Money is one of the most significant stressors in a relationship, and debt can cause tension and strain even in the strongest of bonds. While confessing debt to your spouse may seem daunting, it is an essential step in working together towards a healthier financial future.

In this section, we’ll discuss how to confess debt to your spouse and establish a foundation of trust between the two of you. We’ll also touch on the importance of open communication, understanding the impact of debt on your relationship, and working together to develop a plan to tackle your debt.

Key Takeaways:

- Confessing debt to your spouse is necessary for building trust and finding solutions together

- Open communication and understanding the impact of debt on your relationship are crucial for navigating this conversation

- Working together to develop a plan to tackle your debt and seeking professional help can aid in dealing with debt

Understanding the Impact of Debt on Your Relationship

Before confessing your debt to your spouse, it’s essential to understand how debt can impact your relationship. It’s no secret that debt can be a significant stressor, causing tension, arguments, and even, in some cases, divorce. A healthy financial foundation is vital for any marriage, making it essential to tackle debt together as a team.

The impact of debt on a relationship can manifest differently for each couple. For some, it may cause feelings of shame or guilt, while others may feel overwhelmed or frustrated. Regardless of the emotions, it’s essential to acknowledge that debt can impact both partners in different ways.

One of the most significant challenges that debt can have on a relationship is a breakdown in communication. Financial struggles can make one or both partners feel compelled to hide information or keep secrets, leading to mistrust and resentment. Additionally, debt can cause couples to argue or become defensive, making it difficult to find common ground.

However, it’s essential to remember that debt does not have to be a relationship-killer. With open communication, honesty, and a willingness to work together, couples can overcome financial hurdles and create a stronger, healthier relationship.

Understanding the Impact of Debt on Your Relationship

The impact of debt on a relationship can vary depending on several factors, such as the amount of debt, the interest rates, and the length of time it will take to pay off the debt. Here are some common ways debt can impact your marriage:

| Impact | Description |

|---|---|

| Stress and Anxiety | Debt can cause significant stress and anxiety, particularly if one or both partners are struggling to make ends meet. Short-term stress can lead to long-term problems if left unchecked. |

| Trust Issues | Debt can strain trust within a relationship, often leading to one or both partners feeling the need to hide financial information or keep secrets. |

| Arguments and Tension | Financial problems can cause tension and arguments within a marriage, creating a hostile environment that can be challenging to overcome. |

| Intimacy Issues | Debt can also impact intimacy within a relationship, making it difficult for couples to connect emotionally and physically. |

It’s essential to acknowledge that debt can have a profound impact on a relationship. However, it’s equally crucial to recognize that it’s possible to work through financial hurdles as a team. With open communication, honesty, and a willingness to create a plan, couples can tackle debt together and emerge stronger than ever.

Assessing Your Debt Situation

Before you can tackle your debt, it’s crucial to assess your debt situation. This involves calculating the total amount of debt, understanding interest rates, and identifying any patterns or habits that contribute to your debt. Below are the steps you should follow:

Step 1: Gather All Your Debt Information

The first step is to gather all the information about your debt. This includes credit cards, loans, mortgages, and any other debts you owe. Gather statements from each lender, which will help you determine the interest rates and monthly payments for each debt.

Step 2: Calculate Your Total Debt

Once you have all your debt information, it’s time to calculate your total debt. Add up all the balances you owe for each debt to get your total debt amount. This will give you a starting point to work from.

Step 3: Understand Interest Rates and Minimum Payments

Understanding interest rates and minimum payments for each debt is crucial to develop a plan to pay off your debt. Organize your debts by interest rate, and note their minimum payments. This will help you prioritize which debts to pay off first, based on interest rates and total amount owed.

Step 4: Identify Habits and Patterns that Contribute to Your Debt

Identifying your habits and patterns that contribute to your debt is essential to break the cycle of debt. Do you overspend on credit cards? Have you borrowed too much money? Did a life event, like a medical emergency or job loss, contribute to your debt? Make a list of these habits and patterns to see areas you need to change.

By taking the time to assess your debt situation, you’ll have a clear picture of your financial status and how to move forward. Remember to stay positive and work together as a couple to tackle your debt.

