Looking for personal loan services? Cash Kitty Loans is a trusted lending platform that aims to connect you with lending partners who offer personal loans. Whether you need funds to cover emergency expenses or unexpected bills, Cash Kitty Loans can provide a quick and hassle-free solution.

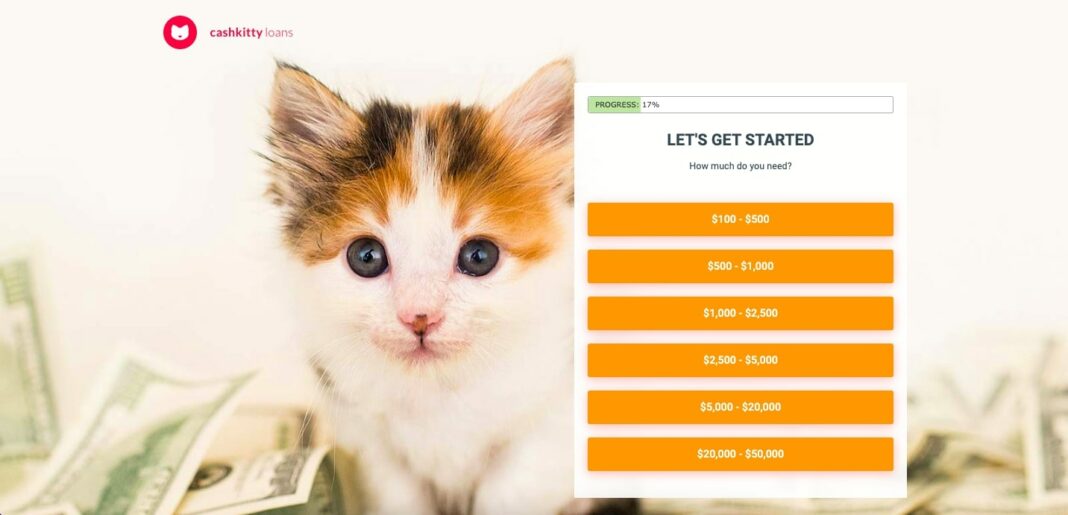

With Cash Kitty Loans, you can easily access their secure online form and submit your loan application in minutes. They offer loan amounts up to $50,000, giving you flexibility to meet your specific financial needs. Plus, Cash Kitty Loans understands that not everyone has a perfect credit history, so they may be able to approve loans for individuals with poor credit scores.

When it comes to personal loans, Cash Kitty Loans is committed to providing convenience, quickness, and potential approval for borrowers. Their streamlined application process and focus on helping people in need sets them apart from other loan providers.

Key Takeaways

- Cash Kitty Loans offers personal loan services to help individuals access funds for emergency expenses.

- Their online form makes it easy to apply for a loan, with quick approval times.

- Loan amounts of up to $50,000 are available, providing flexibility for borrowers.

- Cash Kitty Loans considers individuals with poor credit history for loan approval.

- When choosing a personal loan provider, factors such as interest rates, repayment terms, and customer reviews should be considered.

What is Cash Kitty Loans?

Cash Kitty Loans is a service that aims to help individuals find suitable loans. Through their platform, people from across the country can connect with lending partners who provide funds for various purposes. The process is quick and convenient, as Cash Kitty Loans offers an online form that allows borrowers to easily and securely submit their information, eliminating the need for extensive paperwork.

By leveraging their network of lending partners, Cash Kitty Loans strives to connect borrowers with loan options that work for them. They understand that individuals have different financial needs, and their platform is designed to cater to a diverse range of loan requirements. Whether it’s for emergency expenses, home improvements, or debt consolidation, Cash Kitty Loans aims to assist borrowers in finding suitable loan options.

Through their easy online application process, Cash Kitty Loans simplifies the loan search and application process. Borrowers can fill out the form from the comfort of their own homes, avoiding the hassle of visiting physical loan offices or waiting in long lines. The platform is user-friendly and secure, ensuring that borrowers’ information is protected.

“Cash Kitty Loans provides a hassle-free way to find loan options that suit your needs. With their easy online form, you can quickly and securely apply for loans without the need for extensive paperwork.” – Satisfied Customer

Benefits of Cash Kitty Loans

Cash Kitty Loans offers several key benefits for borrowers, making it a convenient and secure choice for obtaining quick online loans.

