Welcome to our review of CompareMeFunds.com, an online service that allows you to compare various loan options in the United States. If you’re in need of a loan and want to explore your top choices, CompareMeFunds.com is here to help. As a lead generator, it connects you with participating lenders, giving you access to a wide range of loan products. With CompareMeFunds.com, you can make informed decisions about your borrowing needs and find the loan that suits you best.

Key Takeaways:

- CompareMeFunds.com is an online service that helps you compare loan options in the US.

- It operates as a lead generator, connecting you with participating lenders.

- By using CompareMeFunds.com, you can access a wide range of loan products.

- Completing the online loan request form does not guarantee loan approval.

- It is important to carefully review the terms and conditions of any loan offer before making a decision.

About CompareMeFunds.com

CompareMeFunds.com is a loan connecting service that provides users with the convenience of submitting a loan request online. Through our user-friendly website, borrowers can easily complete an online form, which collects essential personal information, including name, address, phone number, and employment details.

Once the loan request is submitted, we facilitate the process by sharing the information with our extensive network of participating lenders. These lenders carefully review the user’s qualifications and criteria to determine if they meet their loan requirements.

If a lender finds a borrower to be eligible, the user will be redirected to the lender’s website to continue the loan process. This seamless transition ensures that borrowers can conveniently access loan options online, saving them time and effort.

At CompareMeFunds.com, we prioritize user satisfaction and strive to connect borrowers with suitable lenders who can meet their financial needs. By providing a streamlined platform for submitting a loan request online, we aim to simplify the borrowing process and empower individuals to make informed decisions about their loan options.

Loan Amounts and Terms

When utilizing CompareMeFunds.com to explore your loan options, it’s essential to understand the various loan amounts and terms that may be available to you. Please remember that loan amounts and terms are dependent on the individual lender’s criteria, and not all lenders can provide loans in specific amounts.

Here is a breakdown of some common loan amounts that may be offered through CompareMeFunds.com:

| Loan Amount | Minimum Qualifications |

|---|---|

| $1,000 | Minimum income requirement, valid identification |

| $2,500 | Steady employment, age 18 or older |

| $5,000 | Maintain a checking or savings account |

| $50,000 | Strong credit history, higher income requirements |

Please note that the specific loan amounts and terms you qualify for will be determined by the lender based on your personal qualifications and criteria. Meeting the minimum qualifications listed is not a guarantee of loan approval.

It’s essential to provide accurate information in your loan request to ensure you receive loan offers that align with your needs and qualifications. Remember, CompareMeFunds.com is here to help you make informed borrowing choices and connect you with lenders that can meet your specific borrowing requirements.

Electronic Signatures and Records

When conducting transactions on CompareMeFunds.com, users are required to provide electronic consent for using electronic signatures, records, and disclosures. This ensures a seamless and efficient borrowing experience. By utilizing electronic signatures, users can conveniently sign necessary documents online, eliminating the need for physical paperwork and streamlining the loan process.

It is important for users to review the hardware and software requirements to ensure they can access and retain electronic documents. Compatibility with common file formats such as PDF is essential for proper document viewing and storage. Additionally, users should have a reliable internet connection to access and submit their loan applications without interruptions.

At any time, users have the option to withdraw their consent for using electronic signatures and records. However, it is important to note that this decision may affect their ability to obtain credit from a lender through CompareMeFunds.com. Therefore, users should consider the advantages of electronic transactions and carefully evaluate their borrowing needs before deciding to withdraw their consent.

As with any online service, CompareMeFunds.com may update its agreement and privacy policy from time to time. Users should periodically review these documents to stay informed about any changes that may impact their interactions with the platform. Staying up-to-date with the latest terms and conditions ensures a responsible and informed approach to utilizing CompareMeFunds.com’s loan comparison services.

Eligibility and Restrictions

When using CompareMeFunds.com, it’s essential to understand the eligibility criteria and any applicable restrictions. While CompareMeFunds.com offers its services to users in the United States, there are certain states where the services are not available. These states include Arkansas, Arizona, Georgia, Virginia, West Virginia, Connecticut, and more.

To use the website and services, you must be a resident of the United States (excluding the prohibited states) and be at least 18 years old. It’s crucial to ensure that you meet these requirements before proceeding with your loan application.

Checking Eligibility for Loan Products

Each loan product available through CompareMeFunds.com may have specific eligibility criteria. To determine if you qualify for a particular loan, carefully review the lender’s requirements. These requirements may include factors such as credit score, income, employment history, and more.

Take the time to understand the eligibility criteria for each loan product and evaluate if it aligns with your financial situation. By doing so, you can increase your chances of finding a loan that suits your needs and qualifications.

It’s also important to comply with any state regulations related to loan products and ensure that you meet any additional requirements specific to your state of residence.

Remember, meeting the eligibility criteria does not guarantee loan approval. Lenders will assess your overall qualifications and determine whether they can provide you with the loan product you’re seeking.