Choosing the Right Time and Place to Confess

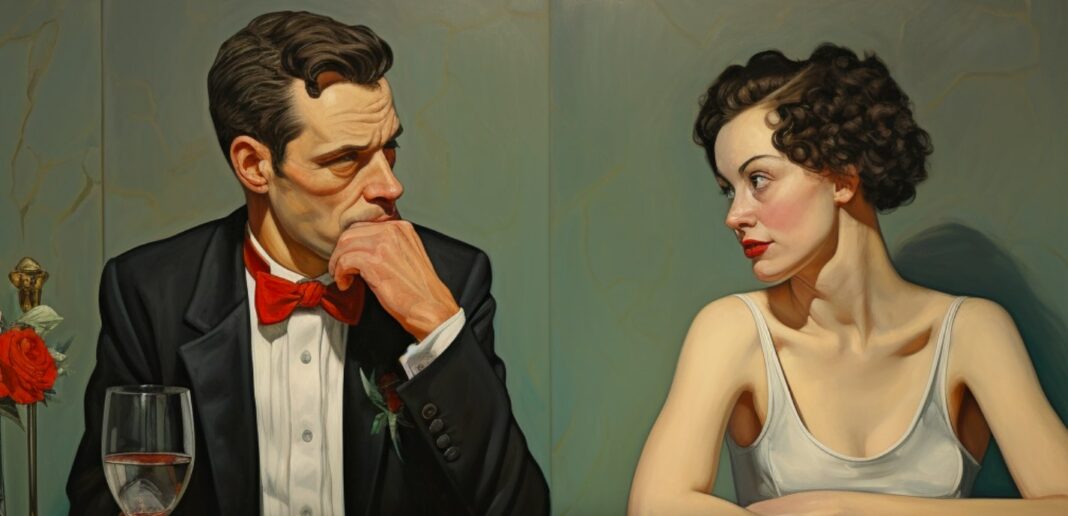

Timing and environment play a crucial role in a successful debt confession. Choosing the right moment can make the difference between a calm and productive conversation or a heated argument. It’s essential to find a time when both you and your spouse are relaxed, free from distractions, and in a good mood. Avoid discussing debt-related matters when either of you is tired, hungry, or stressed. Scheduling a specific time in advance can allow both of you to prepare mentally and emotionally for the conversation.

Additionally, it’s important to consider where you will have the conversation. Choose a location that is private and comfortable, where you can both sit down and have an uninterrupted talk. It could be at home, in a park, or at a quiet cafe. Consider your spouse’s preferences and choose a place where they feel comfortable and relaxed.

When confessing your debt, it’s important to avoid blaming or criticizing your spouse. Instead, focus on the facts and express your emotions honestly. It’s okay to feel scared, ashamed, or guilty, but avoid letting these emotions turn into anger or resentment towards your spouse. Remember that this conversation is about finding a solution together, not pointing fingers.

By choosing the right time and place and approaching the conversation with empathy and understanding, you can create a safe space for a productive and honest conversation about debt. Remember, confessing your debt to your spouse can ultimately strengthen your relationship and lead to a healthier financial future as a couple.

Approaching the Conversation with Honesty and Transparency

When it comes to discussing debt with your spouse, honesty and transparency should be at the forefront of your approach. It’s important to take responsibility for your actions and express genuine remorse for any mistakes made. Emphasize that you want to work together to find a solution and create a healthier financial future for your family.

You may feel nervous or ashamed about discussing your debt, but it’s essential to be open and transparent about the amount of debt you have and any contributing factors. Avoid hiding details or minimizing the situation, as this can lead to further trust issues down the line.

It’s also crucial to be aware of your emotions and how they may impact the conversation. Emotions can run high during discussions about finances, and it’s essential to practice active listening and empathize with your partner’s feelings. Encourage them to express any concerns or questions they may have and listen without judgment.

In summary, approaching the debt conversation with honesty, transparency, and empathy can create a solid foundation for moving forward as a team. Remember that this may be a challenging conversation, but it’s an important step towards building trust and finding solutions together.

Developing a Plan to Tackle Debt Together

Now that you’ve shared your debt situation with your spouse, it’s time to create a plan to tackle it together. The first step is to calculate your total debt and identify any high-interest debts. This will help you understand the scope of your debt and prioritize which debts to pay off first.

Once you have a clear picture of your debt situation, it’s time to create a joint budget. This should include all of your expenses, including debt payments, and your combined income. Make sure to discuss and agree on any necessary lifestyle adjustments to accommodate for debt payment.

When creating a debt payment plan, consider exploring various methods of debt repayment, such as the debt snowball or debt avalanche method. Research and discuss which option makes the most sense for your situation.

Set achievable financial goals together, such as paying off a certain amount of debt within a specific period or working towards saving for a future expense, like a down payment on a house.

Managing debt as a couple requires ongoing communication and collaboration. Set regular check-ins to track your progress and make any necessary adjustments to your plan. Remember to celebrate small milestones along the way to stay motivated.