- Quickness: With Cash Kitty Loans, there’s no need to wait in long lines or endure lengthy processing times. Many applicants receive results within minutes, allowing them to access funds promptly and address their financial needs without unnecessary delays.

- Convenience: Applying for a loan has never been easier. Cash Kitty Loans enables borrowers to submit loan requests online, all from the comfort of their own homes. The simple and user-friendly online form streamlines the application process, eliminating the need for extensive paperwork and minimizing hassle.

- Safety and Security: Cash Kitty Loans places a primary focus on the safety and security of borrowers’ information. The platform utilizes SSL encryption to protect sensitive data, ensuring a safe and secure loan application process. Borrowers can have peace of mind knowing that their personal and financial details are kept confidential.

These benefits make Cash Kitty Loans a reliable and efficient lending platform for individuals seeking quick and hassle-free access to funds. Whether it’s an unexpected medical expense or a necessary home repair, Cash Kitty Loans provides a secure and convenient solution to help you through financial challenges.

Loan Amounts

When it comes to borrowing money, having the flexibility to access the right loan amount is crucial. With Cash Kitty Loans, you have the option to choose a loan amount that suits your specific needs. They offer loan amounts of up to $50,000, giving you the opportunity to secure larger sums of money.

Whether you need funds for significant expenses or have financial obligations that require a substantial loan, Cash Kitty Loans has you covered. Their range of loan amounts allows you to borrow the exact sum necessary to address your unique situation.

By providing loan amounts up to $50,000, Cash Kitty Loans ensures that you have the financial resources you need, offering peace of mind and the ability to tackle any unexpected expenses that may arise.

| Loan Amounts | Benefits |

|---|---|

| Up to $50,000 | – Access larger sums of money – Suitable for significant expenses – Ideal for addressing financial obligations |

Eligibility Criteria

When it comes to the eligibility criteria for Cash Kitty Loans, specific details are not provided on their website. However, they do mention that individuals with poor credit history may still be approved for loans. So, even if you have had financial difficulties in the past, you may still have a chance to access the funds you need through Cash Kitty Loans.

It is important for potential borrowers to review the specific requirements of their chosen lending partner before applying. Each lending partner may have their own set of criteria that applicants must meet in order to be eligible for a loan. By reviewing the requirements beforehand, you can ensure that you meet the necessary criteria and increase your chances of being approved.

Application Process

Applying for a loan with Cash Kitty Loans is a straightforward and convenient process. By utilizing their online platform, you can complete the entire application from the comfort of your own home. This eliminates the need for lengthy paperwork and long waiting times.

The application form collects essential personal and financial information. You will be required to provide details such as your full name, contact information, employment status, income, and banking details. This information is necessary to assess your eligibility for a loan and to identify suitable lending partners.

Once you have submitted the application form, Cash Kitty Loans aims to connect you with a lending partner who can provide the funds you need. The specific loan terms, including loan amount, interest rates, and repayment terms, will be determined by the lending partner selected for you.

It is important to note that Cash Kitty Loans does not guarantee loan approval, as the final decision rests with the lending partner. However, their platform aims to streamline the application process and increase your chances of finding a suitable loan option.

Benefits of Cash Kitty Loans Application Process:

- Convenience: Apply for a loan from the comfort of your own home, at any time that suits you.

- Streamlined Process: Complete the application form online, eliminating the need for extensive paperwork and long waiting times.

- Increased Eligibility: Cash Kitty Loans works with lending partners who may consider individuals with poor credit history.

“The online application process with Cash Kitty Loans was quick and hassle-free. I appreciated the convenience of being able to complete everything from home.” – satisfied customer

| Step | Description |

|---|---|

| 1 | Access the Cash Kitty Loans website and navigate to the loan application page. |

| 2 | Fill out the online application form, providing accurate and up-to-date personal and financial information. |

| 3 | Review the information entered to ensure its accuracy and completeness. |

| 4 | Submit the application form and wait for Cash Kitty Loans to connect you with a suitable lending partner. |

| 5 | If approved, review the loan offer from the lending partner, including loan terms and repayment options. |

| 6 | Accept the loan offer if it meets your requirements, and the funds will be disbursed to your designated bank account. |

Repayment Terms

Cash Kitty Loans does not provide specific details about their repayment terms on their website. However, it is crucial for borrowers to thoroughly review the terms and conditions set by their chosen lending partner before accepting any loan offer. The repayment terms may vary depending on the lending partner’s policies and the borrower’s individual agreement.

