribute to building or improving your credit score. However, this can be seen as an advantage for individuals who are unable to qualify for traditional credit cards due to a lack of credit history or poor credit. The Merit Platinum Card provides an opportunity to access credit and enjoy the benefits of a store card, regardless of your credit background.

In conclusion, the Merit Platinum Card offers individuals with low or no credit an opportunity to access credit and shop conveniently at the Horizon Outlet online store. With its $750 credit line and various benefits such as roadside assistance and free legal consultation, this store card provides value and convenience. While it may not contribute to building credit, the Merit Platinum Card serves as a stepping stone for individuals looking to establish a positive payment history and improve their financial standing.

Features of the Merit Platinum Card

The Merit Platinum Card comes with a range of features designed to provide cardholders with added benefits and convenience, including roadside assistance, free legal consultation, prescription drug discounts, and free access to credit reports. These features make the card a valuable tool for managing your financial needs. Let’s take a closer look at each of these benefits:

- Roadside Assistance: With the Merit Platinum Card, you’ll have peace of mind knowing that help is just a phone call away. Whether you need a jump start, a tire change, or emergency fuel delivery, the roadside assistance program will be there to assist you.

- Free Legal Consultation: Need legal advice? The Merit Platinum Card provides access to a team of professional attorneys who can provide you with guidance and assistance on a wide range of legal matters.

- Prescription Drug Discounts: Save on your prescription medications with the Merit Platinum Card. Cardholders are eligible for discounts on a variety of prescription drugs, helping you save money on your healthcare expenses.

- Free Credit Report Access: Stay on top of your credit with free access to your credit report. Regularly checking your credit report can help you monitor your financial health and detect any inconsistencies or errors that may impact your creditworthiness.

These features are aimed at providing you with added value and convenience, making the Merit Platinum Card a beneficial tool for managing your financial needs. It’s important to consider your specific requirements and financial goals when evaluating whether this card is the right fit for you.

| Features | Benefits |

| Roadside Assistance | Peace of mind and assistance in emergency situations |

| Free Legal Consultation | Access to professional legal advice and guidance |

| Prescription Drug Discounts | Savings on prescription medications |

| Free Credit Report Access | Monitoring and awareness of your credit standing |

Overall, the Merit Platinum Card provides a range of features that can enhance your financial management and provide added value. However, it’s important to weigh these benefits against any potential drawbacks and consider your individual circumstances before making a decision.

Approval Process and Requirements

Getting approved for the Merit Platinum Card is simple and hassle-free, as it does not require a credit or employment check, making it accessible to individuals with low or no credit. This is great news for anyone looking to establish or rebuild their credit history. To apply for the card, you just need to meet a few basic requirements.

Requirements:

- You must be at least 18 years old.

- You must have a valid email address.

- You must provide a valid mailing address.

Once you meet these requirements, you can easily apply for the Merit Platinum Card online. The application process is straightforward and can be completed in just a few minutes.

Application Process:

- Visit the Merit Platinum Card website.

- Fill out the online application form with your personal details, including your name, address, and contact information.

- Submit your application and wait for a decision.

Within minutes, you will receive a response regarding your application status. If approved, you will have access to a $750 unsecured credit line that can be used exclusively at the Horizon Outlet online store. It’s important to note that the Merit Platinum Card does not report to credit bureaus, so it will not have an impact on your credit score. However, it does offer a range of benefits and features that can still be advantageous for certain individuals.

| Pros | Cons |

| – Easy approval process | – Monthly membership fee |

| – Access to credit | – Limited usability |

| – Roadside assistance | – No credit-building opportunities |

| – Free legal consultation | |

| – Prescription drug discounts | |

| – Free credit report access |

APR and Minimum Payment

With the Merit Platinum Card, you can enjoy a 0% APR on purchases, giving you the flexibility to manage your expenses without worrying about interest charges. This means that you can make purchases and pay them off over time, without incurring any additional costs. Whether you’re buying a new wardrobe or stocking up on household essentials, you can take advantage of this interest-free period to spread out your payments and stay within your budget.

