Welcome to our review of CashAdvance.com, a platform that provides reliable solutions for individuals facing financial emergencies or unexpected expenses. If you’re in need of quick loans and have bad credit, CashAdvance.com might be the answer you’ve been searching for. By connecting customers with lenders offering short-term loans, CashAdvance.com aims to help you get the financial assistance you need, even in challenging situations.

Key Takeaways:

- CashAdvance.com provides a free service to connect individuals with lenders offering quick loans.

- They specialize in helping those with bad credit situations find reliable financial solutions.

- By submitting a secure online form, you can receive a response from a lender within minutes.

- Short-term loans should be used as a last resort and borrowers should review all loan terms carefully.

- CashAdvance.com offers resources to help you determine if a cash advance is the right option for your needs.

How CashAdvance.com Works

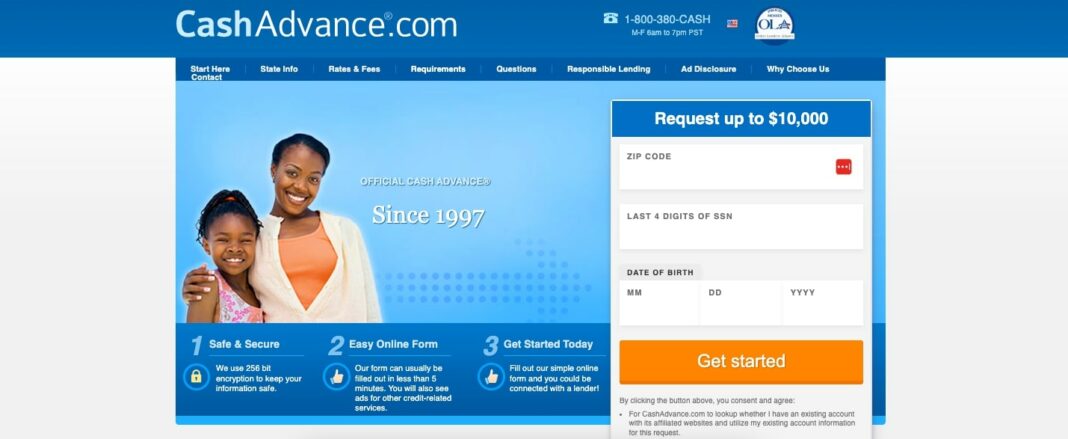

CashAdvance.com offers a simple and convenient process for obtaining a loan. By submitting a loan request through their secure online form, you can access a wide network of lenders and increase your chances of finding the right loan option for your needs.

The process is as follows:

- Access the CashAdvance.com website from the comfort of your home, office, or mobile device.

- Complete the online loan request form with the required information, including the loan amount and desired repayment term.

- Submit your loan request by clicking the “Submit” button.

- CashAdvance.com will connect your loan request with potential lenders who will review your application and make loan offers based on their assessment.

- If a lender is interested in providing you a loan, they will present you with an offer detailing the loan amount, interest rate, repayment terms, and any applicable fees.

- You have the option to review the loan offer and its terms carefully before making a decision. If the terms are agreeable, you can accept the offer.

- Upon acceptance, the lender will typically deposit the funds into your bank account as soon as the next business day.

CashAdvance.com aims to provide a seamless and efficient process, ensuring that you receive the funds you need in a timely manner. It’s important to note that each lender may have different criteria and requirements, so carefully review the terms and conditions of any loan offer before accepting.

Here is an example representation of how CashAdvance.com’s network can connect you with lenders:

| Lender | Loan Amount | Interest Rate | Repayment Term | Loan Approval |

|---|---|---|---|---|

| Lender A | $500 | 10% | 14 days | Approved |

| Lender B | $1,000 | 12% | 30 days | Approved |

| Lender C | $2,000 | 15% | 45 days | Declined |

As seen in the table above, CashAdvance.com’s network provides multiple loan options, allowing you to choose the one that best fits your financial situation.

Representative APR Range

CashAdvance.com does not provide short-term loans directly but refers consumers to lenders who may provide such loans. As a result, they are unable to provide an exact APR that borrowers will be charged. The APR on a short-term loan can vary based on factors such as loan fees, loan duration, and loan renewal actions. It’s important for borrowers to review the loan terms, including the APR, provided by their lender. CashAdvance.com encourages consumers to consult their Questions section or contact them for further assistance.