Seeking Professional Help and Support

Dealing with debt can be overwhelming, and seeking professional help can provide much-needed support and guidance. Financial counseling is an effective way to get expert advice and assistance in managing your finances as a couple.

Professional financial counselors can help you assess your debt situation, identify any financial habits that contribute to your debt, and develop a plan to pay off your debt efficiently. They can also assist in creating a budget, establishing financial goals, and improving your credit score.

It’s essential to find a reputable financial counselor who is unbiased and has your best interests in mind. Look for counselors who are licensed and certified in financial counseling and have experience in dealing with debt and credit issues.

Talking to a financial counselor can help alleviate the stress and anxiety that comes with dealing with debt. They can provide objective advice and support, and help you and your spouse navigate the ins and outs of managing debt together.

Remember that seeking professional help is not a sign of weakness, but rather a proactive step towards a healthier financial future.

Maintaining Open Communication Moving Forward

Once you and your spouse have come clean about your debt, maintaining open communication about finances becomes vital. It’s essential to keep each other informed about any financial decisions or changes that could impact your joint financial plan.

A great way to establish healthy communication habits is to schedule regular check-ins to discuss your finances. Set aside time each week or month to go over your budget, reevaluate your financial goals, and discuss any concerns or challenges you may be facing.

It’s also crucial to set financial boundaries and respect each other’s individual financial goals. Be open and honest about your spending habits and financial priorities, and work together to find a balance that works for both of you.

Remember, managing debt as a couple requires teamwork and a joint effort. It’s essential to work together towards a healthy financial future by keeping the lines of communication open and being transparent about your finances.

Conclusion

Confessing debt to your spouse can be a daunting task, but it’s a crucial step towards building a healthy and strong relationship. By discussing your debt with your spouse, you can work together towards a brighter financial future.

In this guide, we’ve explored the importance of open and honest communication, the impact of debt on your relationship, assessing your debt situation, and choosing the right time and place to confess. We’ve also discussed strategies for approaching the conversation with honesty and transparency, developing a plan to tackle debt together, seeking professional help and support, and maintaining open communication moving forward.

Remember that the key to success is working together as a team. By setting financial goals and boundaries and committing to ongoing communication, you can create a healthy and happy financial future.

So take a deep breath, gather your thoughts, and start the conversation today. Confessing debt to your spouse may not be easy, but it is the first step towards finding solutions and a brighter financial future together.

FAQ

Q: How do I approach discussing debt with my spouse?

A: When discussing debt with your spouse, it’s important to approach the conversation with honesty and transparency. Choose a time and place where you both feel comfortable and ready to have an open dialogue. Express your emotions honestly and be prepared to answer any questions your spouse may have.

Q: How can debt impact my relationship?

A: Debt can have various impacts on a relationship. It may lead to stress, arguments, or a loss of trust. However, by openly discussing the situation and working together to develop a plan, you can navigate these challenges and strengthen your relationship in the process.

Q: How do I assess my debt situation?

A: To assess your debt situation, calculate the total amount of debt you have, understand the interest rates and monthly payments associated with each debt, and identify any patterns or habits that contribute to your debt. This will provide you with a clear picture of your financial situation and help you make informed decisions moving forward.

Q: When is the right time to confess my debt to my spouse?

A: Choosing the right time to confess your debt is important. It’s best to find a time when both you and your spouse are in a calm and relaxed state of mind, free from distractions. Avoid discussing the matter during stressful or emotionally charged situations.

Q: How do I approach the debt conversation with honesty and transparency?

A: When approaching the debt conversation, be honest about your financial situation. Frame your confession in a way that emphasizes your desire to work together to find solutions. Be transparent about any mistakes or patterns that led to the debt and express your commitment to making positive changes.

Q: What should I do after confessing my debt?

A: After confessing your debt, it’s important to develop a plan to tackle it together. Create a joint budget, establish financial goals, and explore strategies to pay off the debt efficiently. By working together, you can make progress towards a healthier financial future.

Q: Should I seek professional help for dealing with debt?

A: Seeking professional help, such as financial counseling, can be beneficial when dealing with debt. A reputable professional can provide guidance, support, and tailored advice based on your specific situation. They can help you develop a plan, negotiate with creditors, and provide strategies to manage your debt effectively.

Q: How do I maintain open communication about finances moving forward?

A: To maintain open communication about finances, continue having regular check-ins with your spouse. Set financial boundaries and be transparent about your spending and saving habits. Work together to establish a shared financial vision and create a plan to achieve your goals.