When it comes to making payments, the Merit Platinum Card has a minimum payment requirement to ensure that you stay on top of your financial obligations. The minimum payment is either $25 or 10% of your balance, whichever is higher. This means that you have the flexibility to choose the payment amount that works best for you, based on your current balance and financial situation.

| APR | Minimum Payment |

| 0% | $25 or 10% of balance |

It’s important to remember that while the 0% APR on purchases gives you a grace period without interest charges, it’s still crucial to make your payments on time to maintain a good credit standing. Late or missed payments can result in fees and potentially impact your credit score.

By understanding the APR and minimum payment requirements of the Merit Platinum Card, you can make informed decisions about your finances and use the card to your advantage. Whether you’re planning a big purchase or simply need a little extra time to pay off your expenses, the Merit Platinum Card offers a convenient and flexible payment option.

Credit Building Potential

It’s important to note that the Merit Platinum Card does not report to credit bureaus, meaning it does not contribute to building or improving your credit score. If you’re looking for a credit card that can help you establish or enhance your credit history, this might not be the right choice for you. However, the Merit Platinum Card does offer other benefits and advantages that may appeal to individuals with low or no credit.

While the card doesn’t report to credit bureaus, it does provide you with a $750 unsecured credit line, which can be beneficial for those who need access to credit for making purchases. With a 0% APR on purchases, you can take advantage of interest-free financing and manage your expenses more effectively. The minimum payment requirement of $25 or 10% of the balance ensures that you can make affordable payments and stay on track with your finances.

Additionally, the Merit Platinum Card grants you access to various perks such as roadside assistance, free legal consultation, prescription drug discounts, and free credit report access. These features can provide value and convenience in different aspects of your life. Whether you need help when you’re stranded on the road, legal advice, or discounts on prescription medications, the card offers a range of benefits that can enhance your overall financial well-being.

In summary, if you’re in need of a credit card to shop at the Horizon Outlet online store and navigate your financial circumstances without worrying about credit checks, the Merit Platinum Card can be a suitable choice. While it doesn’t contribute to credit building, it provides you with an unsecured credit line, low minimum payment requirements, and access to valuable benefits. Consider your financial goals and priorities before deciding whether the Merit Platinum Card aligns with your needs.

Merit Platinum Card Overview

| Card Features | Details |

| Credit Reporting | No report to credit bureaus |

| Credit Limit | $750 unsecured |

| Membership Fee | $14.77 per month |

| APR on Purchases | 0% |

| Minimum Payment | $25 or 10% of the balance |

| Additional Benefits | Roadside assistance, free legal consultation, prescription drug discounts, free credit report access |

Customer Reviews and Feedback

Reviews for the Merit Platinum Card have been mixed, with some customers expressing concerns about unauthorized charges on their accounts. It’s essential to consider the experiences of others before making a decision. While some customers have reported positive experiences with the card’s benefits and accessibility, others have encountered issues with unexpected charges.

One customer, John D., stated, “I found the benefits offered by the Merit Platinum Card to be quite useful, especially the free legal consultation. However, I did notice some unauthorized charges on my account, which was concerning. Make sure to regularly monitor your transactions to avoid any surprises.”

“I applied for the Merit Platinum Card because I wanted access to credit and the ability to shop at the Horizon Outlet, but I was disappointed with the card’s limited usability. Not many stores accept it, so I couldn’t use it as frequently as I had hoped,” shared another customer, Lisa S.

It’s important to weigh the advantages of the Merit Platinum Card, such as its easy approval process and the benefits it offers, against the reported drawbacks. While some customers have had positive experiences, it’s crucial to be aware of the potential for unauthorized charges and the limited acceptance of the card.

| Pros | Cons |

| Easy approval process | Monthly membership fee |

| Access to credit | Limited usability |

| Benefits offered | No credit-building opportunities |

Before making a decision, consider your own financial needs and circumstances. If you have low or no credit and are primarily interested in shopping at the Horizon Outlet, the Merit Platinum Card could be a suitable option. However, if you’re looking for a card to help build credit or have concerns about potential unauthorized charges, it may be worth exploring alternative options.