Interest Rates

Cash Kitty Loans does not disclose specific information about their interest rates on their website. It is important for borrowers to discuss interest rates and any associated fees with their chosen lending partner before finalizing a loan agreement. Interest rates may vary depending on factors such as the borrower’s creditworthiness and the lending partner’s policies.

When considering a loan from Cash Kitty Loans, it is crucial to understand the interest rates that will apply to your loan. By having a clear understanding of the interest rates, you can make an informed decision about whether the loan is affordable and suitable for your financial situation. It is recommended that you carefully review the terms and conditions provided by the lending partner to ensure that you are comfortable with the interest rates and repayment terms.

Keep in mind that interest rates can have a significant impact on the overall cost of borrowing. Higher interest rates will result in higher monthly payments and potentially higher total repayment amounts. On the other hand, lower interest rates can help you save money over the life of the loan.

To determine the interest rates you may be offered, it is important to consider factors such as your credit score, income level, loan amount, and the specific lending partner’s policies. These factors can influence the interest rates you are eligible for and the overall cost of borrowing.

“Understanding the interest rates associated with your loan is crucial to make a well-informed borrowing decision. Take the time to discuss interest rates and fees with your chosen lending partner to ensure that you fully understand the terms and conditions of your loan agreement.” – Financial Advisor

| Lending Partner | Interest Rates | Loan Amounts | Repayment Terms |

|---|---|---|---|

| Bank A | 8.99% – 15.99% | $1,000 – $50,000 | 12 – 60 months |

| Bank B | 10.99% – 17.99% | $2,000 – $50,000 | 24 – 72 months |

| Bank C | 12.99% – 19.99% | $5,000 – $50,000 | 36 – 84 months |

Customer Reviews

At Cash Kitty Loans, we believe in transparency and providing our customers with the best service possible. While we do not provide customer reviews on our website, we encourage borrowers to conduct thorough research and read reviews from other sources to gain insights into the experiences of previous customers with Cash Kitty Loans and our trusted lending partners.

By reading customer reviews, you can gather valuable information about the loan application process, the speed of approval, the quality of customer service, and overall satisfaction levels. This can help you make an informed decision when choosing a personal loan provider that meets your specific needs.

When researching customer reviews, consider platforms such as Trustpilot, Google Reviews, or independent financial forums where borrowers often share their experiences. Look for a balance of positive and negative reviews to get a holistic understanding of the service offered by Cash Kitty Loans and our lending partners.

Remember, customer reviews provide real-life insights that can give you a better understanding of the loan provider’s reliability, professionalism, and commitment to customer satisfaction. Your research and due diligence will help you make an informed decision and choose the best personal loan provider for your financial needs.

Alternatives to Cash Kitty Loans

If you’re considering personal loans, it’s essential to explore alternative lending options to ensure you make an informed decision. While Cash Kitty Loans offers a convenient platform, there are other online personal loan providers that you can compare. By evaluating different lenders based on their terms, interest rates, and eligibility criteria, you can find the best fit for your financial needs.

When researching alternatives to Cash Kitty Loans, consider the following:

- Loan Terms: Compare the repayment periods, fees, and flexibility offered by different lenders to find the most suitable option.

- Interest Rates: Assess the interest rates charged by each lender to determine the overall cost of borrowing.

- Eligibility Criteria: Review the requirements set by different lenders to see if you qualify for their personal loans.

By conducting thorough research and evaluating multiple lenders, you can confidently choose an online personal loan provider that meets your unique financial requirements.

Tips for Choosing a Personal Loan Provider

When you are in need of a personal loan, it is essential to carefully select the right provider for your financial needs. Consider the following factors to ensure you make an informed decision:

- Interest Rates: Compare the interest rates offered by different lenders to find the most favorable terms. Lower interest rates can save you money in the long run.

- Repayment Terms: Evaluate the repayment terms offered by each lender. Look for flexible options that align with your financial situation and allow you to manage payments comfortably.