Implications of Non-Payment and Other Considerations

Before accepting a loan offer, it is crucial to carefully review the loan terms and conditions provided by the lender. Take the time to compare the terms with other options available to you. Understanding the details of the loan is essential to make an informed decision and avoid any potential issues later on.

When it comes to loan repayment, it is important to be aware of the consequences of non-payment, late payment, or partial payment. Lenders may charge additional fees or request extra charges for such actions. These fees can add up and make the loan more expensive in the long run.

CashAdvance.com understands that they do not have control over the specific loan details between the borrower and the lender. It is recommended to consult the loan documents provided by the lender to get a clear understanding of late payment, partial payment, and non-payment policies. Being well-informed will help you navigate the loan process more effectively.

It’s important to note that all lenders and debt collectors are required to adhere to fair debt collection practices. If you have any concerns or questions regarding the loan terms, it is advisable to reach out to the lender directly for clarification.

Example of Late Payment Fees:

| Lender | Late Payment Fee |

|---|---|

| Lender A | $25 |

| Lender B | $30 |

| Lender C | $35 |

As seen in the table above, different lenders may have varying late payment fee structures. By understanding these fees, you can make a more informed decision when selecting a lender and avoid unnecessary financial burden.

Remember, it is crucial to carefully review loan terms and disclosures before accepting an offer. This step will ensure you are fully aware of the potential implications and fees related to non-payment or late payment.

Fees and Interest

Before accepting a loan offer, CashAdvance.com requires lenders to present borrowers with the exact fees and interest rate of the loan. CashAdvance.com does not have control or knowledge of the loan details between the borrower and the lender, so borrowers are under no obligation to continue with the loan request if they find the terms unsuitable. It’s important to carefully review the loan terms presented by the lender before making a decision.

Loan Fees and Interest Rate Comparison

| Lender | Loan Fees | Interest Rate | Loan Terms |

|---|---|---|---|

| Lender A | $25 | 15% | 14 days |

| Lender B | $30 | 12% | 30 days |

| Lender C | $20 | 18% | 7 days |

As seen in the table above, different lenders may offer varying loan fees, interest rates, and loan terms. Comparing these factors can help borrowers make an informed decision that suits their financial needs and repayment capabilities.

Credit Score Impact

When it comes to credit decisions and credit checks, CashAdvance.com does not have any involvement. However, it is important to note that some lenders in their network may conduct a non-traditional credit check to determine loan eligibility. These lenders typically do not perform a credit inquiry with major credit bureaus.

If a borrower fails to repay their loan on time, the lender has the right to report the delinquency to one or more credit bureaus. This can have a negative impact on the borrower’s credit score. It is advisable for individuals with credit problems to consult a Credit Counseling company for assistance.

Renewal Policy Information

Loan renewal policies are determined by state regulatory legislation. Before accepting a loan offer, lenders are required to disclose their loan renewal policies to borrowers. It is crucial for borrowers to carefully read and understand the renewal policy before signing the loan documents. Payday loans, which are short-term financial instruments, should ideally be repaid on time and in full to avoid incurring late payment and non-payment fees.

If you are uncertain about your ability to repay a loan, CashAdvance.com recommends exploring loan alternatives before submitting a request. Taking the time to consider other options and finding the right solution for your financial needs can help you make a more informed decision.

| Loan Renewal Policy | |

|---|---|

| Rollover | Allowed in some states |

| Extension | Allowed in some states |

| Repayment Plans | Varies by lender |

Collection Practices

At CashAdvance.com, we value transparency and want to ensure that borrowers understand the collection practices associated with their loans. While we don’t collect any debts directly, we work with lenders who are required to disclose their specific debt collection practices to borrowers before accepting a loan offer.

If you have any concerns or questions regarding a lender’s collection practices, we recommend reaching out to them directly for clarification. It’s essential to have a clear understanding of how any potential debts would be handled before committing to a loan.

Rest assured that all lenders and debt collectors must adhere to fair debt collection practices. This includes following the regulations outlined in the Fair Debt Collection Practices Act, a federal law designed to protect consumers from unfair or abusive debt collection practices.