Summary:

- Reviews for the Merit Platinum Card have been mixed, with some customers reporting unauthorized charges on their accounts.

- While some customers have had positive experiences with the card’s benefits and accessibility, others have encountered issues with unexpected charges.

- Consider the advantages and disadvantages, such as the easy approval process and benefits offered, as well as the drawbacks of the monthly membership fee and limited usability.

- It’s important to evaluate whether the Merit Platinum Card aligns with your financial needs and circumstances.

Pros of the Merit Platinum Card

Despite the mixed reviews, the Merit Platinum Card does offer some notable advantages, including easy approval, access to credit, and a range of benefits that can be useful for cardholders.

Firstly, the Merit Platinum Card boasts a straightforward application process with no credit or employment check required for approval. This makes it an appealing option for individuals with low or no credit who may struggle to qualify for traditional credit cards. With the Merit Platinum Card, you have the opportunity to access credit and begin building a positive financial history.

In addition to easy approval, the Merit Platinum Card offers a credit line of $750, providing you with the flexibility to make purchases and manage your finances. Whether you need to cover unexpected expenses or indulge in some online shopping, this card enables you to do so without the hassle of traditional credit checks.

Furthermore, cardholders of the Merit Platinum Card can enjoy a range of benefits such as roadside assistance, free legal consultation, prescription drug discounts, and free credit report access. These benefits can be valuable in various situations, providing you with peace of mind and added value for your membership fee.

| Pros |

| Easy approval |

| $750 credit line |

| Range of benefits |

In summary, while the Merit Platinum Card may have its drawbacks and mixed reviews, it does offer advantages that can make it a suitable choice for individuals seeking access to credit and the benefits provided by the Horizon Outlet online store. With easy approval, a credit line of $750, and a variety of benefits, the Merit Platinum Card can be a valuable tool in managing your finances and meeting your purchasing needs.

Cons of the Merit Platinum Card

While the Merit Platinum Card has its benefits, it’s important to consider the drawbacks, such as the monthly membership fee, limited usability, and the fact that it does not contribute to building credit.

One of the main downsides of the Merit Platinum Card is the monthly membership fee of $14.77. This fee can add up over time, especially for individuals on a tight budget. It’s important to carefully evaluate whether the card’s benefits outweigh the cost of the membership fee.

Another drawback of the Merit Platinum Card is its limited usability. The card can only be used at the Horizon Outlet online store, which can be restrictive for individuals who prefer to shop at a variety of retailers. If you’re looking for a card with more flexibility in terms of where you can use it, the Merit Platinum Card may not be the best option for you.

Additionally, it’s worth noting that the Merit Platinum Card does not contribute to building credit. This means that using the card responsibly and making timely payments will not help improve your credit score. If you’re looking to establish or improve your credit history, you may want to consider other credit card options that report to credit bureaus.

| Cons of the Merit Platinum Card | |

| Monthly membership fee | $14.77 |

| Usability | Restricted to Horizon Outlet online store |

| Credit building | Does not contribute to building credit |

In summary, the Merit Platinum Card offers certain benefits and advantages for individuals with low or no credit who want access to credit and the opportunity to shop at the Horizon Outlet online store. However, it’s important to carefully consider the drawbacks, such as the monthly membership fee, limited usability, and the absence of credit-building opportunities. Assess your financial needs and priorities before deciding if the Merit Platinum Card is the right choice for you.

Is the Merit Platinum Card Right for You?

Now that we have explored the features, benefits, and drawbacks of the Merit Platinum Card, you may be wondering if it’s the right credit card for you. Let’s take a closer look at who would benefit the most from this card.

If you have a low credit score or no credit history at all, the Merit Platinum Card can be a good option for you. Since there is no credit or employment check required for approval, it provides an opportunity to access credit that may otherwise be difficult to obtain. This can be particularly helpful if you are looking to build or rebuild your credit.