- Eligibility Criteria: Understand the eligibility criteria set by each lender. Some lenders may have specific requirements regarding credit scores, income, or employment status. Make sure you meet the criteria before applying.

- Customer Reviews: Research customer reviews for each personal loan provider to gauge their reputation and customer satisfaction. Take note of both positive and negative feedback to make an informed decision.

- Overall Reputation: Consider the overall reputation of the lender. Look for well-established institutions with a track record of reliable and trustworthy lending practices.

By carefully considering these factors, you can find the personal loan provider that best suits your needs and allows you to request a loan with confidence.

Conclusion

In conclusion, Cash Kitty Loans provides a convenient platform for individuals seeking personal loans. Their emphasis on quickness and the potential for approval, even for those with a poor credit history, sets them apart. When evaluating Cash Kitty Loans or any other personal loan provider, it is essential to consider factors such as loan amounts, eligibility criteria, repayment terms, interest rates, and customer reviews. Thorough research and careful consideration will empower borrowers to make informed financial decisions that align with their needs.

Whether you are in need of immediate funds to cover unexpected expenses or have long-term financial goals, Cash Kitty Loans and other personal loan services offer a range of options to meet your unique circumstances. By exploring different loan providers, carefully reviewing the terms and conditions, and considering feedback from other customers, you can make a well-informed decision that suits your financial situation.

Remember, taking out a personal loan is a significant financial decision. It is crucial to fully understand the terms and potential implications before proceeding. Always borrow responsibly and ensure that you have a clear plan for repayment. By approaching the process thoughtfully and considering all relevant factors, you can navigate the world of personal loans with confidence and find a solution that meets your needs.

FAQ

What is Cash Kitty Loans?

Cash Kitty Loans is a lending platform that connects customers with lending partners who offer personal loans. They provide an online form for individuals to request a loan quickly and conveniently.

What are the benefits of using Cash Kitty Loans?

Cash Kitty Loans offers a quick and convenient loan application process. They highlight the ability to receive loan approvals in minutes and the convenience of submitting loan requests online. The service also ensures the security of personal data with SSL encryption.

What loan amounts are available through Cash Kitty Loans?

Cash Kitty Loans offers loan amounts up to $50,000, allowing borrowers to access larger sums of money if needed for significant expenses or financial obligations.

What are the eligibility criteria for Cash Kitty Loans?

Cash Kitty Loans does not provide specific details about their eligibility criteria on their website. However, they mention that individuals with poor credit history may still be approved for loans. It is important for potential borrowers to review the specific requirements of their chosen lending partner before applying.

How does the application process work?

Cash Kitty Loans simplifies the loan application process by providing an online form that borrowers can fill out from the comfort of their own homes. The form collects necessary personal and financial information to assess the borrower’s eligibility for a loan. Once submitted, Cash Kitty Loans aims to connect the borrower with a lending partner who can provide the requested funds.

What are the repayment terms for Cash Kitty Loans?

Cash Kitty Loans does not provide specific details about their repayment terms on their website. Borrowers are encouraged to thoroughly review the terms and conditions set by their chosen lending partner before accepting any loan offer.

What are the interest rates for Cash Kitty Loans?

Cash Kitty Loans does not disclose specific information about their interest rates on their website. It is important for borrowers to discuss interest rates and any associated fees with their chosen lending partner before finalizing a loan agreement.

Can I read customer reviews for Cash Kitty Loans?

Cash Kitty Loans does not provide customer reviews on their website. It is recommended for borrowers to research and read reviews from other sources to gain insights into the experiences of previous customers with Cash Kitty Loans and their lending partners.

Are there alternatives to Cash Kitty Loans?

While Cash Kitty Loans offers a platform to connect individuals with personal loan options, there are alternative lending options available. Borrowers may consider exploring other online personal loan providers to compare terms, interest rates, and eligibility criteria. It is essential for borrowers to conduct thorough research and evaluate multiple options before making a decision.

What should I consider when choosing a personal loan provider?

When looking for a personal loan provider, borrowers should consider factors such as interest rates, repayment terms, eligibility criteria, customer reviews, and overall reputation. It is crucial to compare multiple lenders to find the best fit for individual financial needs. Borrowers should also carefully review and understand the terms and conditions before accepting a loan offer.