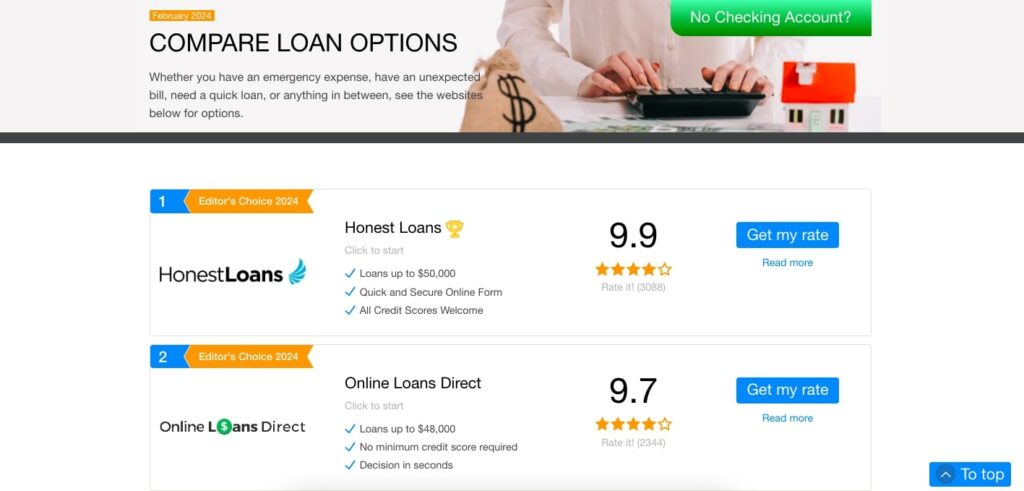

How CompareMeFunds.com Works

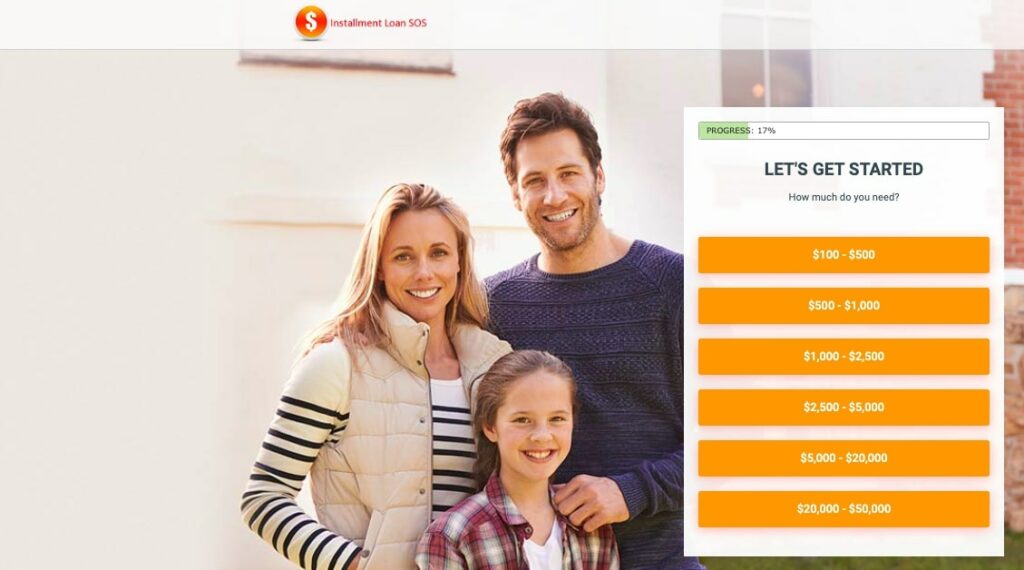

CompareMeFunds.com functions as a loan connecting service, facilitating the process of matching users with participating lenders. To begin, users are required to complete an online loan request form, providing relevant personal and financial information. This information is then securely shared with a network of lenders who review the user’s qualifications and loan criteria. If a lender determines that the user meets their loan criteria, they will be directed to the lender’s website to proceed with the loan application.

Disclosure and Privacy Policy

When using CompareMeFunds.com, it is crucial for you to carefully review the disclosure and privacy policy provided by the platform. The disclosure clearly states that CompareMeFunds.com is a lead generator and not a lender. This means that by completing the online form, it does not guarantee loan approval. It merely connects you with participating lenders who will assess your qualifications and criteria.

The privacy policy focuses on how your personal information is collected, stored, and shared. It is important for you to understand the terms and conditions before using the CompareMeFunds.com website and services. Your privacy and the security of your personal data are of utmost importance, so ensure that you are comfortable with how your information is handled.

Important Considerations

When using CompareMeFunds.com to connect with lenders for a loan, it’s important to understand the loan qualification criteria and carefully review any loan offers you receive. Meeting the lenders’ qualification criteria is essential to securing the loan you desire. However, if you do not meet these criteria, you may still receive solicitations for alternative loan products.

These alternative loan offers may come with different terms and conditions than your original loan request. It is crucial to thoroughly examine and compare these offers before making a decision. Understanding the specific terms, interest rates, repayment plans, and any additional fees associated with each offer will allow you to make an informed choice that aligns with your financial needs and goals.