Privacy and Security

CashAdvance.com prioritizes the privacy and security of your information. Rest assured that your data is protected using high-grade 256-bit encryption. This advanced encryption ensures that every cash loan request you submit is securely transmitted to potential lenders, safeguarding your personal details from unauthorized access.

When it comes to privacy, CashAdvance.com follows a strict policy. They only share your information with potential lenders who are part of their trusted network. Be assured that your personal data will not be sold to third parties for marketing purposes.

To further ensure your peace of mind, CashAdvance.com provides a secure online form. This form can be easily accessed from the comfort of your own home, office, or mobile device, allowing you to submit your loan request with confidence.

Conclusion

In conclusion, CashAdvance.com is a reliable platform that provides quick loans to individuals facing bad credit situations. Their free service allows you to easily submit a loan request through a secure online form. It is crucial to carefully review all loan terms before making a decision.

With CashAdvance.com, you can access the resources needed to determine if a cash advance is the right solution for your financial needs. However, it is important to remember that short-term loans should be used as a last resort in emergency situations.

With their extensive network of lenders, CashAdvance.com strives to connect individuals in need with reliable solutions. Take advantage of this convenient service to find the quick loan that’s right for you.

FAQ

How does CashAdvance.com work?

CashAdvance.com works by allowing users to submit a loan request through their secure online form. Once the request is submitted, CashAdvance.com connects the user with potential lenders who can choose whether to offer a loan. If a loan offer is presented, the user has the option to review the terms and either approve or decline the offer.

What is the representative APR range for loans from CashAdvance.com?

CashAdvance.com does not provide short-term loans directly but refers consumers to lenders who may provide such loans. Therefore, they are unable to provide an exact APR that borrowers will be charged. The APR on a short-term loan can vary based on factors such as loan fees, loan duration, and loan renewal actions. It’s important for borrowers to review the loan terms, including the APR, provided by their lender.

What are the implications of non-payment and other considerations?

Before accepting a loan offer, CashAdvance.com recommends carefully reviewing the terms and conditions presented by the lender and comparing them to other options. Non-payment, late payment, or partial payment may result in additional fees or charges requested by the lender. It’s important to consult the loan documents provided by the lender for information on late payment, partial payment, and non-payment policies. All lenders and debt collectors are required to adhere to fair debt collection practices.

Are there any fees and interest associated with loans from CashAdvance.com?

Before accepting a loan offer, CashAdvance.com requires lenders to present borrowers with the exact fees and interest rate of the loan. CashAdvance.com does not have control or knowledge of the loan details between the borrower and the lender, so borrowers are under no obligation to continue with the loan request if they find the terms unsuitable. It’s important to carefully review the loan terms presented by the lender before making a decision.

How does obtaining a loan from CashAdvance.com impact credit scores?

CashAdvance.com does not make credit decisions or conduct a credit inquiry. However, some lenders on their network may conduct a non-traditional credit check to determine eligibility for a loan. If a borrower fails to repay their loan on time, the lender may report the delinquency to one or more credit bureaus, which could negatively impact the borrower’s credit score. CashAdvance.com encourages individuals with credit problems to consult a Credit Counseling company.

What is the loan renewal policy at CashAdvance.com?

Loan renewal policies are determined by state regulatory legislation. Before accepting a loan offer, lenders are required to disclose loan renewal policies to borrowers. CashAdvance.com advises borrowers to read the renewal policy carefully before signing the loan documents. Payday loans are intended to be short-term financial instruments, and CashAdvance.com encourages borrowers to repay the loan on time and in full to avoid late payment and non-payment fees.

What are the collection practices at CashAdvance.com?

CashAdvance.com does not collect any debts. Lenders are mandated to disclose their debt collection practices to borrowers before they accept a loan offer. If a borrower is unsure about a specific lender’s collection practices, CashAdvance.com recommends discussing the issue directly with the lender. All lenders and debt collectors are required to engage in fair debt collection practices, which are regulated by federal law, including the Fair Debt Collection Practices Act.

- How does CashAdvance.com ensure privacy and security?

CashAdvance.com places a high priority on the privacy and security of user information. They use high-grade 256-bit secured encryption to protect every cash loan request. The platform’s privacy policy ensures that user information is only shown to potential lenders. CashAdvance.com also clarifies that they do not sell user information to third parties for marketing purposes. Their online form can be accessed securely from home, the office, or a mobile device.