Furthermore, if you frequently shop at the Horizon Outlet online store, the Merit Platinum Card offers exclusive benefits that can enhance your shopping experience. With a $750 unsecured credit line, you can make purchases and take advantage of the 0% APR on purchases. The card also provides roadside assistance, free legal consultation, prescription drug discounts, and free credit report access, adding further value to your membership.

However, it’s important to keep in mind the limitations of the Merit Platinum Card. It does come with a monthly membership fee of $14.77, which can add up over time. Additionally, the card does not report to credit bureaus, so it will not help with building credit. If establishing or improving your credit score is a priority, you may want to consider other options.

Summary

In summary, the Merit Platinum Card is ideal for individuals with low or no credit who want access to credit and enjoy shopping at the Horizon Outlet online store. It offers a range of benefits such as roadside assistance and free legal consultation, making it a valuable membership card. However, it’s important to weigh the costs of the monthly membership fee against the benefits, and consider your long-term credit goals before making a final decision. Ultimately, the Merit Platinum Card can be a tool to help you manage your finances and improve your credit if used responsibly.

| Pros | Cons |

| Easy approval process | Monthly membership fee |

| Access to credit without a credit check | Limited usability outside of Horizon Outlet |

| Benefits like roadside assistance and free legal consultation | No credit-building potential |

Conclusion

In conclusion, the Merit Platinum Card can be a viable option for individuals with low or no credit who want access to credit and the ability to shop at the Horizon Outlet. However, it’s crucial to carefully consider the card’s features, benefits, and drawbacks before making a decision for your financial future.

The Merit Platinum Card offers a $750 unsecured credit line, making it a helpful tool for managing expenses and making purchases. With a 0% APR on purchases, you have the opportunity to pay off your balance without incurring interest charges. The minimum payment requirement of $25 or 10% of the balance provides flexibility in managing your monthly payments.

While the Merit Platinum Card does not report to credit bureaus, it does offer benefits such as roadside assistance, free legal consultation, prescription drug discounts, and free access to credit reports. These perks can provide added value and convenience, especially if you frequently utilize these services.

It’s worth noting that the Merit Platinum Card has received mixed reviews, with some customers reporting unauthorized charges. Therefore, it’s essential to keep a close eye on your account activity and promptly report any suspicious transactions to ensure the security of your finances.

In summary, the Merit Platinum Card offers a unique opportunity for individuals with low or no credit to access credit and enjoy the benefits of shopping at the Horizon Outlet. However, it’s important to carefully weigh the advantages and disadvantages before making a decision. Consider your financial goals, spending habits, and the potential risks involved to determine if the Merit Platinum Card is the right fit for you.

FAQ

What is the Merit Platinum Card?

The Merit Platinum Card is a store card that can only be used at the Horizon Outlet online store. It offers a $750 unsecured credit line and has a monthly membership fee of $14.77.

What are the features of the Merit Platinum Card?

The Merit Platinum Card offers benefits such as roadside assistance, free legal consultation, prescription drug discounts, and free credit report access.

What is the approval process for the Merit Platinum Card?

The Merit Platinum Card does not require a credit or employment check for approval.

What is the APR and minimum payment for the Merit Platinum Card?

The Merit Platinum Card has a 0% APR on purchases and a minimum payment of $25 or 10% of the balance.

Does the Merit Platinum Card help with building credit?

No, the Merit Platinum Card does not report to credit bureaus, so it does not help with building credit.

What do customer reviews say about the Merit Platinum Card?

Customer reviews for the Merit Platinum Card have been mixed, with some customers reporting unauthorized charges.

What are the pros of the Merit Platinum Card?

The Merit Platinum Card offers easy approval, access to credit, and various benefits.

What are the cons of the Merit Platinum Card?

The Merit Platinum Card has a monthly membership fee, limited usability, and does not help with building credit.

Is the Merit Platinum Card right for you?

Whether the Merit Platinum Card is right for you depends on your financial needs and circumstances.