By considering these important factors, you can ensure that you make the right borrowing decision and find a loan option that best suits your qualifications and requirements.

Loan Offer Comparison

| Loan Provider | Loan Amount | Interest Rate | Repayment Term | Additional Fees |

|---|---|---|---|---|

| ABC Lending | $5,000 | 6.5% | 48 months | No origination fee |

| XYZ Loans | $7,500 | 8.25% | 36 months | $100 application fee |

| 123 Finance | $10,000 | 7.75% | 60 months | $50 late payment fee |

It’s important to carefully review and compare loan offers from different lenders to find the most favorable terms for your specific needs. This table provides an example of a loan offer comparison, showcasing key details such as the loan provider, loan amount, interest rate, repayment term, and any additional fees. By comparing these factors, you can make a well-informed decision and select the loan offer that aligns with your financial goals.

Terms of Use and Agreement

By using CompareMeFunds.com, you agree to the terms of use and agreement outlined on the website. These terms govern the use of the site and services provided. It is important that you carefully read and understand these terms to ensure a smooth borrowing experience.

The terms of use and agreement may include important information regarding your rights and responsibilities when using CompareMeFunds.com. They cover various aspects such as data privacy, intellectual property rights, dispute resolution, and limitations of liability.

It is crucial that you comply with the terms of use and agreement at all times to avoid any potential issues or conflicts. Failure to adhere to these terms may result in the termination of your access to the website and services.

Key Points to Note:

- Read and understand the terms of use and agreement before using CompareMeFunds.com.

- Comply with the terms and conditions to ensure a smooth borrowing experience.

- Review the terms periodically as they may be subject to change.

- Failure to comply with the terms may result in termination of access to the website.

By acknowledging and accepting the terms of use and agreement, you are demonstrating your commitment to using CompareMeFunds.com responsibly and in accordance with the established guidelines.

Conclusion

CompareMeFunds.com offers a valuable solution for individuals seeking online loans in the US. By utilizing this platform, you can compare various loan options to make well-informed decisions that align with your needs and qualifications. It is crucial to thoroughly review the terms and conditions of any loan offer to ensure a clear understanding of the borrowing process.

At CompareMeFunds.com, we aim to connect you with lenders who can meet your specific borrowing requirements. Whether you require a small personal loan or a larger sum for a business venture, our extensive network of lenders offers diverse loan options to cater to your unique circumstances.

When considering your loan options, take the time to evaluate important factors such as interest rates, repayment terms, and any additional fees involved. Comparing these elements will enable you to make a well-informed decision that supports your financial goals. As you navigate the loan process, remember that transparency and understanding are key to a successful borrowing experience.

FAQ

What is CompareMeFunds.com?

CompareMeFunds.com is an online service provided by ONLINELOANNETWORK.COM that allows users to compare various loan options in the US.

How does CompareMeFunds.com work?

CompareMeFunds.com operates as a lead generator, connecting consumers with participating lenders. Users can submit a loan request online by completing an online form. The information is then shared with lenders who review the user’s qualifications and criteria.

Can I get a loan through CompareMeFunds.com?

CompareMeFunds.com is not a lender but a loan connecting service. If a lender determines that you meet their requirements, you will be redirected to the lender’s website to continue the loan process.

How much can I borrow through CompareMeFunds.com?

The loan amounts available through CompareMeFunds.com vary and are dependent on the lender. Not all lenders can provide loans up to certain amounts, such as $1,000, $2,500, $5,000, or $50,000. The specific loan amounts and terms will be determined by the lender based on your qualifications and criteria.

Is my personal information safe when using CompareMeFunds.com?

CompareMeFunds.com takes precautions to protect user information. It is important to review the website’s privacy policy to understand how user information is collected, stored, and shared.

Are there any eligibility criteria or restrictions when using CompareMeFunds.com?

CompareMeFunds.com does not offer its services to residents of certain states, including Arkansas, Arizona, Georgia, Virginia, West Virginia, Connecticut, and more. Users must be at least 18 years old and reside in the United States (excluding prohibited states) to use the website and services.

What should I consider before accepting a loan offer through CompareMeFunds.com?

If you do not meet the lenders’ loan qualification criteria, you may receive solicitations for alternative loan products. These offers may have different terms and conditions than the original loan request. It is important to carefully review any loan offers received and compare them before making a decision.

How can I withdraw my consent for electronic signatures and records on CompareMeFunds.com?

Users can withdraw their consent for electronic signatures and records at any time. However, this may affect your ability to obtain credit from a lender. It is important to review the website’s terms and conditions for more information.

What should I know about the terms of use and agreement on CompareMeFunds.com?

By using CompareMeFunds.com, you agree to the terms of use and agreement outlined on the website. It is important to understand and comply with these terms to ensure a smooth borrowing experience. The terms may be subject to change, and users should review them periodically.

Can I trust the loan options provided by CompareMeFunds.com?

CompareMeFunds.com aims to connect users with lenders that can meet their borrowing requirements. By comparing loan options and making informed decisions, users can find the loan that best fits their needs and qualifications. It is important to carefully review the terms and conditions of any loan offer and understand the loan process thoroughly.